- Looking at this pair, you can see that the market has shown it's shown to be somewhat negative during the early hours on Monday.

- But at this point in time, I think we continue to pay close attention to the oil market as the Canadian dollar is so highly levered to crude.

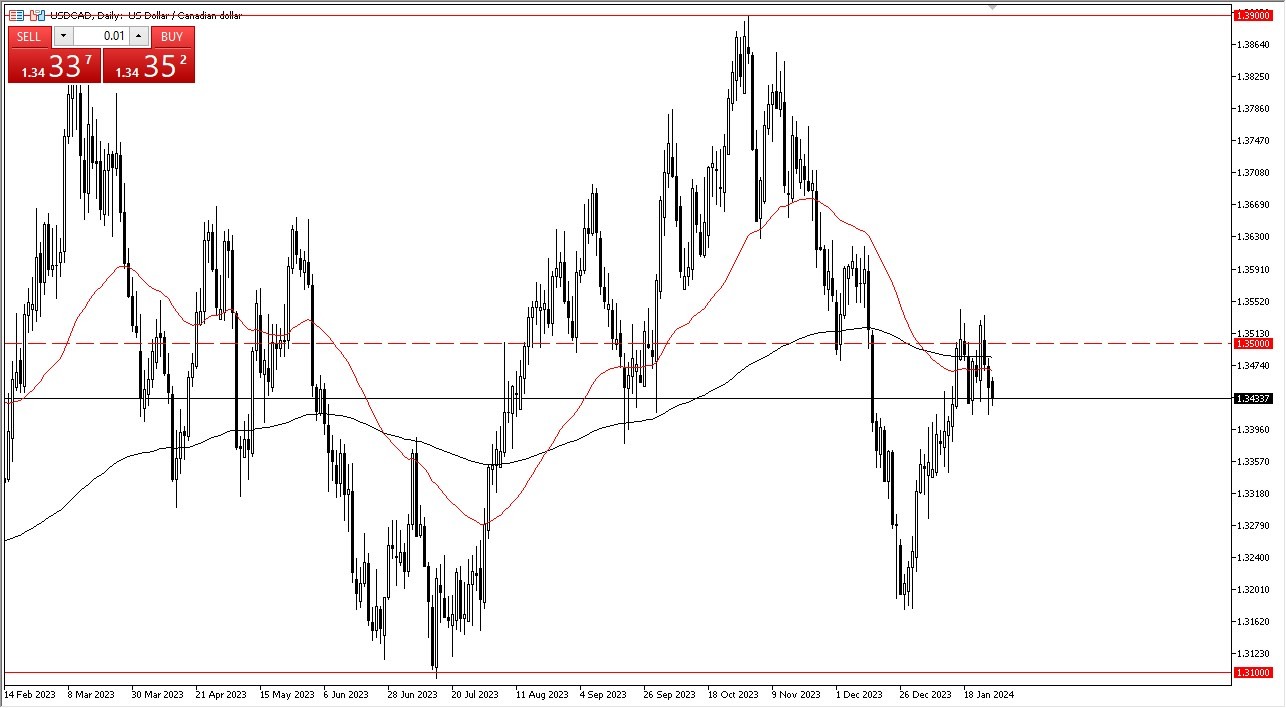

- A breakdown below the 1.34 level could send this pair much lower, perhaps down to the 1.33 level, maybe even down to the 1.32 level.

- To the upside, the 1.3550 level is where we've seen some selling pressure.

So, at this point in time, the market looks as if it is trying to get to the 1.3650 level if we break above there. There are a lot of questions asked about interest rate differential at the moment, because the Bank of Canada recently stated that interest rate hikes are not necessarily impossible from here. And I think that did somewhat shock the market. At the same time, we have a major announcement coming out on, Wednesday in the form of the FOMC statement and of course, the crucial press conference afterwards.

So, with all that being said, I think you have the possibility of volatility in this neighborhood and add in the fact that the 200 day EMA and the 50 day EMA indicators are right there as well, adds to that potential drama and noise. In general, I think this is a market that stays somewhat neutral, but probably favors the downside at least in the short term unless of course Jerome Powell truly spooks the market. Keep in mind that these two economies are heavily interconnected, so choppiness is the norm.

Range-bound traders like trading and that's not necessarily a bad thing. That being said, we are at the bottom of the short-term consolidation box. This isn’t to say that we won’t break out of it, just that it is an area that I think is going to continue to be very important. In general, this is a situation where we continue to see a lot of volatility, but in general I think this is a situation where we will continue to see a lot of noisy behavior, but ultimately, I think this is also a market that is going to show volatility more than anything else but eventually will run in a decisive direction.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.