- The natural gas markets witnessed a rapid surge during Thursday's trading session as traders braced themselves for an impending winter storm in the northeastern United States.

- However, it's essential to recognize that this upswing is likely to be short-lived. Those who intended to capitalize on this move may have already established long positions in the market over the past few days, while others may be waiting for a pullback.

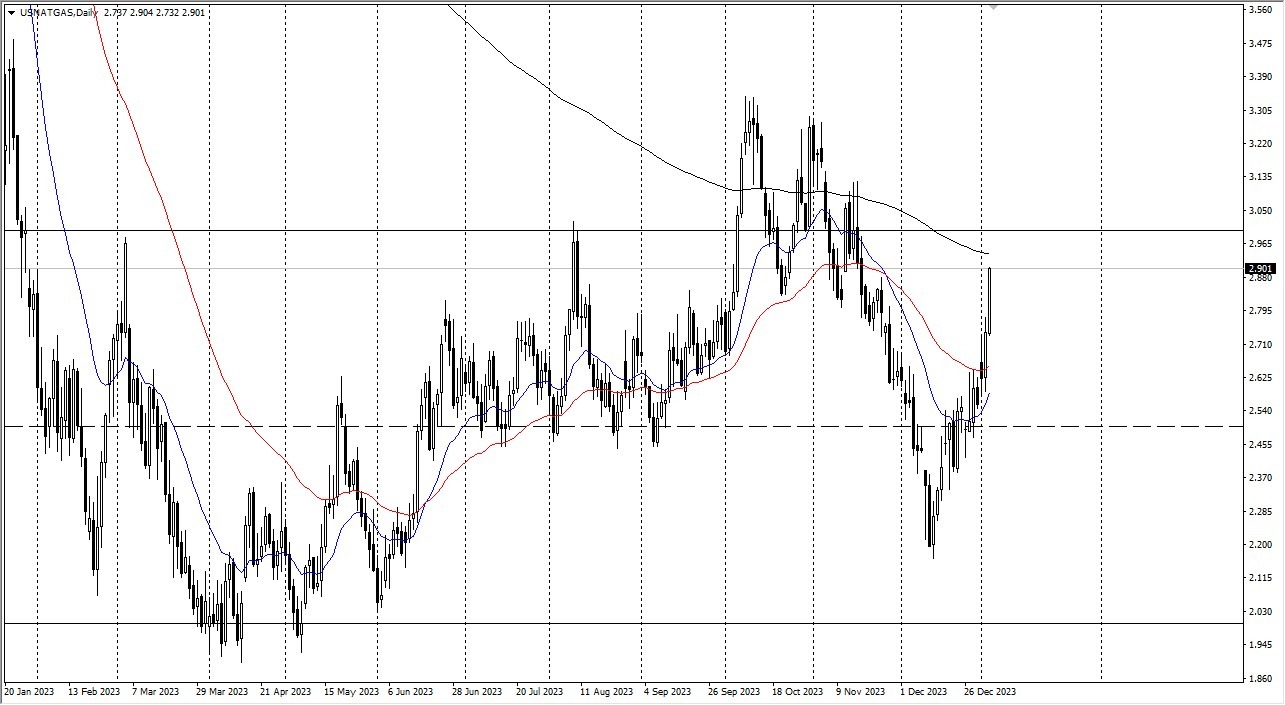

- Currently, futures markets are pricing for February, and the significant supply of natural gas suggests that this strong upward movement has not yet broken out of the established trading range. Unless a significant event occurs, a sustained breakout seems improbable.

The market's attention will eventually shift towards March when natural gas consumption typically experiences a significant decline. Consequently, this recent rally fails to elicit strong enthusiasm. While opportunities may have arisen a few days ago, the lackluster winter conditions have dampened the appeal of playing in this market. For traders who specialize in range-bound trading, it's worth noting that the market is approaching the upper boundary of the overall range. While the possibility of breaking above the $3 level exists, any further upside potential appears limited in that vicinity.

Support Below?

On the downside, the 50-day Exponential Moving Average is situated around the $2.65 level, potentially serving as short-term support. However, expectations for substantial follow-through on this upward movement are low. It would be surprising to witness a break above the $3.30 level unless a more substantial winter storm materializes. It's important to consider that certain parts of the northeastern United States are teetering on the edge between receiving snow or rain, which may impact the storm's actual intensity. If the weekend storm fails to materialize as anticipated, the natural gas market could reverse its gains as swiftly as it ascended.

In the end, the natural gas markets experienced a sudden upswing in response to the impending winter storm in the northeastern United States. However, this rally is likely to be temporary, given the market's current supply dynamics and the forthcoming decrease in natural gas consumption in March. Range-bound traders should note that the market is nearing the upper boundary of its established range. While further upside potential exists, it remains constrained in the absence of a significant event. Moreover, the actual impact of the weekend storm remains uncertain, which may influence the market's direction in the days ahead.

Ready to trade Natural Gas Forex? We’ve made a list of the best commodity broker platforms worth trading with.