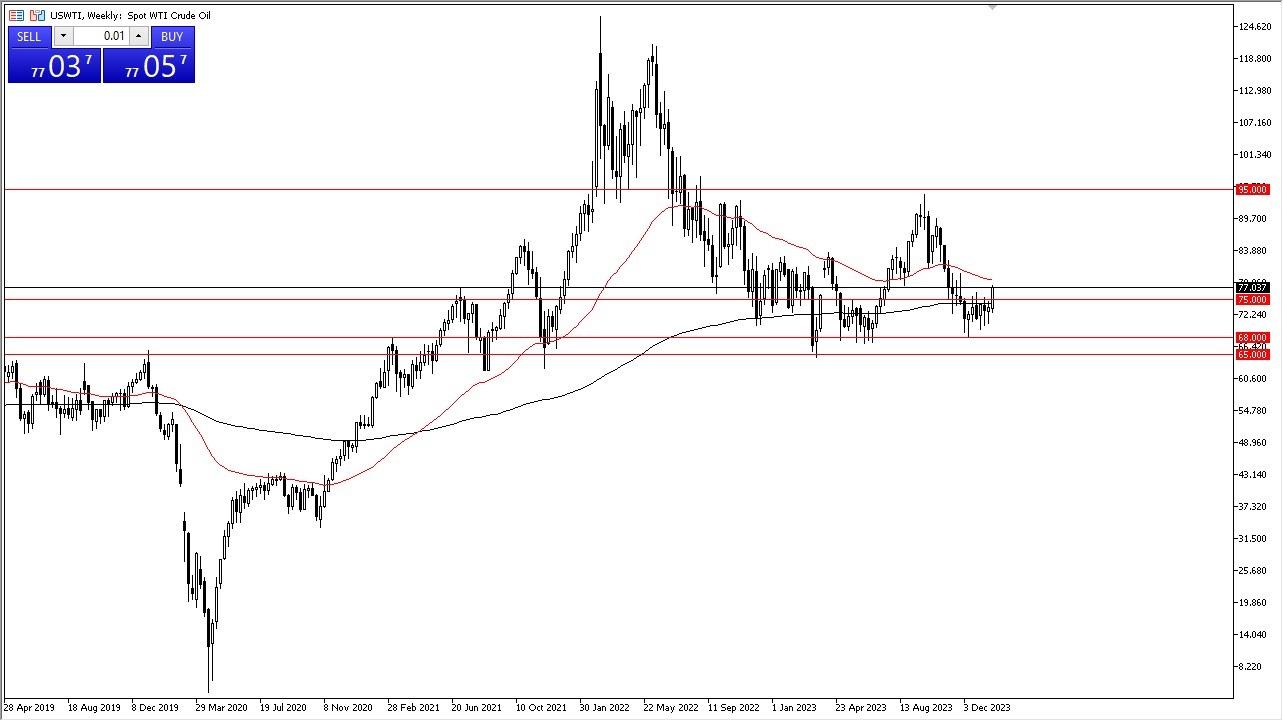

WTI Crude Oil

The West Texas Intermediate Crude Oil market has seen quite a bit of upward pressure during the course of the week as we have finally broken above the crucial $75 level. By doing so, the market looks as if it is ready to attack the 50-Week EMA, which is an area that has been important more than once. With this, a break above that opens up the possibility of a move to the $85 level. Short-term pullback should continue to be buying opportunities in this market as we have seen it behave favorably over the last several weeks.

