- The natural gas market has experienced some recent fluctuations, leading to concerns that it may be overextended.

- These fluctuations are primarily attributed to the impact of the latest winter storm in the United States.

- However, you have to ask how long it will last.

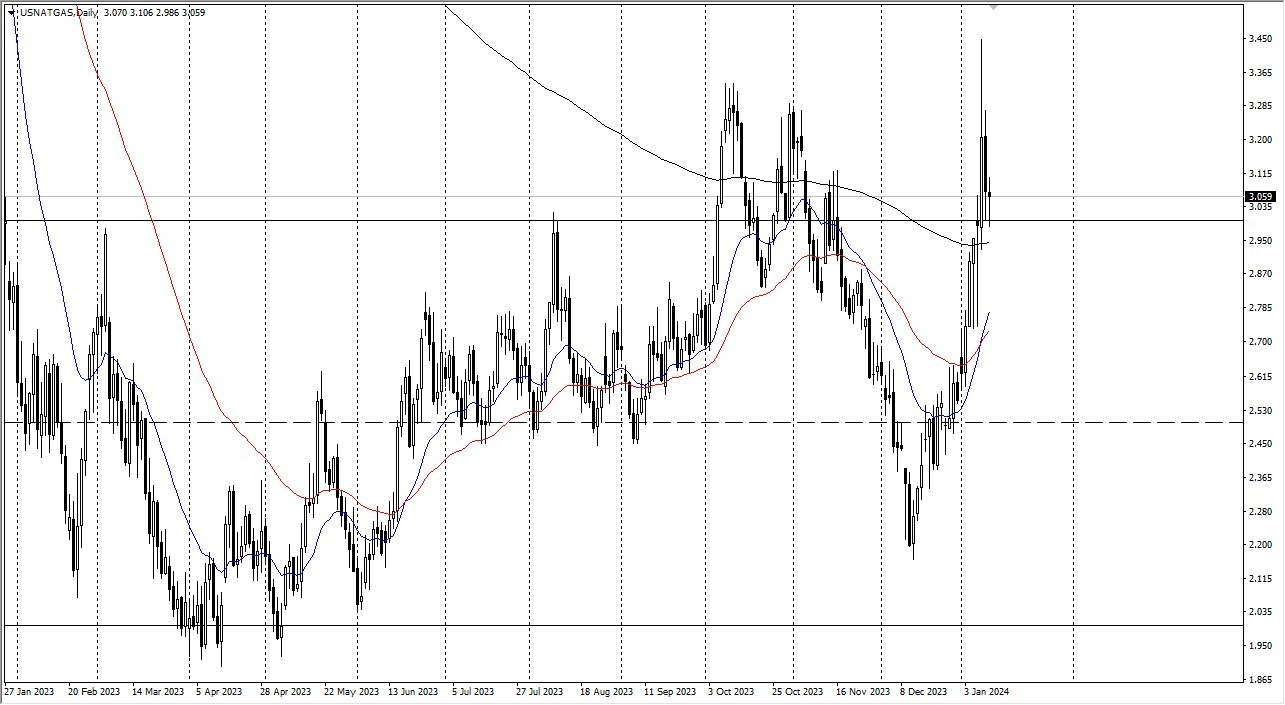

During the recent trading session, natural gas prices initially declined, signaling a certain level of uncertainty in the market. The market had previously surged towards the $3.33 level, mainly due to anticipation surrounding the upcoming winter storm in the northeastern part of the United States. This anticipation was driven by the expected increase in natural gas demand during the cold weather. However, it is essential to consider that there is a surplus of natural gas supply, which has been an ongoing concern.

Additionally, it's worth noting that the futures market is already factoring in the February futures contract. As we approach March, there is an anticipation of decreased demand as the cold weather subsides. This transition from one contract to another can impact market dynamics. This could be a big factor going forward in the next few weeks.

Winter Storm

While this may not be the final winter storm affecting market sentiment, it is likely one of the last. If there is a slight pullback in prices, or if they drop below the 200-day Exponential Moving Average, the market could potentially decline towards the $2.50 level. Conversely, breaking through the top from the Monday candlestick could pave the way for a challenge towards $3.50.

At present, the market appears to be hovering near the upper end of a significant consolidation range. Consequently, it may not be advisable to adopt an aggressive trading stance. The natural gas market tends to be highly influenced by short-term weather patterns in the northeastern United States. Given the market's current position closer to the upper end of this range, the potential for a pullback remains a distinct possibility.

At the end of the day, the recent natural gas market movements have been driven by the anticipation of the winter storm and its impact on demand. However, the presence of a surplus supply and the approaching transition to the March futures contract should not be overlooked. It is advisable to exercise caution and closely monitor market developments, as a more extensive pullback is a potential scenario.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.