Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a buy deal with a pending order from the 29.80 level.

- Place a stop loss point to close below the 29.65 support level.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 29.99.

Best-selling entry points

- Entering a sell deal with a pending order from the level at 30.05.

- The best points to place a stop loss are closing the highest levels of 30.19.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 29.80.

The USD/TRY maintained its continuous rise during the current week, as the pair approaches the level of 30 lira to the dollar. It appears that the pessimistic forecasts about the price of the lira during 2024 issued by international banks are under investigation, as the lira continues its successive annual losses. The lira had lost about 36.6% of its value during 2023.

In detail, several international financial institutions published their expectations for the price of the Turkish lira during the current year. They agreed among themselves that the lira would continue to decline during 2024, continuing its losses that have been ongoing for several years. The lowest estimates for the price of the Turkish lira were issued by Barclays Bank, whose analysts expected that the price of the dollar would rise to levels of 43.80 lira by the end of the year.

While the expectations of Goldman Sachs analysts for the price of the lira were slightly better, as the dollar was expected to record levels of 40.70 liras, while the expectations of Citibank and Standard & Poor's analysts were unified at levels of 40 liras per dollar. In the same context, the expectations of Morgan Stanley and Deutsche Bank had stabilized at levels of 38 liras per dollar, and finally HSBC Bank, the most optimistic forecast for the price of the lira at levels of 33 liras per dollar.

In terms of data, data released this morning revealed that the unemployment rate in Turkey rose last November by 0.4 points to reach 9 percent.

TRY/USD Technical Analysis

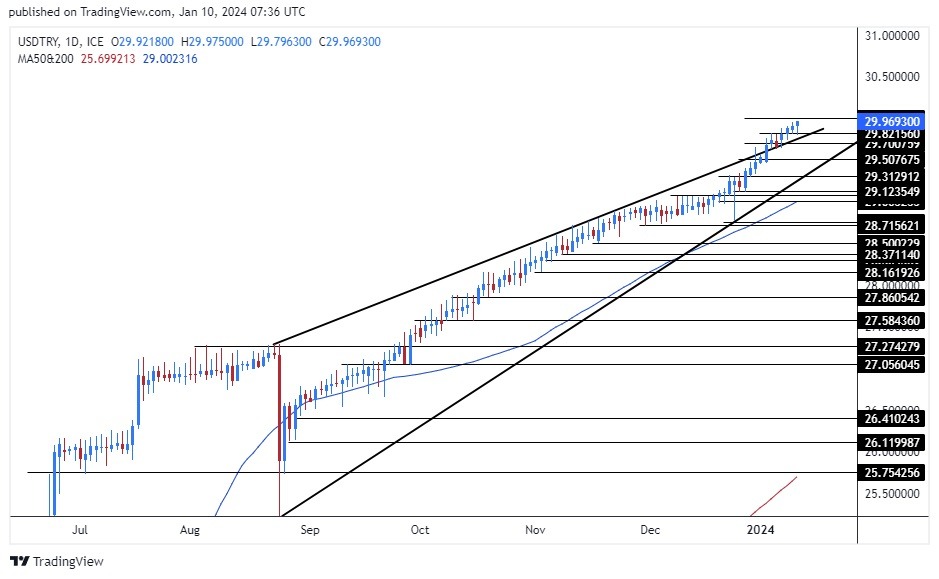

The USD/TRY The pair rose during early trading this morning, with the expansion of the Turkish lira’s losses, recording new lows against the dollar daily, as the pair heads to the psychological barrier at 30 lira per dollar. Currently, the pair has stabilized above the upper border of the rising wedge pattern on the daily time frame shown on the chart. At the same time, the general upward trend in the pair continued with the price stabilizing above the 50 and 200 moving averages on the daily and four-hour time frames, respectively, which intersect positively.

If the pair maintains its gains, it targets 30.00 and 30.15 levels, respectively, while if the price declines, it targets 29.80 and 29.75 levels, respectively.

The Turkish Lira price forecast includes an increase in the pair, targeting 30 Lira levels. Please adhere to the mentioned recommendation points and maintain capital management.

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.