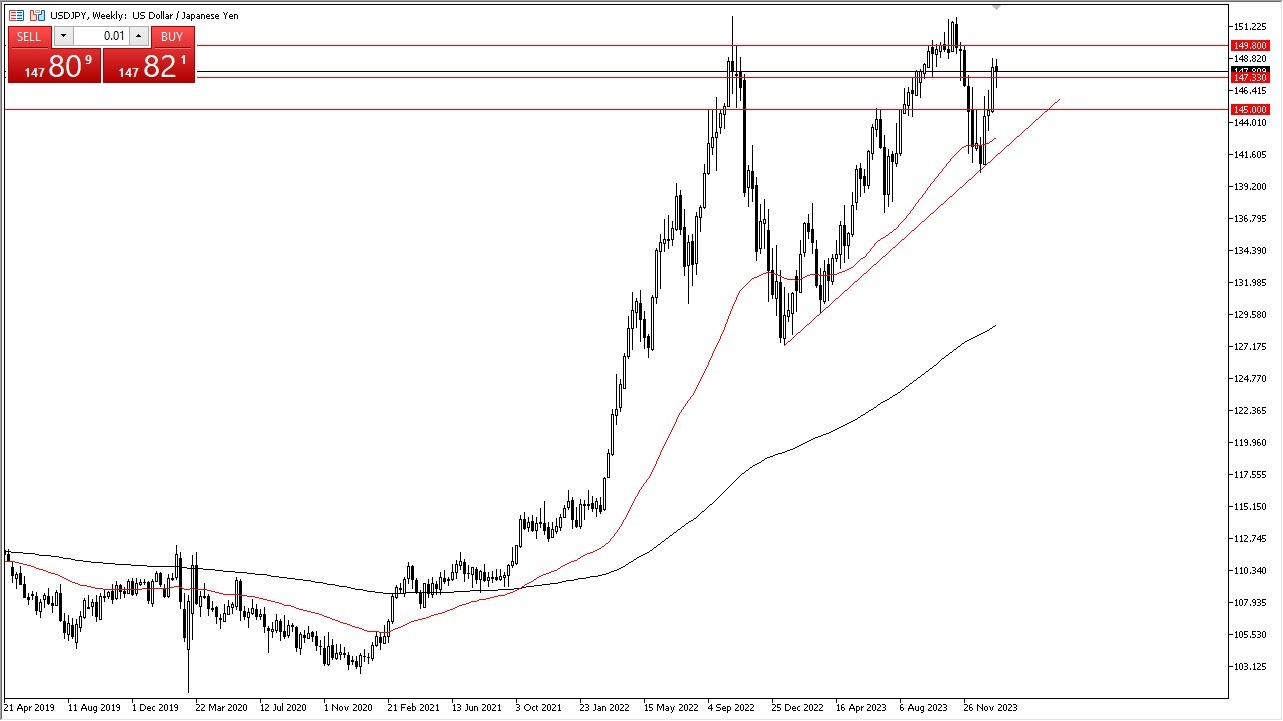

USD/JPY

The US dollar has initially fallen during the course of the training week against the Japanese yen only to turn around and show signs of life again by doing so it looks as if the market is going to continue to be very volatile, but I do think that this retains more of a “buy on the dip” attitude going forward and therefore I think you need to look at it through that prism. Underneath, I see the ¥145 level as a major support level that a lot of people will be paying close attention to. Anything below there starts to ask questions of the greenback, but right now it doesn’t look likely.

USD/CAD

The US dollar initially tried to rally against the Canadian dollar during the week, and even broke above the 1.35 level. However, just like the previous week, we have seen the US dollar selloff against the Loonie. We had a Bank of Canada interest rate decision this past week where it was stated that interest rate hikes aren’t necessarily an impossibility going forward. Quite frankly, I think what we are seeing here more than anything else is a return to the old correlations of the Canadian dollar following the oil market which of course looks very bullish.

USD/CHF

The US dollar has tried to break above the 0.87 level against the Swiss franc but gave up those gains rather quickly to show signs of hesitation. At this point, it looks like we could very well continue to drive, perhaps down to the 0.85 level. However, if we can break above this candlestick high from the past week, then we could see this market really start to take off and reach toward the 0.8850 level. Keep in mind that both of these are considered to be safety currencies so you would have to assume that there is going to be a lot of noise regardless of what happens.

