Today's Recommendation on the TRY/USD

Risk 0.50%.

Best Buying Entry Points

- Enter a buy deal with a pending order at the 29.90 level.

- Place a stop loss point lower than the support level at 29.75.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 30.25.

Best Selling Entry Points

- Enter a sell deal with a pending order at the 30.25 levels

- The best points to place a stop loss are closing the highest levels of 30.39.

- Move the stop loss to the entry area and follow the profit with the price move by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level at 30.05

The USD/TRY rose during the early trading this morning, as the pair arrived at the psychological 30 level.

In terms of data, reports revealed that the Turkish Central Bank led the list of the largest central banks in buying gold during November. According to the figures, the bank bought about 25 tons, about six tons of the Polish Central Bank, which came in second place.

Meanwhile, investors have followed the statements. The Minister of Commerce, Omar Balla, affirmed the government's commitment to protecting consumers from the excessive rise in prices, holes, and price fluctuations. Despite the global economic challenges, Minister Blatt shed light on Turkey's flexibility, citing the positive indicators of growth, employment, exports, foreign trade, and a decrease in the current account deficit.

He stressed the government's focus on enhancing exports, especially from small and medium-sized companies, with a focus on competitiveness, research, development, innovation, brand development, and market diversification. Minister Blatt also pointed to the significant increase in the contribution of small and medium-sized companies to the total exports of Turkey, which increased to nearly 30%.

He revealed the great financial support provided to the two exporters last year, which amounted to 11.7 billion pounds, which constitutes 60% of the budget of the Ministry of Commerce. In addition, he announced plans to increase export support in 2024.

Despite the Turkish economy’s good numbers, the lira appears to pay the price of the unconventional monetary policy that it has followed over the past years before the elections in the middle of last year, which are reinforced by the expectations of global financial institutions.

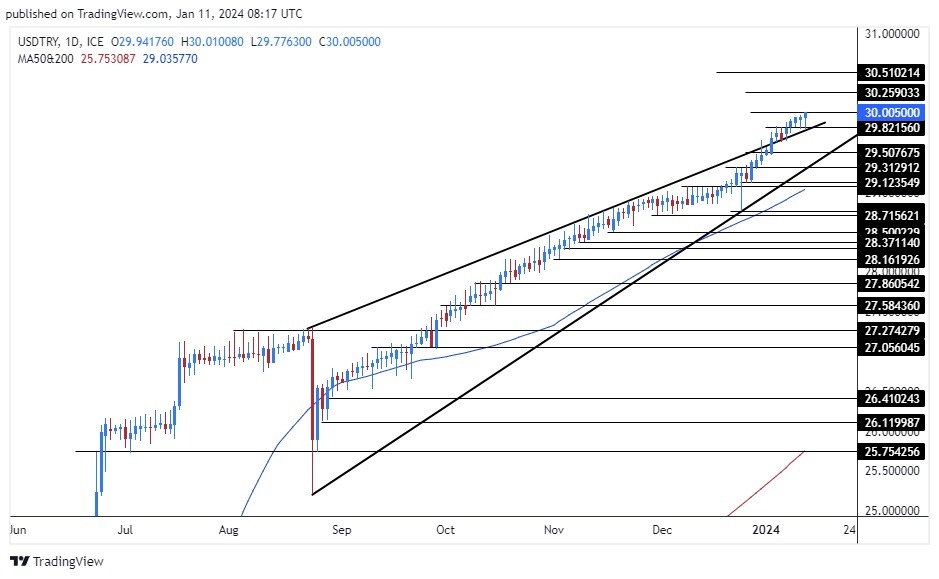

USD/TRY Technical Analysis

The pair rose during early trading, as it maintained the emerging general trend that has been trading within its limits for several months. The pair’s rise receives support from stability above the upper limit of the duration model on the time frame of the day as shown through the chart. At the same time, both the 50 and 200 moving averages intersect, and the price is traded higher than those levels, indicating the control of buyers.

If the dollar continues to rise against the lira, the pair is expected to reach the 30.35 and 30.50.50 levels, respectively. If it declines, it may target the 29.90 and 29.75 levels, respectively. The price of the Turkish lira forecast includes a continuous rise of the pair even with some corrective decline, as it targets the 30.25 level. Please adhere to the aforementioned recommendation points and maintain capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.