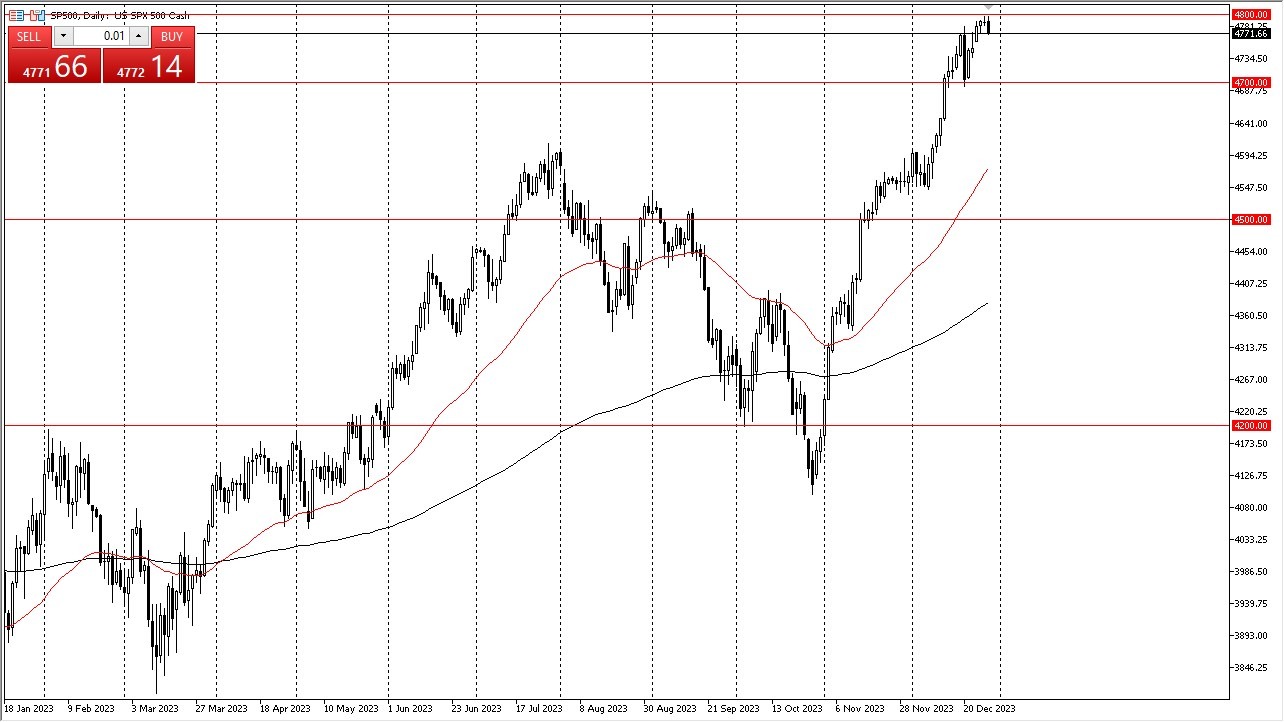

- Friday's trading session demonstrated initial attempts to stage a rally. However, the 4,800-level proved to be an insurmountable hurdle.

- This level marks the historical pinnacle of the market and encountering resistance when approaching it is entirely expected.

- The current market conditions are marked by low liquidity, which is characteristic of the period between Christmas and New Year's Day.

- This phase is renowned for its challenging nature, leading experienced traders to exercise prudence and often abstain from active participation.

Final Session of the Year

It is essential to note that this marks the final trading session of the year, resulting in a relatively subdued market environment. At present, only the most determined traders are actively seeking profit opportunities. Conversely, a significant number of traders are in the process of closing out their existing positions. Consider the broader context: the S&P 500 has witnessed an exceptional rally of 600 points within just two months, translating to a remarkable 17% increase. Considering such substantial gains, it becomes prudent to consider securing profits, especially when anticipating a decline in liquidity. Furthermore, on the horizon are impending inflation figures scheduled for release in the early part of the new year, which have the potential to unsettling the market. These figures could be very difficult to trade around, as traders continue to argue about the trajectory of the Federal Reserve.

Given the prevailing circumstances, adopting a strategy of purchasing during price dips appears rational. My primary focus centers on two specific levels, with particular emphasis on the 4,700 level. Historically, this level has served as a reliable support zone. Nevertheless, it is worth noting that a dip below this mark, targeting the 4,600 level where the 50-day Exponential Moving Average is rapidly approaching, would be a favorable development. Conversely, a breach above the 4,800 threshold could signify a continuation of the upward trend. However, it is crucial to acknowledge that, at the very least, a period of consolidation within this range is imperative to alleviate the prevailing excess enthusiasm. Engaging in reckless trading without due consideration is a risk that should be avoided within the current market climate. After all, the last thing you want is to wreck your account when the big traders start pushing things around to kick off the year.

Ready to trade our S&P 500 daily forecast? Here are the best CFD brokers to choose from.

Ready to trade our S&P 500 daily forecast? Here are the best CFD brokers to choose from.