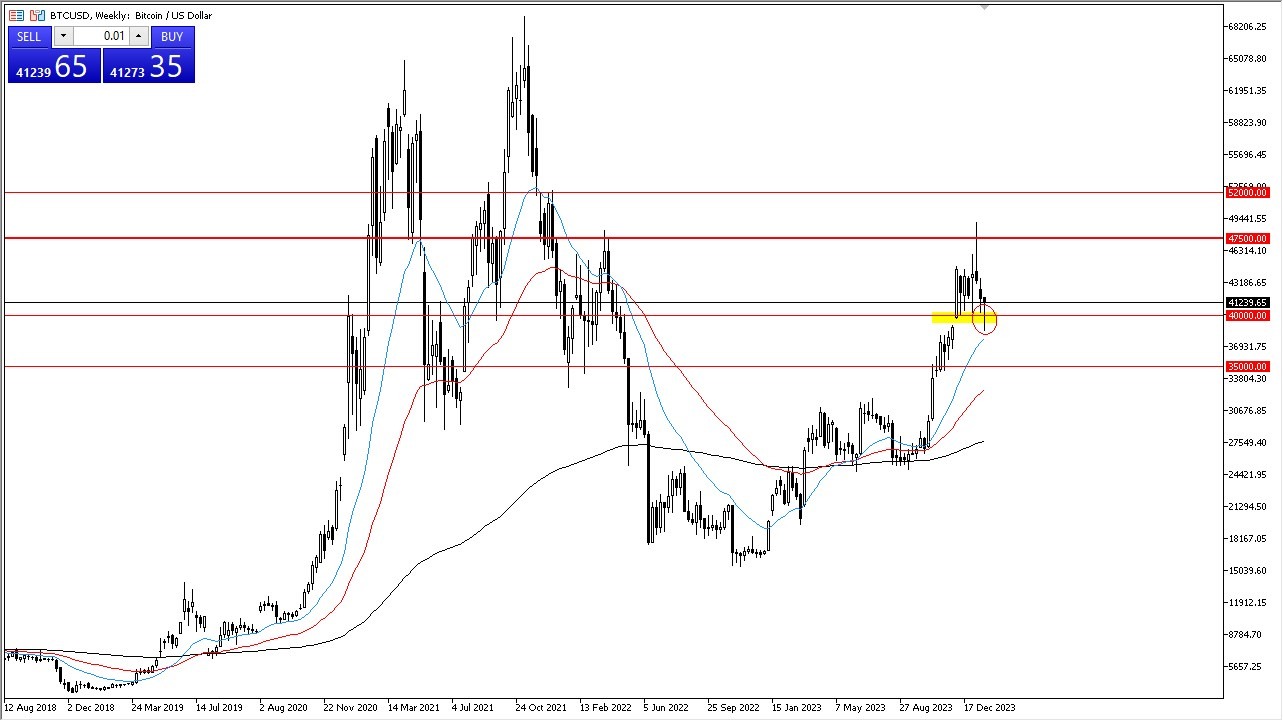

Bitcoin

Bitcoin has plunged to kick off the week, dropping down below the $40,000 level only to turn around and save itself. By doing so, it looks like we are going to at least attempt to continue the overall uptrend, and it’s probably worth noting that we are in a situation where the market has reaffirmed the $40,000 level as being an area of interest. Now the question of course is going to be whether or not we try to get back to the top of the overall range, which I see at the $47,500 level.

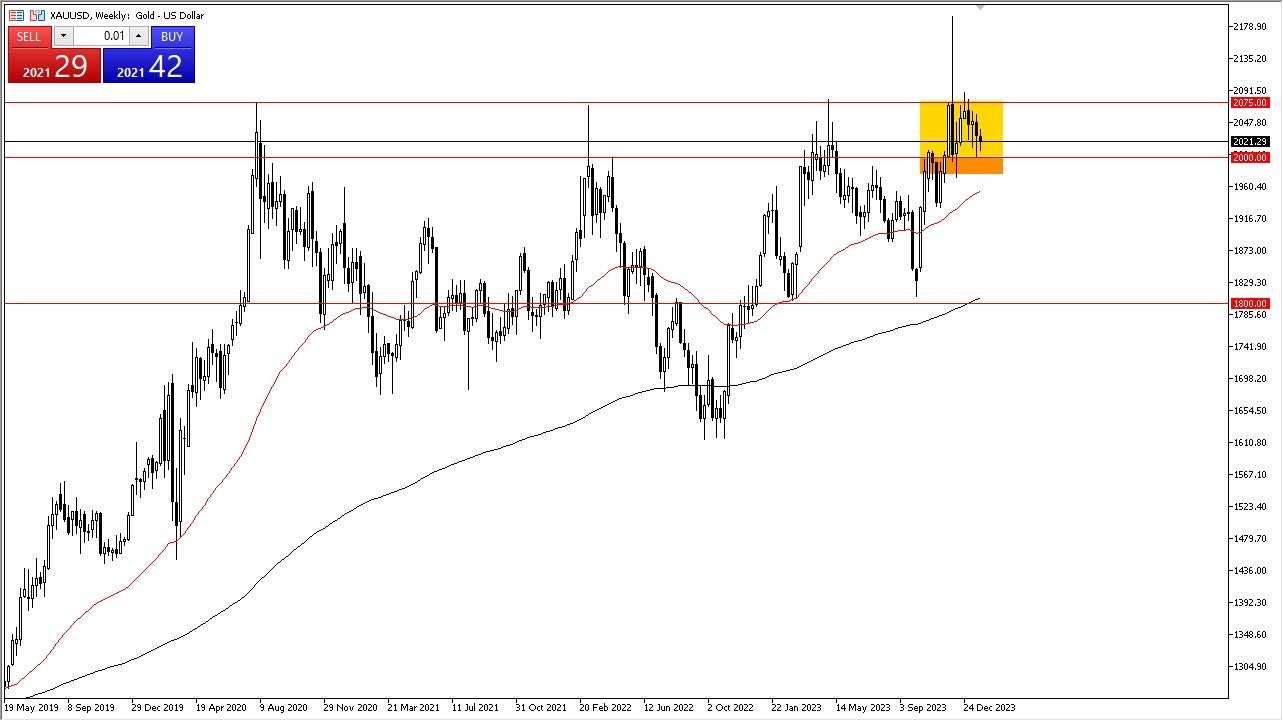

Gold

Gold markets have been somewhat choppy during the course of the week, but we also have reaffirmed the idea of the $2000 level being support, which of course is something that we needed to do. By doing so, I think you have got a situation where buyers continue to come in and pick up the dip every time it shows up, as there are a lot of central banks out there that could be loosening monetary policy. Furthermore, gold also has the geopolitical aspect tied to it that can have a major influence as well.

S&P 500

The S&P 500 has been bullish all week, as we continue to see traders on Wall Street assume that the Federal Reserve is there to back them up. With loose monetary policy coming, that obviously will attract a lot of inflows into risk assets, because that’s the way things have worked since the Great Financial Crisis. At this point, the economy doesn’t matter and “bad news is good news” going forward. Each depth will almost certainly attract a certain amount of value hunting by those looking to play the trend.

GBP/USD

The British pound continues to bang up against the 1.2750 level, an area that I think eventually could give way. However, it’s probably worth noting that it is also the 61.8% Fibonacci level from the selloff, so there might be a little bit of technical analysis at play also. I think we remain more or less range bound with an upward tilt until we finally break out of what has been a very solid level.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.