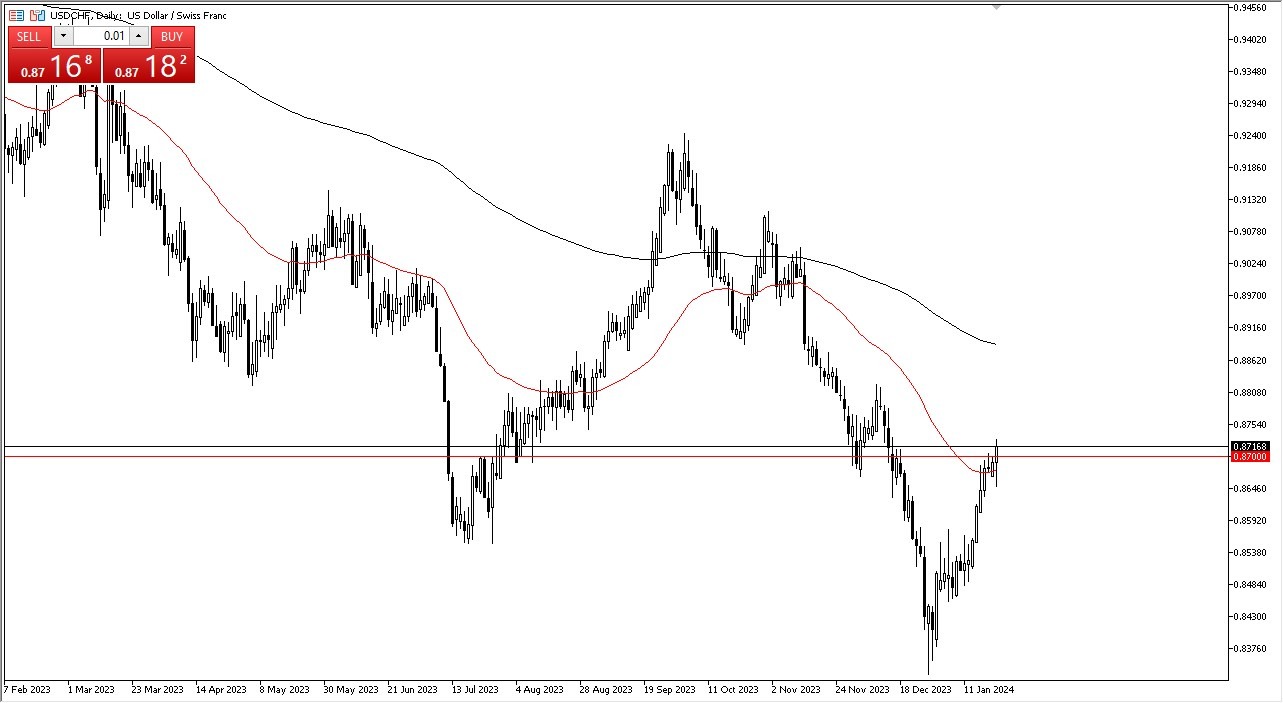

- The US dollar initially tried to fall against the Swiss franc, but on Tuesday we have seen buyers come back into the market and support the green bank.

- The question now is going to be whether or not this is a huge move across the world or if it is just a short term blip on the radar.

Keep in mind that interest rates will obviously have a major influence on what happens next, and it does appear that interest rates in America at least are climbing for the session. With this, I think you've got a scenario where traders will continue to look at the Swiss franc perhaps through the prism of whether or not the Swiss National Bank will get involved. They are known to get involved in the markets in a stealthy manner, and there is starting to be a little bit of a murmur out there that perhaps the SNB has started to interfere in the markets. It's not unlike them to get involved and let the market know after the fact. We currently find the 50-day EMA a little bit of support and it looks like the 0.87 level is also going to be an area of extreme interest.

The Bullish Scenario

If we can continue to go higher, then I believe that the 0.88 level gets targeted, followed by the 200-day EMA, which sits right around the 0.89 level. Conversely, if we were to turn around and break down below the 0.86 level, then we would probably see a continued downward trajectory of the US dollar. At this point, it seems like we are more or less at an inflection point, and I do think that is something that you have to pay close attention to.

There are a lot of questions right now asked about the Federal Reserve and of course the Swiss National Bank and its monetary policy will come into the picture as well. I do believe at this point it is probably a very neutral pair and it would not surprise me at all to see a little bit of sideways action over the next several days. Ultimately, we should get some clarity and I think people will start to jump into the market and place their bets accordingly. Simply stand back and let the market tell you what it’s going to do.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.