- In recent trading sessions, the crude oil market has demonstrated a resurgence, particularly during the early hours of Wednesday.

- This movement indicates a potential breakout from a significant consolidation region, signaling a shift in market dynamics that could have far-reaching implications for traders and investors.

West Texas Intermediate

Focusing on West Texas Intermediate Crude Oil, the market initially experienced a slight pullback during Wednesday's session, only to reverse course and exhibit strength. The WTI has been consistently pressuring the $75 level, a psychologically important round number that naturally garners market attention. The ability of the market to stay above this level is now a critical factor that could usher in a more bullish phase. Additionally, the 200-day Exponential Moving Average is seen as the next potential target, aligning with the market’s current trajectory. Short-term pullbacks are increasingly viewed as buying opportunities, with the $71 level offering substantial support.

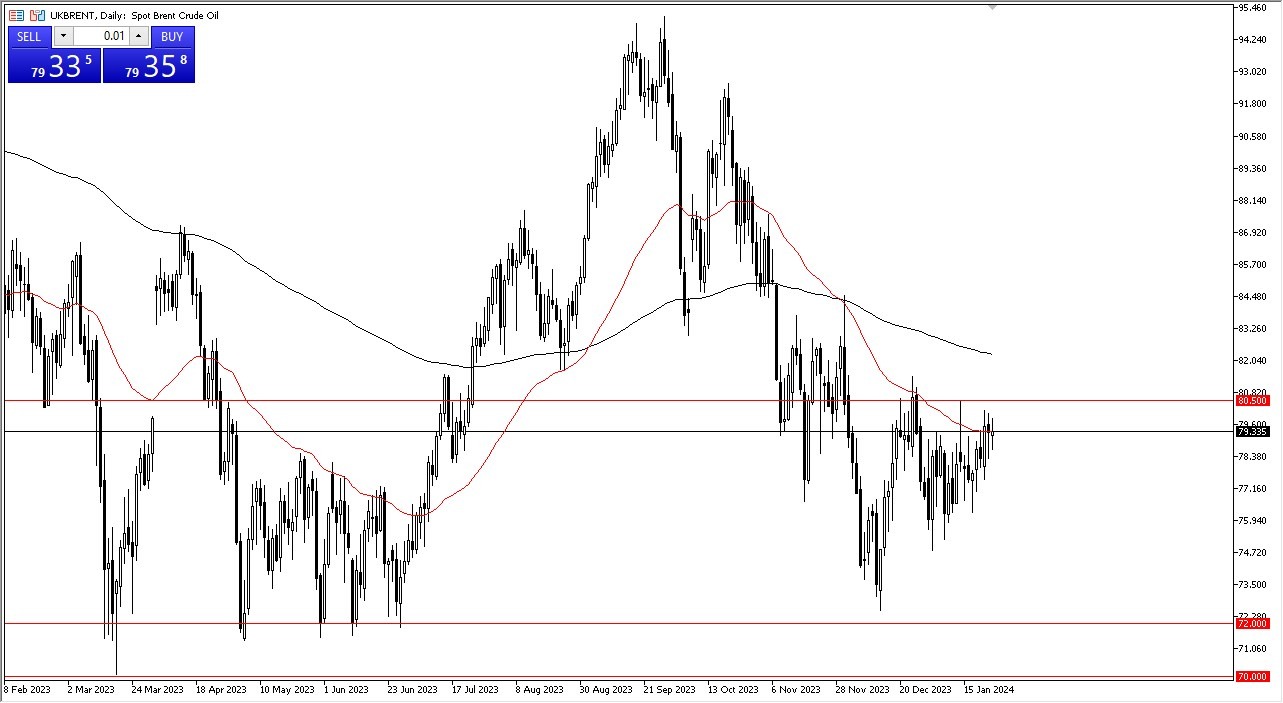

Brent

In the Brent crude market, a similar pattern is observable. After an initial pullback, the market is striving to reach the $80.50 level, a threshold that has previously acted as a significant resistance point. A breakthrough above this level, akin to the WTI market, could see Brent oil aiming for its 200-day EMA.

The prevailing sentiment among traders and analysts is to "buy on dips," with particular focus on the $75 level as a pivotal point for market entry. This strategy stems from the anticipation that buyers will be keen to capitalize on lower-priced crude oil, considering the current market trends.

However, there are multiple factors at play that necessitate a careful and informed approach to trading in these markets. One of the key considerations is the potential impact of geopolitical events, such as the Red Sea attacks, on crude oil supply and prices. Additionally, the market must contend with the ever-present question of economic demand and how it will influence crude oil prices. The actions of OPEC also remain a significant factor in determining the direction of the market.

Given these considerations, trading in the crude oil market requires an understanding of both technical indicators and global events. The market's response to these factors will be crucial in determining the future trajectory of crude oil prices. This is a market that continues to see a lot of noise, but the buyers look stronger at this point.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.