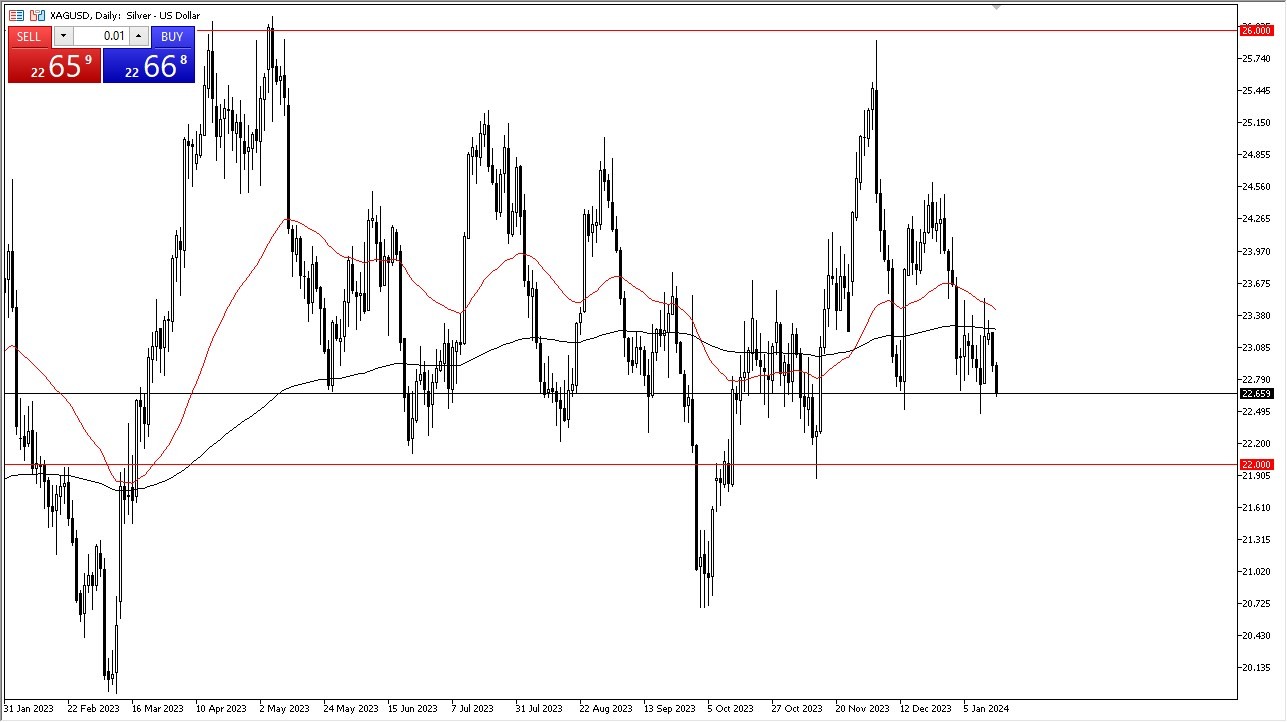

- The silver market appears to be in the process of stabilizing around the $22.50 level, although it's important to recognize that a broader range extends down to the $22 level.

- This range provides opportunities for value-seeking traders, but it's crucial to bear in mind that silver is characterized by considerable volatility.

In Wednesday's trading session, silver initially experienced a decline but subsequently reversed course, indicating the presence of substantial support level near the $22.50 level. However, it's important to note that this support zone likely extends downward to the $22 level. The 200-day Exponential Moving Average is situated at approximately the $23.33 level, and a breakthrough above this level would be a positive signal for silver's upward trajectory.

Upon breaching the $23.33 level, the next significant target would be the $24.50 level, which has demonstrated importance on multiple occasions. Further advancement could lead silver towards the $26 level. While I maintain a bullish stance on silver, it's essential to acknowledge the inherent challenges associated with this market, characterized by its noise and unpredictability.

Under current circumstances, marked by uncertainty, exercising caution in position sizing becomes particularly important. This approach is best when trading silver, regardless of the prevailing conditions as the overall volatility is one of the biggest issues at times.

All Things Being Equal

In an environment where all other factors remain equal, it's crucial to monitor the bond market, specifically the 10-year yield in the United States, as it holds a negative correlation with silver price. Additionally, the movement of the US dollar should be closely observed, as it often exhibits a negative correlation with silver due to similar underlying reasons.

In the end, the silver market appears to be stabilizing around the $22.50 level, with a broader support zone extending down to $22. The 200-day EMA at $23.33 represents a pivotal level. Breaking through this level could propel silver toward $24.50 and potentially even $26. While I maintain a bullish outlook, it's essential to exercise caution and consider prudent position sizing, given silver's intrinsic volatility. Monitoring the bond market and the US dollar is crucial, as they have a significant influence on silver's movements. Buying dips in the silver market is a reasonable strategy, but aggressive position sizing should only occur once the market validates the correctness of the position, allowing traders to capitalize on momentum.

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.