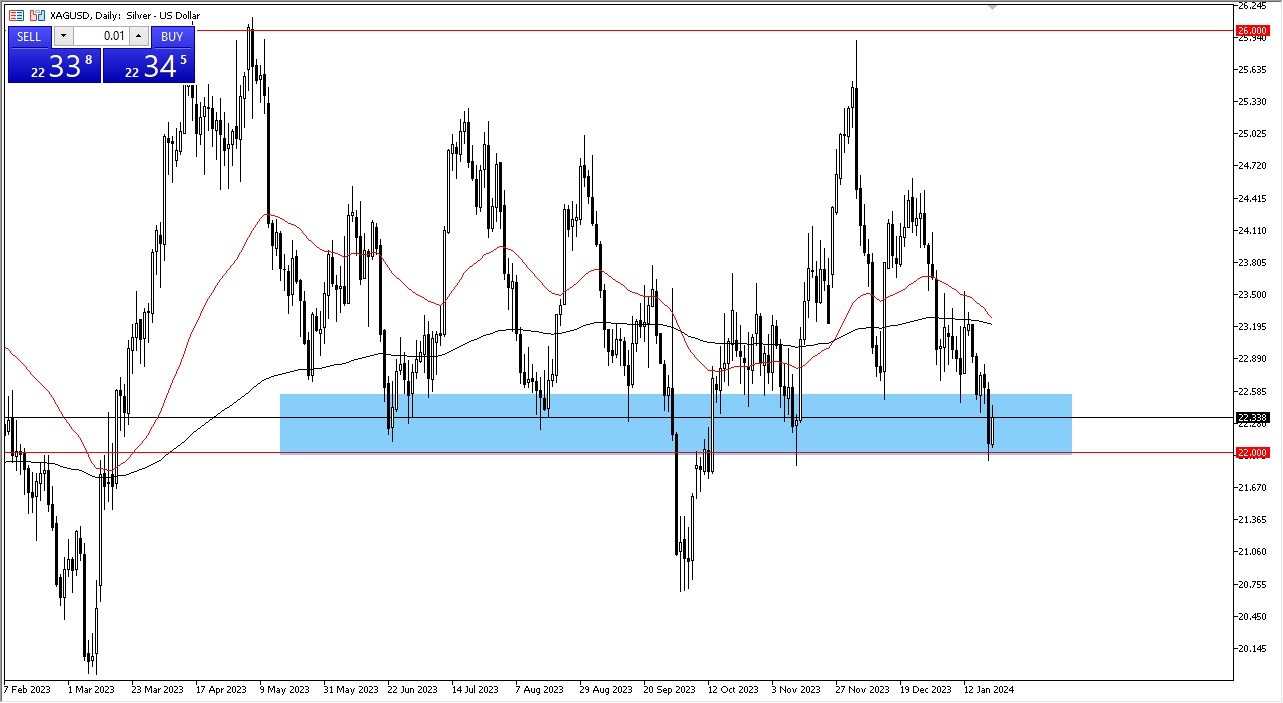

- Taking a look at the silver market and as you can see silver has shown itself to be quite bullish during the trading session on Tuesday, using the $22 level as a bit of a springboard.

- That being said, I think this is also a situation where market participants will probably continue to.

Keep in mind that silver does tend to be very choppy and volatile, so you will have to be cautious with your position size regardless. After all, it is a huge contract in the futures markets, and therefore people tend to be a lot quicker to take profits and get rid of losers, and therefore it makes the contract a bit slippery at times.

Look at this through the prism of whether or not the interest rates in America are going higher lower Or if they're just staying flat remember there is an argument to be made that the market is highly sensitive to interest rates and therefore if Interest rates start to drop in America that should help anything that's not the US dollar and that includes silver that being said we've got a situation where market players continue to look at this through the prism of some type of barrier at 22. If we were to break down below 22, then things could get interesting.

It's at that point that I think you have to look at it through the prism of looking for support at 21. To the upside, we have the 200 day EMA at the $23 level, and then again at the $24.50 level, we see a significant amount of resistance. Finally, the $26 level would be your ceiling, if you will. I think we're trying to carve out a range for the year. We'll have to wait and see if this continues to hold, but right now, it does look like it's trying to hold. Again, a lot of this is going to come down to the US dollar, but don't forget, silver itself is an industrial metal as well, so demand could come into the picture also.

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.