- In the USD/JPY pair, the initial rally on Friday was followed by a relatively rapid reversal.

- This development aligns with the overall market sentiment, as the pair has been on a steady upward trajectory for several weeks.

- Given this backdrop, the likelihood of a pullback looms on the horizon.

- However, such pullbacks are anticipated to serve as buying opportunities, a strategy that has generally yielded positive results as traders continue to focus on getting paid via swap as well as appreciation overall.

It's important to note that while the US dollar experienced a significant decline against the yen in late 2023, the Bank of Japan has communicated its reluctance to start on a monetary policy tightening path. Such a move would be necessary for the yen to witness substantial strengthening. The prevailing dynamics suggest that the yen's weakness against multiple other currencies is a primary driver behind this currency pair's movements.

Potential Pullback and Support

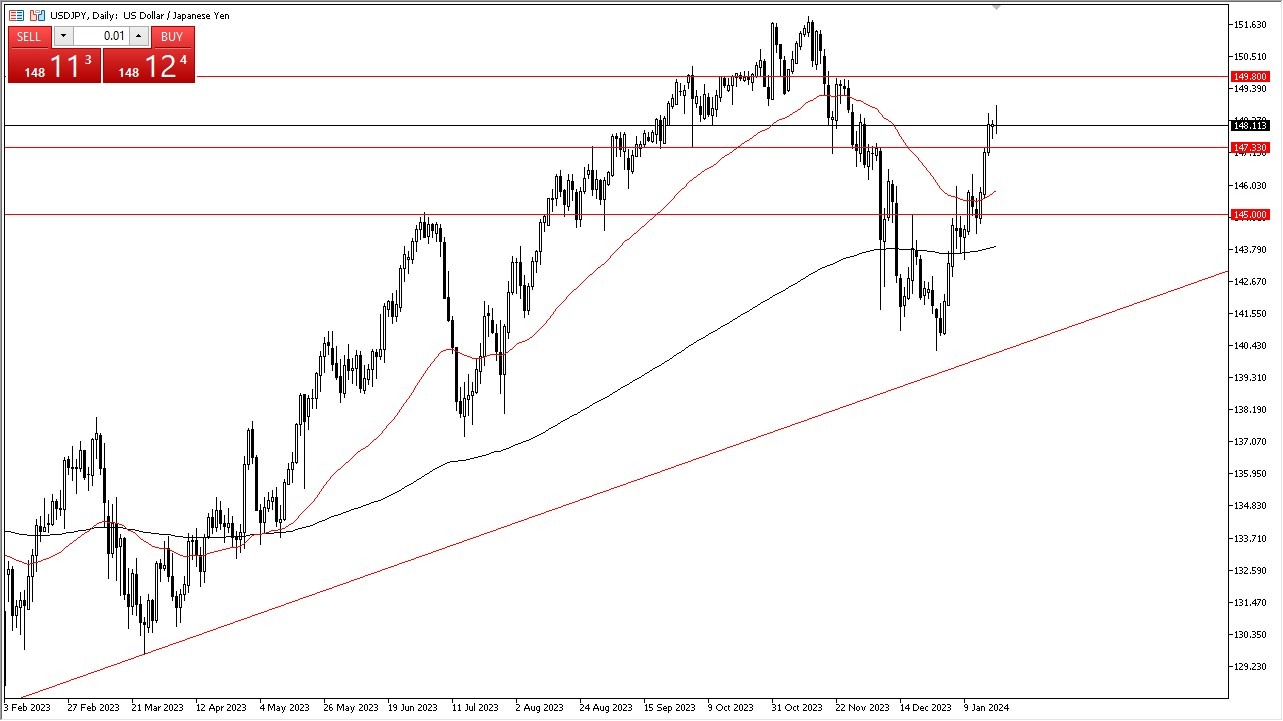

With the potential pullback in sight, key support levels come into focus. The level at $147.33 holds significance, followed by the 50-day Exponential Moving Average indicator. Beyond that, the 145 yen level is considered pivotal. It is essential to seek value in the market rather than buying into overextended positions, so like anything else – you don’t want to “overpay”, which is something you might do chasing it all the way up here.

Currently, the US dollar is deemed relatively expensive in its exchange with the Japanese yen. Nevertheless, the approach remains focused on buying the dip, utilizing incremental purchases to build a position aimed at reaching the highs near the 152 yen level. Conversely, the idea of selling holds little appeal, unless there is a sudden and aggressive shift in the Federal Reserve's interest rate policies and a corresponding change in the Bank of Japan's stance. Such developments are not anticipated in the short term.

At the end of the day, the US dollar demonstrated an initial surge against the Japanese yen on Friday, followed by a retracement, indicative of a potential pullback. This expected pullback is regarded as an opportunity to enter the market, with a preference for buying into the prevailing longer-term uptrend. Key support levels and value-seeking strategies underscore the approach to this currency pair, as prevailing conditions point to yen weakness as a driving factor.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.