- Bitcoin has been on the rise recently, showing signs of recovery after a period of decline.

- This upward momentum continued during Tuesday's trading session, with Bitcoin's price pushing higher.

- It's important to note that this bullish trend may persist, but there's a possibility of a consolidation phase in the near future.

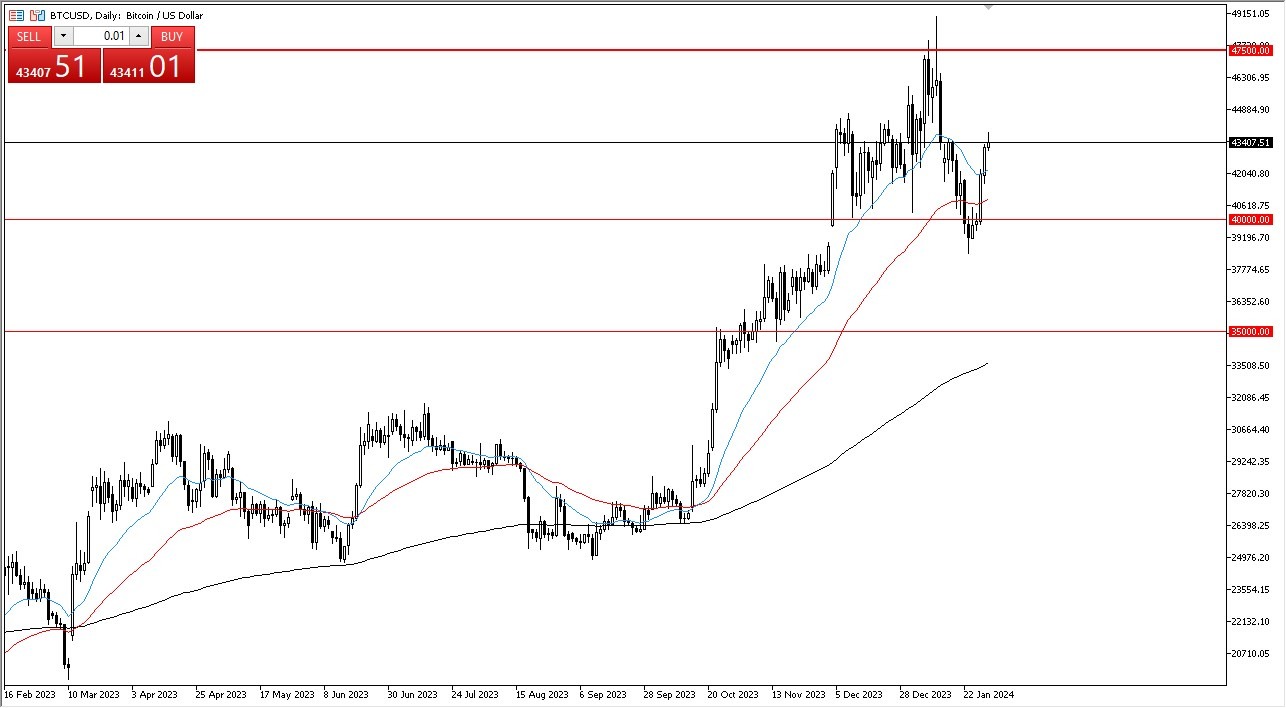

In the past few days, Bitcoin has witnessed a notable surge in its value. However, it's worth mentioning that the market has become somewhat overextended, which could lead to a pullback. If such a pullback occurs, it could offer an attractive buying opportunity for investors. The price level around $40,000 has proven to be a strong support zone, extending down to $38,000, where we previously witnessed a bounce.

Even if Bitcoin were to break below these support levels, there's a significant level of support around $35,000. This is reinforced by the fact that the 200-day Exponential Moving Average (EMA) is approaching this level, potentially acting as a solid floor for the ongoing trend.

On the upside, we encounter resistance around the $47,500 mark, where Bitcoin experienced a pullback in the past. This level could serve as a target for buyers looking to capitalize on the current bullish momentum. If this resistance is breached, the next target could be the $52,000 level.

BTC in an Uptrend

The overall trajectory of the Bitcoin market appears to be upward, largely influenced by the loose monetary policies of central banks. Investors often view cryptocurrencies like Bitcoin as "hard money" since they aren't subject to constant printing, making them an attractive alternative.

Looking ahead, it's important to consider the impact of the upcoming Federal Open Market Committee (FOMC) meeting scheduled for Wednesday. The statements and stance of Jerome Powell, the Chairman of the Federal Reserve, during this meeting, could significantly influence risk appetite in the financial markets, including cryptocurrencies. If Powell adopts a dovish tone, it could further boost Bitcoin's prospects. Conversely, if he sounds hawkish, it might trigger the anticipated pullback, offering investors an opportunity to enter the market at more favorable prices.

In the end Bitcoin's recent rally reflects a broader trend driven by factors such as loose central bank policies and a desire for "hard money" assets. While a pullback is possible due to the market's current overextension, investors should remain vigilant and consider the potential opportunities that may arise in the coming days, particularly in response to the FOMC meeting.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.