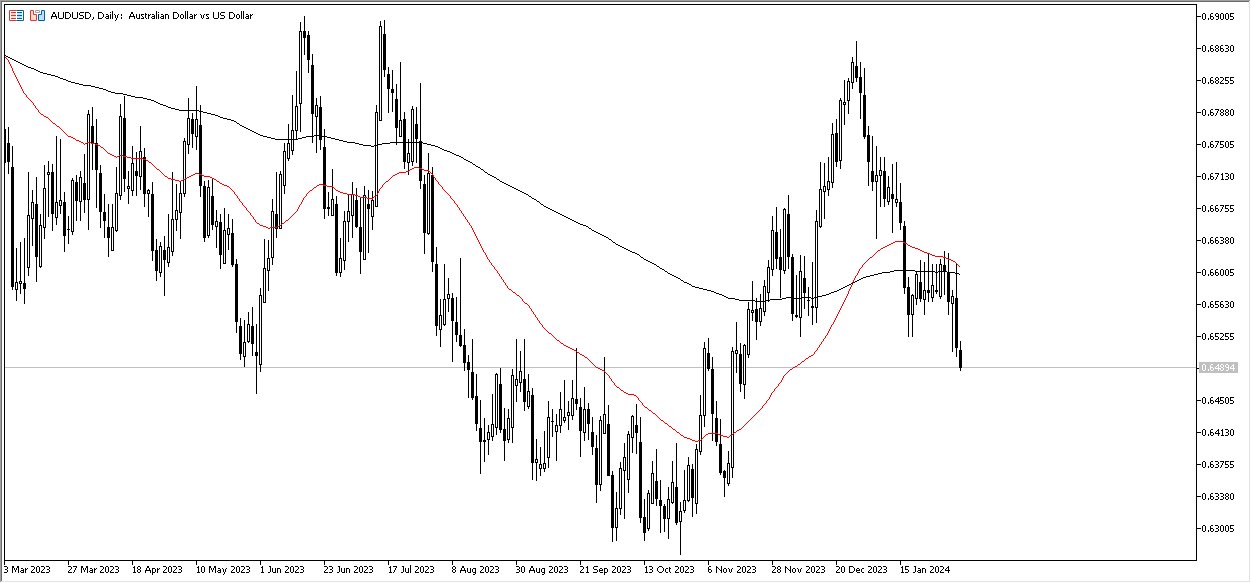

- The AUD/USD currency pair appears to be in the process of breaking down as of the past couple of trading sessions.

- This decline can be attributed to the recent strength observed in the US dollar overall.The pair's current trajectory suggests a potential move towards the 0.6350 level in the future.

- The duration of this descent remains uncertain, but it is worth noting that the pair has now moved below the 0.65 level.

- However, it is important to mention that this move below 0.65 is not definitive, so a more conclusive assessment may be made by observing the session's conclusion. If the pair remains below this level by the end of the session, it may trigger a consideration of selling opportunities.

Consolidation Being Broken?

The 0.6350 level represents a region of significant consolidation and has historically shown signs of bullish pressure. Therefore, it logically serves as a viable target in the downward trajectory. Conversely, if the pair manages to reverse its course and reclaims the 0.6550 level, the Australian dollar could potentially aim for the 0.6650 level above. This upper level was previously part of a consolidation range.

The movement of the Australian dollar is closely influenced by factors such as the interest rate differential and the Federal Reserve's perceived actions. Additionally, it is highly sensitive to fluctuations in commodity prices. Furthermore, the Australian economy maintains a strong connection to the Asian market, particularly China. The current economic situation in China, however, has not been particularly robust, which has exerted some downward pressure on the Australian dollar.

In general, the market sentiment suggests a gradual descent for the AUD/USD pair. Expectations do not indicate rapid and significant movements, but rather a steady decline, which applies to both upward and downward directions. Momentum in this market appears limited at present. It is important to note that the Australian dollar is considered a risk-on currency, and this characteristic can contribute to occasional volatility.

Considering the prevailing circumstances, a cautious approach is advisable. The US dollar is demonstrating resilience, which further supports the potential for a sustained downward movement in this currency pair. Traders should remain vigilant and assess the evolving market conditions as the situation develops.

Ready to trade our daily Forex forecast? Here’s some of the top forex online trading Australia to check out.