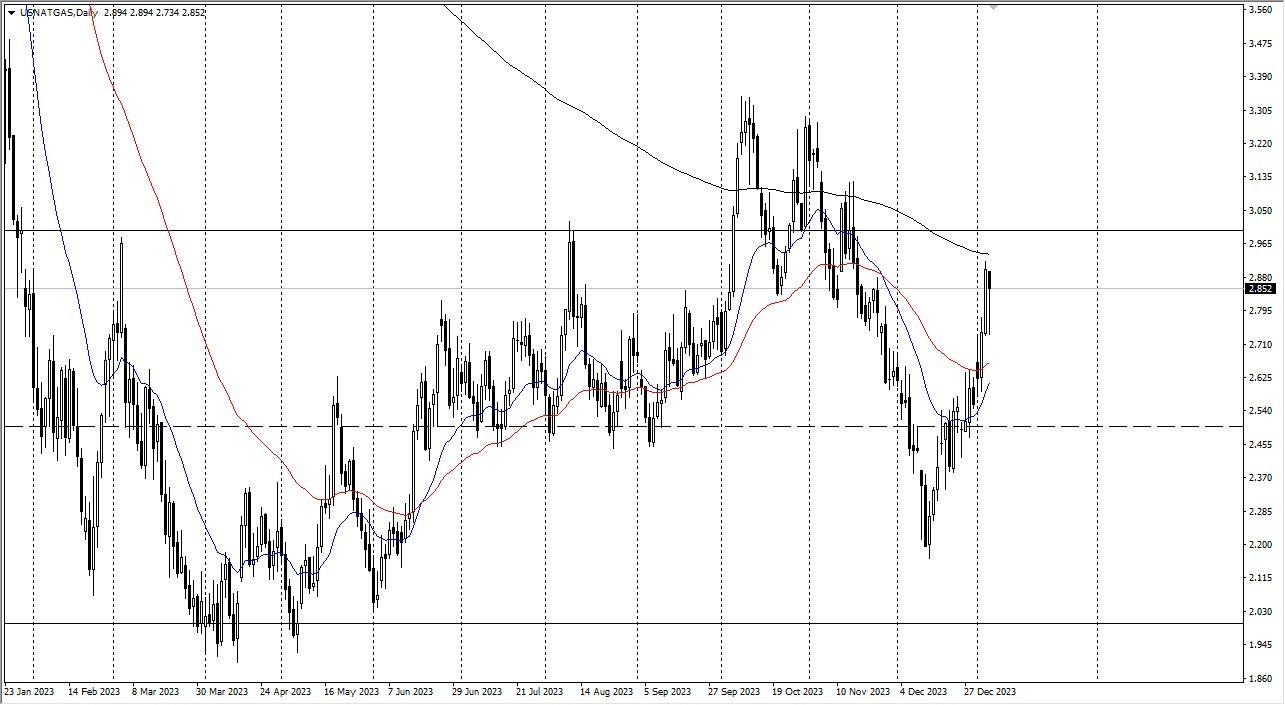

- Natural gas witnessed a decline on Friday as it neared the 200-day Exponential Moving Average, a technical indicator known for its potential to generate market turbulence.

- The price level just below the crucial $3 mark also played a role in shaping market dynamics. It is important to consider that natural gas is highly responsive to weather patterns, particularly the impending winter storm expected to hit the United States this weekend.

- Even minor alterations in weather forecasts can have a profound impact on the behavior of this market. This presents a significant challenge for retail traders who must navigate not only market forces but also meteorological factors.

The substantial volume of natural gas reserves in the United States inherently exposes the market to the risk of oversupply. The surge in prices observed last year attracted an influx of drillers into the natural gas sector, resulting in an increased supply of gas. Currently, the market continues to grapple with an excess of supply. Therefore, unless we witness an extended period of unseasonably cold weather or an unexpected event, sustaining price gains remains a formidable task. The futures markets have already shifted their focus to February, signaling that the current upswing may represent one of the last surges of the year.

Another Surge? Maybe, But Don’t Get Too Excited.

While another surge in prices may occur in the future, it is likely to be a short-term opportunity. The oversupply of natural gas has placed significant constraints on sustaining upward momentum. The market's struggle to maintain higher price levels is evident, and even amid various geopolitical developments such as the Nordstream II situation and gas transportation challenges in West Africa, the winter has remained relatively mild. As long as such weather conditions persist, the natural gas market is expected to face difficulties. In essence, it may be too late in the season to anticipate a substantial shift in market dynamics.

Ultimately, natural gas experienced a decline as it approached the 200-day EMA and the pivotal $3 level. Market participants need to remain vigilant, considering the influence of meteorological factors on natural gas prices. The ongoing oversupply of natural gas in the United States and a relatively mild winter have contributed to the market's struggle to sustain upward momentum. While short-term opportunities may arise in the future, the overall outlook for natural gas remains influenced by abundant supply and seasonal factors.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.