- Silver's performance remains subdued as buyers appear to be elusive.

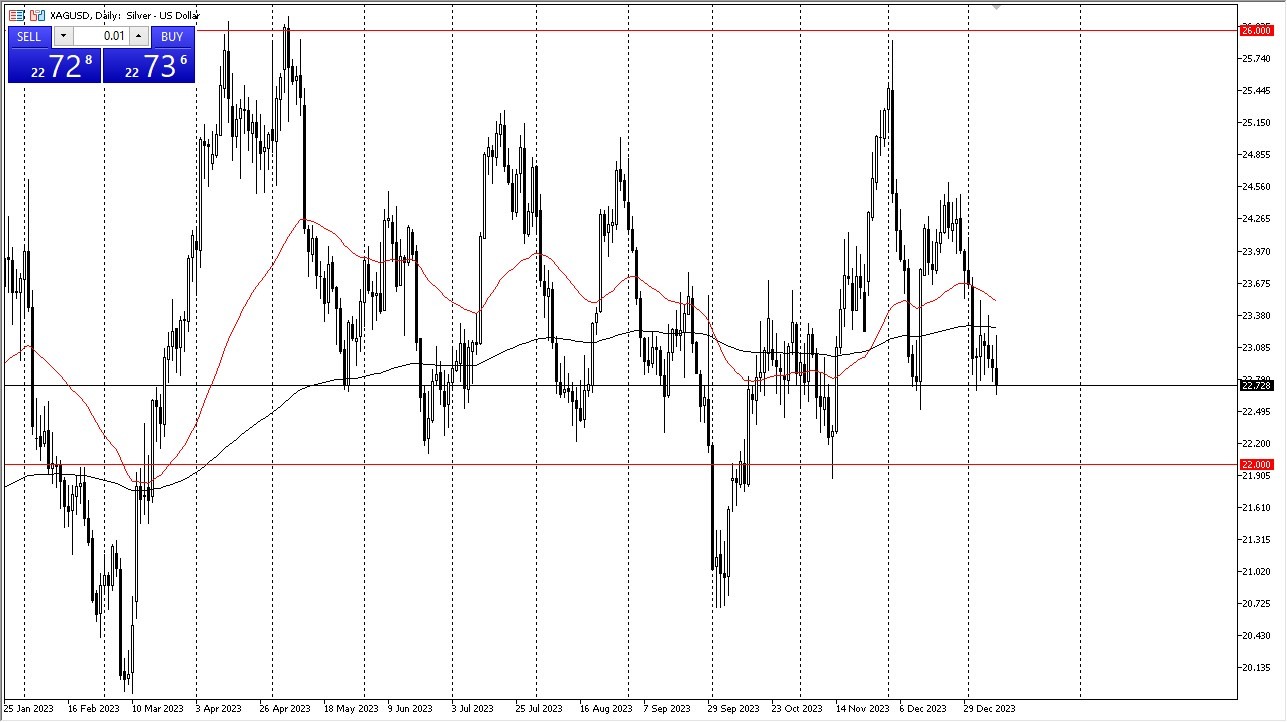

- Nevertheless, there is substantial support in the vicinity, notably around the $22.50 level and further reinforcement at the $22 mark.

- This is something that the markets will be cognizant of.

In recent trading sessions, silver displayed notable volatility, coinciding with the release of the Consumer Price Index (CPI) data from the United States. This data suggests that the Federal Reserve may have some room to maneuver in considering potential interest rate cuts. However, it's important to note that silver's lackluster performance is not unique; many markets are currently experiencing a similar lack of momentum.

This prevailing sense of indecision is not limited to silver alone but is rather a broader characteristic in many markets. Consequently, it's prudent to approach all markets with caution given the prevailing uncertainty.

At present, silver seems to be in a holding pattern, with the $22.50 level providing support below. Additionally, there is significant support at the $22 level, which holds a longer-term significance. In essence, the current positioning places us closer to the lower boundary of a wide consolidation range, with the upper limit around the $26 mark. It's worth noting that the 200-day Exponential Moving Average sits just above, potentially introducing some market noise.

Traders Are Looking to Get Involved

In this environment, traders are essentially seeking reasons to participate, but such catalysts remain elusive. The tight conditions in the bond markets are exerting an influence on the silver market as well. While a buying bias may be favored, it's essential to acknowledge the need for extraordinary patience in this environment, which seems to be characterized by a sense of marking time.

A potential bullish scenario could emerge if silver manages to breach the 200-day EMA and subsequently the 50-day EMA. Such a development might lead to a pursuit of the $24.50 level. However, traders should be prepared for noisy trading conditions and exercise prudent position sizing, a general rule applicable in the silver market and beyond.

In the end, silver's performance remains subdued, reflecting the broader uncertainty prevalent in many markets. Support levels around $22.50 and $22 provide a safety net, while a consolidation phase places us nearer to the lower boundary of the range. Patience is paramount in this market, as traders await catalysts that can inject momentum. While a buying stance is favored, caution and disciplined position management are essential in navigating the current market landscape.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.