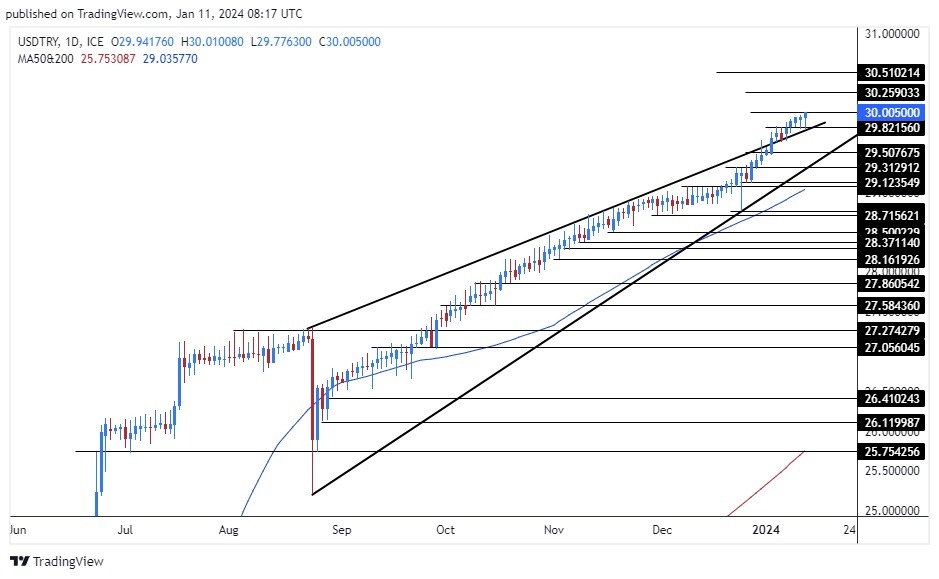

The USD/TRY has climbed above 30.00000 in early trading this morning. The price movement above the 30.00000 may prove to be an important psychological level and financial institutions will watch to see if this mark now becomes sustained. The U.S will be releasing important Consumer Price Index data today, but unfortunately for the USD/TRY it may have little effect on the momentum of existing behavioral sentiment.

Traders of the USD/TRY on the 13th of December did see the USD/TRY trade slightly lower momentarily when the U.S. Federal Reserve changed the tone of their monetary policy upon the publication of the FOMC Statement. However, the dip lower in the USD/TRY was relatively short-lived, and higher values developed within the coming days and weeks.

While the important U.S. inflation data will cause a massive reaction in global markets today, the impact of the CPI statistics in the USD/TRY could prove to be short-lived even if the USD becomes weaker against most other major currencies. Traders should brace for volatility later today in the USD/TRY which will cause dangerous short-term conditions.

Reversals Lower in the USD/TRY

Traders of the USD/TRY must endure higher transaction fees, overnight carrying charges, and spreads that are wider to undertake their speculative positions. Experienced traders also have likely grown accustomed to the rather swift reversals lower which can develop in the USD/TRY, only to see them run out of steam and upward movement resume.

The USD/TRY price velocity has gained momentum since the third week of September. Since moving above the 27.00000 level the USD/TRY has not been able to sustain lower price action. Speculators who can hold onto the USD/TRY and absorb the costs of transactions are likely content with their bullish perspectives. Inflation continues to cause pain in Turkey and as much as it is wished that domestic corporations would hold onto Turkish Lira, the prospect of buying USD appears to be too alluring as a hedge against the risking prices for goods and labor inside the nation.

USD/TRY Near-Term Considerations and Fear of the Trend

If the USD/TRY continues to sustain values above 30.00000 in the short term, it will start to solidify the belief the currency pair has attained another bad result and confidence will continue to erode. Speculators who want to pursue the upward momentum of the USD/TRY cannot be blamed, but they need to understand the dynamics of the currency pair.

- Entry price orders are essential when trading the USD/TRY, this is to get ‘fills’ that meet expectations.

- Today’s U.S. inflation data must be given attention and will likely cause momentary fireworks in the USD/TRY.

- Risk management will be essential today and quick-hitting trades will likely need to take profit and stop loss orders working.

Turkish Lira Short-Term Outlook:

Current Resistance: 30.00900

Current Support: 30.00010

High Target: 30.01500

Low Target: 29.99850

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.