- The performance of natural gas markets on Friday appeared to be relatively stagnant, which is unsurprising given that it was the final trading session of the year.

- Most traders were primarily focused on closing their positions before the holiday break, contributing to the subdued market activity.

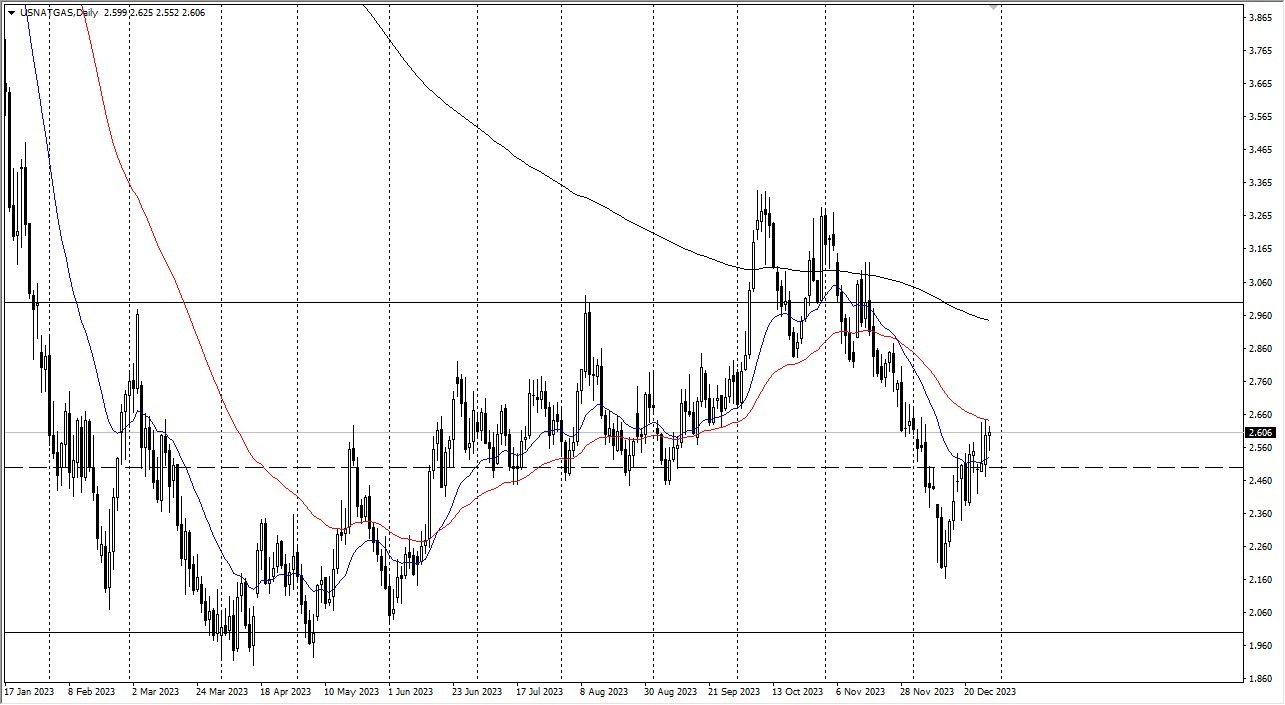

- It is advisable not to overanalyze the price movements during this time. However, it is noteworthy that the price has managed to surpass the $2.50 level, potentially indicating a level of support.

Looking ahead, we should consider the 50-day Exponential Moving Average above as a potential resistance point. A break above this level could be interpreted as a bullish signal. Additionally, the 20-day EMA, situated just slightly above the aforementioned $2.50 level, is likely to provide substantial support.

The Broader Perspective…

In terms of the broader perspective, it's important to acknowledge that the futures markets are already factoring in February. At this point in the year, any significant developments in winter-related factors are expected to be short-lived, at best. A potential catalyst for price fluctuations could be a winter storm in the northeastern part of the United States, but even in such a scenario, any resulting buying opportunity is likely to be temporary. In other words, you are going to need to be nimble to say the least. The markets will continue to see a lot of volatility on the random weather-related occasion, but in the end – we are probably rangebound.

Over the long term, it appears that natural gas is attempting to establish a trading range, with strong support beneath the $2.00 mark and formidable resistance around the $3.33 level. The presence of an oversupply of natural gas has contributed to this range-bound behavior. Earlier in the year, there were speculations that a shortage of supply in Europe might drive prices higher, but this expectation has not materialized. Consequently, the market remains characterized by choppiness and a short-term focus.

In the coming trading sessions, it is reasonable to expect limited market activity unless there are significant changes in weather patterns. Currently, the northeastern part of the United States has been experiencing relatively warm conditions, which hampers the potential for natural gas to gain significant momentum. Consequently, it would be prudent to monitor any shifts in weather conditions as they could play a pivotal role in influencing natural gas prices in the near future.

Ready to trade Natural Gas Forex? We’ve made a list of the best commodity broker platforms worth trading with.

Ready to trade Natural Gas Forex? We’ve made a list of the best commodity broker platforms worth trading with.