- The gold market appeared relatively subdued during the early hours of Thursday, reflecting uncertainty about the level of support available to sustain its stability.

- Notably, Friday's non-farm payroll announcement is on the horizon, making Thursday a naturally quieter day in the market. The outcome of this announcement will wield considerable influence over the bond market, which, in turn, can impact gold prices.

- A decrease in interest rates tends to favor gold, while the opposite holds true as well. Additionally, various geopolitical concerns loom, potentially driving up demand for gold.

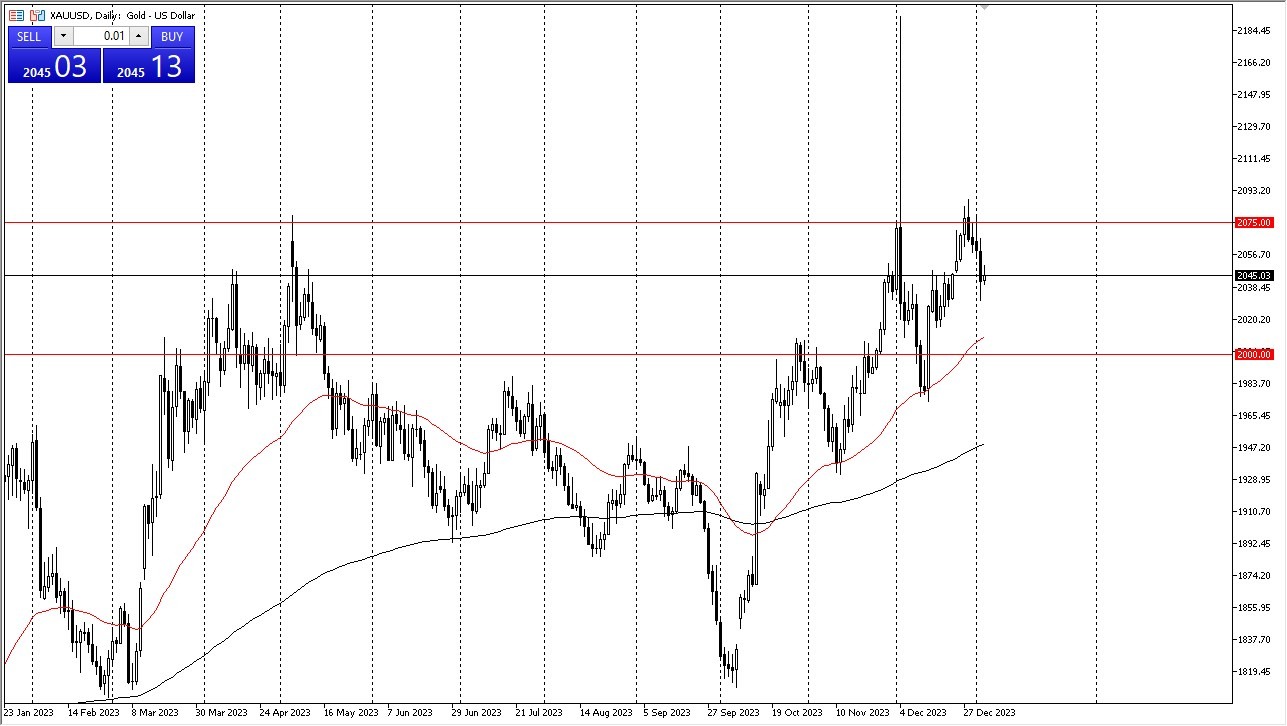

The presence of ample buyers remains a strong possibility. The 50-day Exponential Moving Average (EMA) and the $2,000 price level below it are expected to function as a substantial support zone. In the event of a pullback followed by a rebound, I am inclined to initiate a position. However, it's essential to acknowledge that the next 24 hours may be marked by heightened market noise, but as we approach Monday, liquidity is likely to improve, providing a clearer picture of gold's trajectory.

Gold’s Trajectory Remains Uncertain

A break below the $2,000 level would signal a bearish sentiment, whereas surpassing the $2,075 mark could potentially trigger a significant upward movement, affirming the prevailing uptrend. In such a scenario, the weakening of the US dollar is expected to play a pivotal role in driving the market, rather than a fervent desire to own gold per se. It's worth noting that gold doesn't offer any yield, which makes momentum a crucial factor. Traders often favor yield-bearing assets, as they don't incur storage costs. Nevertheless, given the global uncertainties, owning some gold as part of a diversified portfolio remains a prudent strategy.

At the end of the day, the gold market's near-term trajectory remains uncertain, primarily due to the impending non-farm payroll announcement and the resulting impact on bond markets. Nevertheless, the presence of support levels and ongoing geopolitical concerns suggest a potential for price appreciation. Traders should exercise caution and closely monitor market developments in geopolitics and of course bond markets over the next several days to get an idea as to where we should be putting our money when it comes to the gold market. Gold will be volatile, but at the end of the day, it is also a safe haven so that is something to keep in the back of your head with everything that’s going on.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.