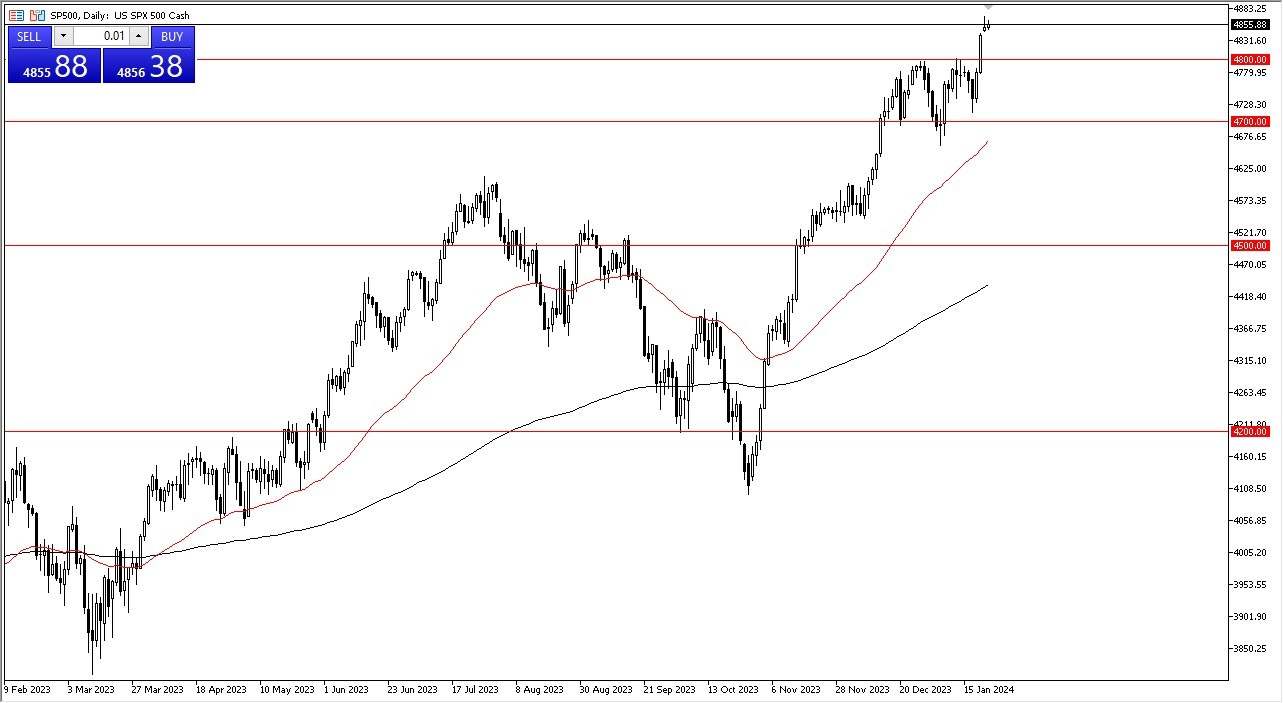

- The S&P 500 has shown a little bit of upward pressure during the trading session on Tuesday, as we continue to struggle to break to the upside.

- I think at this point, we have a situation where we are going to continue to see buyers on dips, and at this point, it's probably going to be a situation where we see a lot of value hunters underneath, especially near the 4,800 level.

The 4,800 level is an area that I think will continue to be important overall, and as long as that's the case, there's no real reason to fight this market, nor is there a reason to chase it. I do think that it's gotten a little bit ahead of itself, but ultimately this is a scenario where buyers will return to take advantage of the market every time it gets cheap.

Underneath the 4800 level, we have the 4700 level also offering support. So, I think that is a scenario that you need to pay close attention to as well. The 50 day EMA is approaching the 4700 level and offers plenty of support. All things being equal, I would love to see a little bit of a pullback, but it's probably worth noting that the market just seems to be on a tear lately, as we continue to focus on the idea that the Federal Reserve is going to loosen monetary policy more than pretty much anything else. As a result, it looks like we are in the midst of a melt up, and I do think that the S&P 500 is not only going to hit 4,900 rather soon, but I think sooner or later, we're going to target the crucial 5,000 level, which obviously will capture quite a few headlines. We are in somewhat unknown territory at this point, other than the fact that it remains very much a buy on the dip scenario that we see out there.

Ultimately this Market is Bullish

The S&P 500 is bullish, right along with other stock indices around the world. I don’t see a situation where I would be a seller, and therefore I look at any pullback at this point in time as a pleasant opportunity to get long of a market that has been strong for quite some time.

Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.