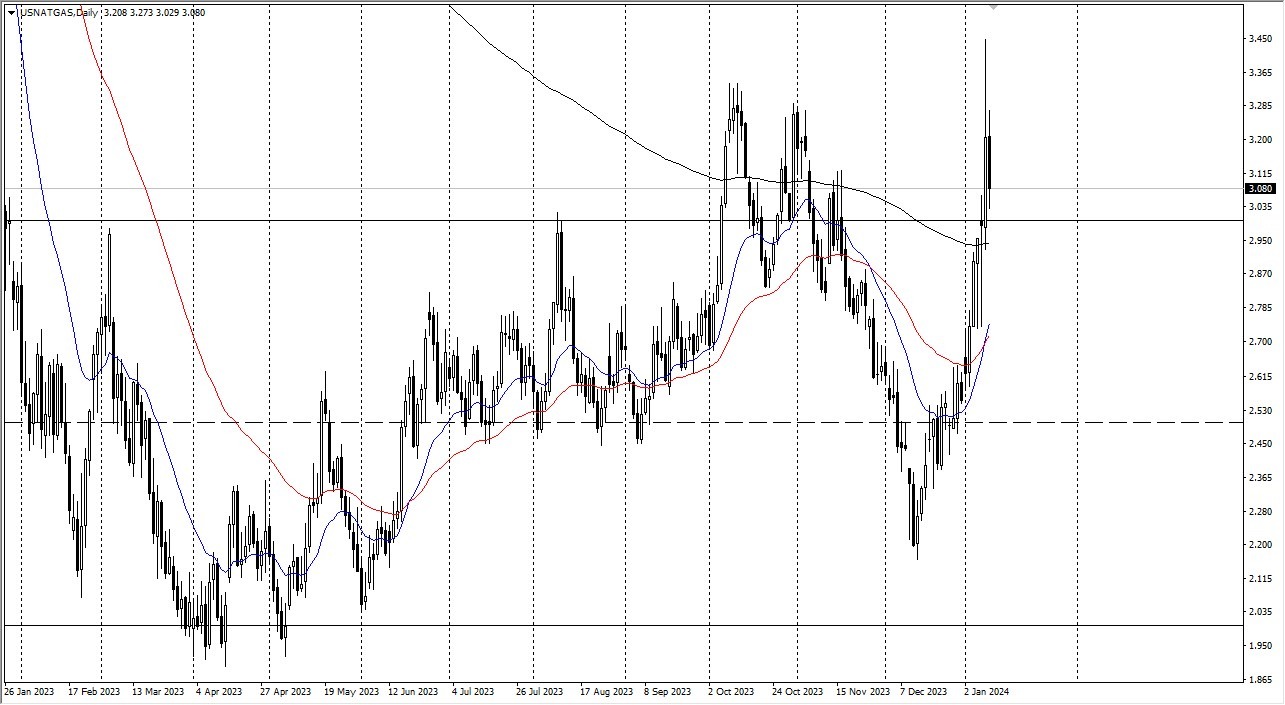

- In the market for natural gas, recent movements have displayed a degree of caution, as the market retraced during the early hours of Wednesday.

- This retracement can be attributed to anticipation of winter weather in the upcoming weekend, which may have pushed expectations beyond their current reality, as the supply of natural gas is still very abundant.

- Consequently, should the anticipated winter storm not materialize as expected, the natural gas market could face a significant downturn.

When examining the natural gas market, it becomes evident that it has exhibited a reluctance to breach the previous resistance level, situated around $3.33. This cautionary stance can be rationalized by the market's heavy reliance on a single weather event. While the possibility for natural gas to continue its ascent remains plausible, it is crucial to acknowledge that the current momentum is finite. Inevitably, the natural gas market will encounter a reversal, potentially resulting in a sharp decline. Presently, we find ourselves at the upper limits of a consolidation range that is likely to persist throughout most of the year.

Three Dollars

Should the market dip below the $3 threshold, it could trigger renewed shorting activity, possibly driving natural gas prices down to the $2.70 level or even as far as $2.50. Despite the anticipated drawdown in natural gas supplies over the upcoming days, it is essential to recognize that the futures market is already priced in the prospects for February. In the context of pricing, the transition to spring is not too distant.

In light of these factors, while sporadic price spikes may occur, it appears that the winter season has not delivered as expected for natural gas. Unless there are significant meteorological developments, it is challenging to envision a substantial surge in natural gas prices, despite the favorable conditions that had been aligning for this year. The absence of a notable reduction in American supply, even in the face of limited European supply, continues to exert downward pressure on the price. In conclusion, it is prudent to exercise caution when considering investments in the natural gas market at its current levels. After all, this is a situation that looks to be a bit dangerous, but given enough time, we will settle back down – something that is needed at the moment.

Ready to trade the NASDAQ 100 Index? Here are the best CFD brokers to choose from.