- The S&P 500 appears to be on a path toward the 5000 level, although it may encounter some detours along the way, particularly in light of the upcoming Federal Open Market Committee (FOMC) meeting and press conference scheduled for Wednesday.

Recent activity in the S&P 500 has been relatively subdued, with a slight negative tone evident as the market saw early-day pullbacks. This development is not surprising, given that market participants are closely monitoring the FOMC meeting. While the focus is not solely on the rate decision, the accompanying statement and subsequent press conference are expected to be scrutinized. Consequently, it's reasonable to anticipate that the market might take a brief pause.

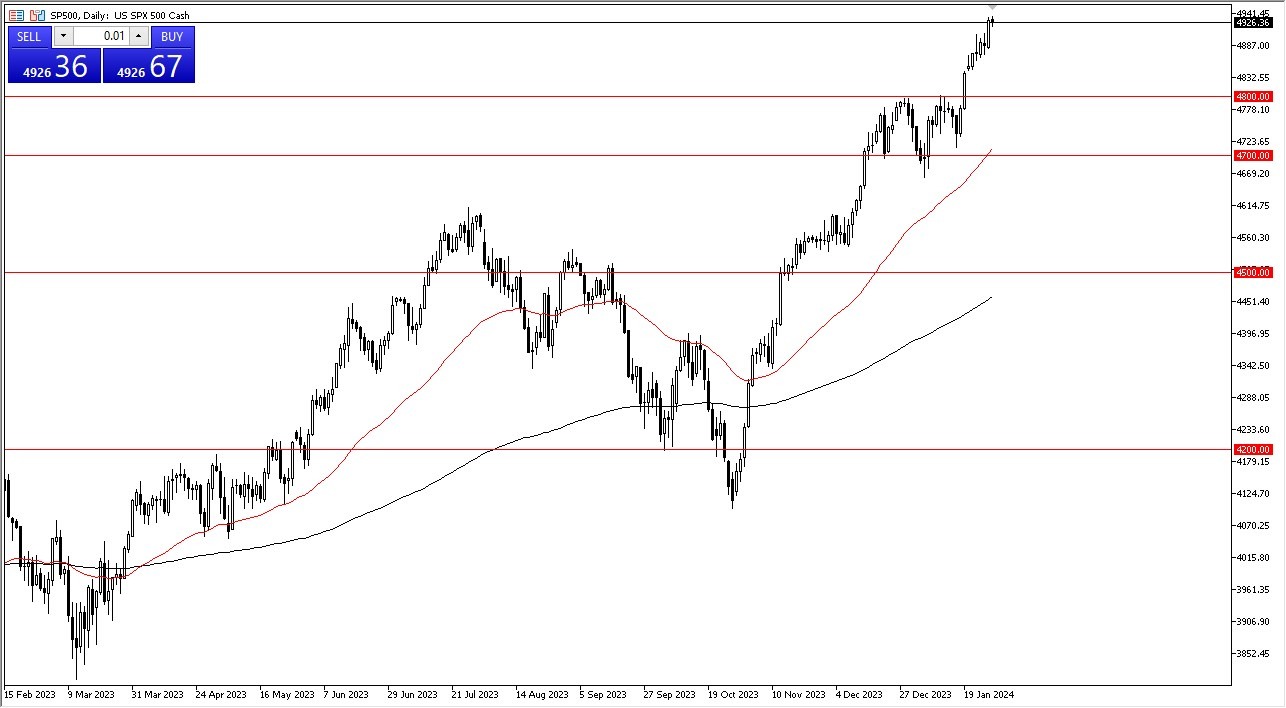

Within this context, the 4900 level is seen as providing minor support, while more substantial support can be found at 4800. Below that, the 4700 level and the presence of the 50-day Exponential Moving Average may attract increased attention. Importantly, there is no inclination to short the S&P 500 at this juncture. Instead, the prevailing sentiment leans towards recognizing that short-term fluctuations may introduce noise into the market.

Looking ahead, the prospect of the S&P 500 reaching the 5000 level remains highly likely, barring any unexpected announcements from the Federal Reserve. While it's improbable that the Fed would rule out interest rate hikes for the entire year, market dynamics are influenced by various factors, including the evolving approach of Federal Reserve governors towards trading and their continued engagement with Wall Street.

The market has experienced a degree of overextension, prompting the need for a cooling-off period. Such a correction, if it occurs, could present an attractive buying opportunity. The key consideration is whether such a pullback materializes. However, until the S&P 500 approaches the 5000 level, there is a prevailing outlook that views occasional pullbacks as potential buying opportunities. It's important to note that the 5000 level is anticipated to introduce both psychological and structural resistance, warranting close attention when the time comes.

In the end, the S&P 500's journey towards the 5000 level remains a focal point, with the upcoming FOMC meeting adding a layer of uncertainty. While short-term fluctuations may introduce noise, the overall outlook remains positive until the 5000 level is within reach. The market's dynamics will continue to be influenced by a range of factors, including the Federal Reserve's approach and broader economic conditions.

Ready to trade the Forex S&P 500? We’ve made a list of the best online CFD trading brokers worth trading with