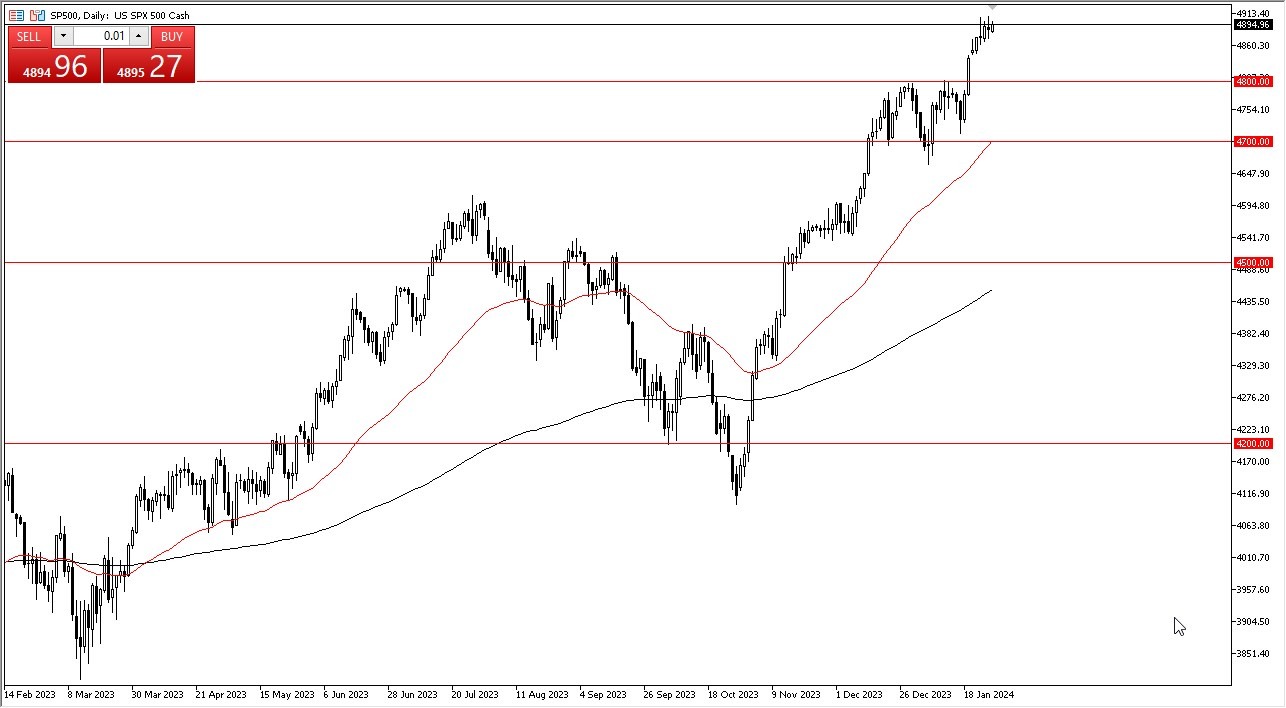

- The S&P 500 rallied early during the trading session on Monday, as we continue to see an overall upward trajectory drive the market.

- That being said, this is a market that is probably a little overextended at the moment, therefore we need to be very cautious about getting too overly aggressive to the upside.

The 4900 level, of course, is an area that has caused issues, but short-term pullbacks I think could end up being nice buying opportunities. The 4800 level underneath is an area that I would anticipate being support because it had been previous resistance, and a certain amount of market memory should come into the picture. If we break down below the 4800 level, then we go looking to the 50-day EMA that sits right at the 4700 level. This is an area that I think is going to be crucial.

Buy the Dips

All things being equal, this is buy on the dips, and the S&P 500 will continue to pay close attention to the idea of liquidity and what the Federal Reserve is doing. For example, if the Federal Reserve is going to loosen monetary policy, then it makes sense that the S&P 500 goes higher. What will be interesting is that on Wednesday, we have the Federal Open Market Committee giving out the interest rate decision, and a press conference afterwards that will have a lot to do with what Wall Street expects to happen. The 5,000 level above is a large round figure that a lot of people should go looking toward. But really at this point, I think that is such a huge barrier that it probably causes a significant amount of trouble. Anything above 5,000, of course, will capture a lot of attention.

As things stand right now, I think this is just simply a buy on the dip type of scenario, but between now and the end of the day on Wednesday, it might be somewhat quiet as we wait to see what Jerome Powell will have to say about the future of interest rates in the United States. Pay close attention to the way the market behaves at the end of the day on Wednesday, it could give us a bit of a “heads up” as where we are heading over the longer-term.

Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.