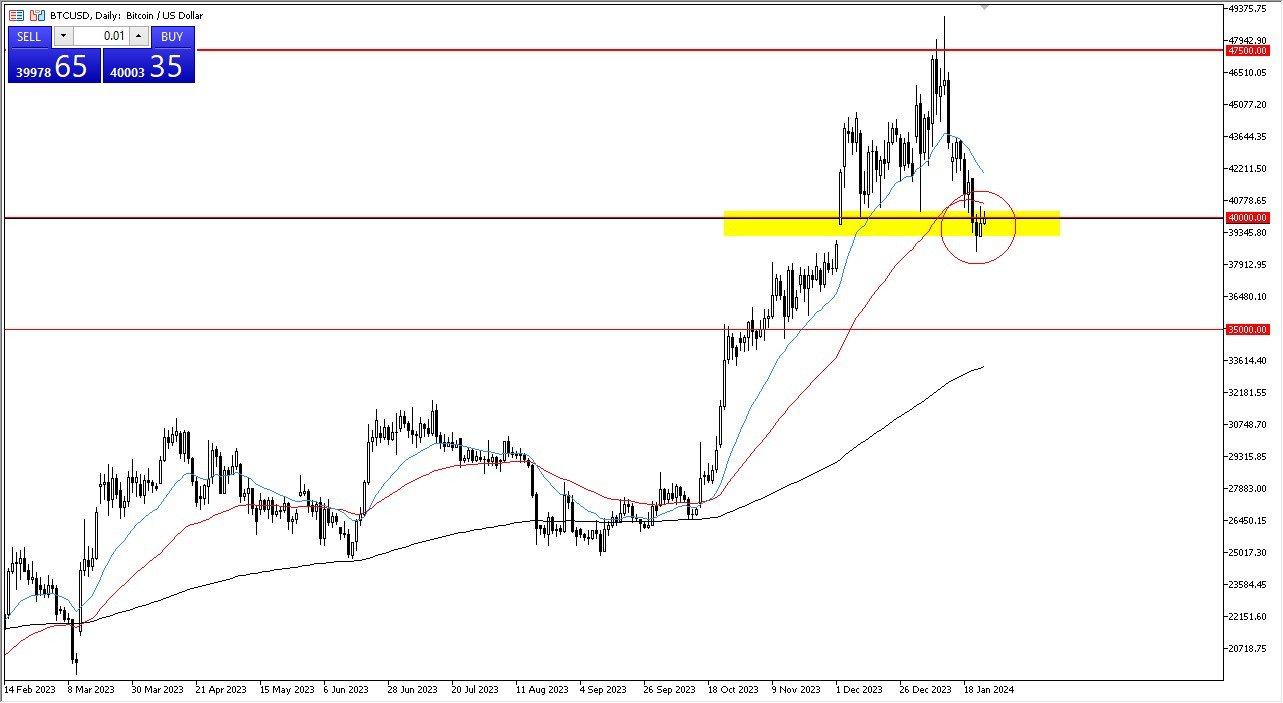

- Bitcoin has had a rather quiet session on Thursday as we continue to hang around the crucial $40,000 level.

- The $40,000 level course will attract a lot of attention and therefore I think is going to be difficult to overcome.

- Just above the $40,000 level, we also have the 50-Day EMA indicator coming into the picture, so that comes with its own set of problems as well.

That being said, if we can break above the 50-Day EMA, then it is likely that we could you look into the $4200 level, and then of course the 20-Day EMA. Breaking above that then opens up the possibility of going even higher, perhaps reaching the $47,500 level. All things being equal, I feel that the market is essentially going sideways, and we are at the bottom of the overall range. Even if we do break down below here, the $38,000 level has offered support in the short term. In general, this is a scenario where I think we have to see some type of fundamental change in order to make this market rally again.

“Here, Hold My Bags…”

During the last couple of weeks, we have seen Bitcoin fall directly from the $47,500 level, an area that was always going to be a significant amount of resistance. That being said, what has happened is that Bitcoin now has an ETF, and therefore everybody got excited. However, anybody who was an institutional trader was already in this market and gained roughly 80%, and in some cases over 90%. They then will sell Bitcoin to retail traders in order to collect their profit. That’s exactly what’s happened and then they wait for a selloff and start to build a position again, assuming that they believe it is going to go higher.

Bitcoin is Changing

Trading this market is going to change quite drastically this year, because quite frankly now that we have an ETF institutional traders will be able to short this market much easier than they could previously, so now Bitcoin is going to behave more like an index from what I can see. It’ll be interesting to see all this plays out and this year is going to be very noisy. Nonetheless, we are still in an uptrend, and therefore you have to look at it through the prism of buying dips, but also recognize that we are in a form of stasis at the moment.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.