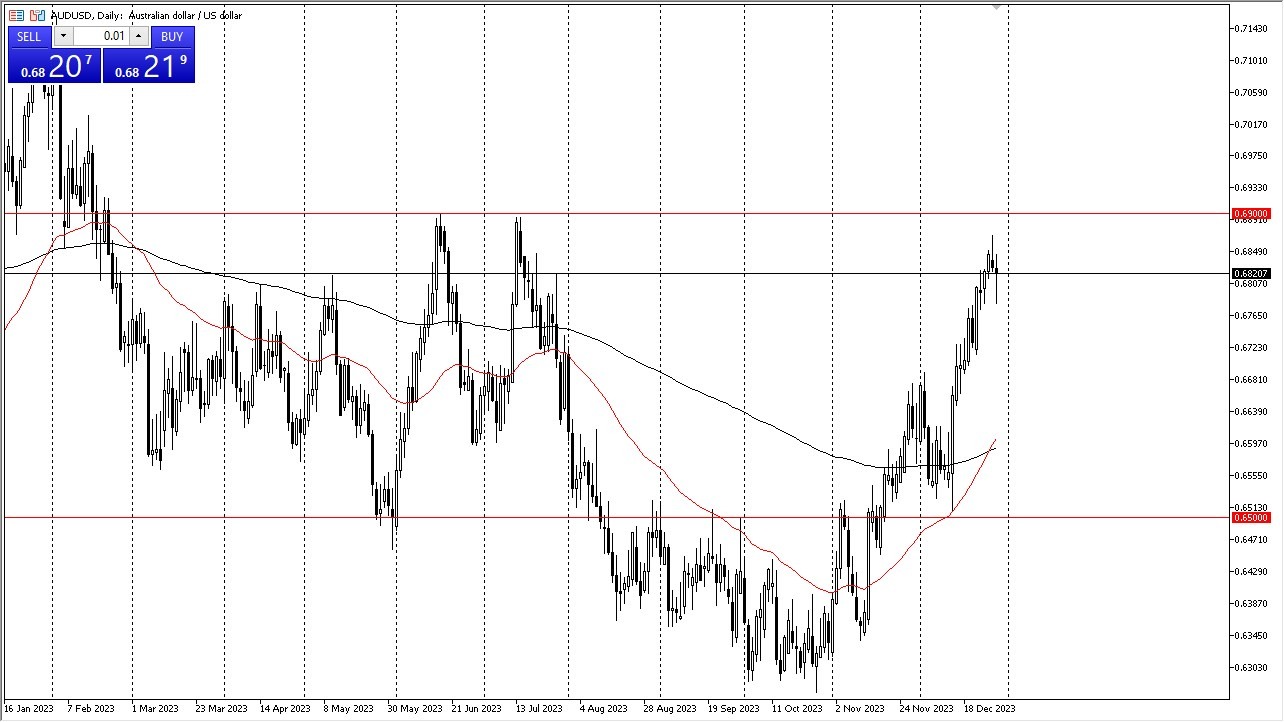

The AUD/USD experienced a significant decline against the US dollar during Friday's trading session, a development that was somewhat expected. The prevailing market conditions had led to an overextended situation, and given the year-end context, profit-taking was in order. Notably, the 0.69 level above presented a formidable barrier that many traders found challenging to breach. A break above this level could potentially trigger a rally in the Australian dollar, opening up the prospect of reaching the 0.70 mark. However, achieving such a milestone would necessitate a substantial influx of bullish sentiment and a heightened risk appetite.

Presently, a substantial portion of market participants appears to be focused on securing profits in the Australian dollar, particularly those who have enjoyed favorable returns throughout the year. Meanwhile, we observe the 50-day Exponential Moving Average surpassing the 200-day EMA, indicative of a Golden Cross pattern that tends to attract attention from longer-term traders, often associated with significant capital investments on a longer time frame perspective.

Support Underneath

- Beneath the current price levels lies substantial support at the 0.65 mark, although it remains a considerable distance away.

- The prospect of reaching this level in the near term appears unlikely.

- In the short term, traders may view pullbacks as potential buying opportunities.

- Nevertheless, the initial week of January could present challenges, with liquidity remaining an issue.

The Australian dollar's performance is closely tied to the movements in commodity markets and the global economic growth outlook. Observing these factors is essential for understanding the currency's trajectory. Additionally, monitoring the 10-year yield is crucial, as it exhibits a negative correlation with this currency pair. A rise in US yields typically strengthens the US dollar, influencing the pair accordingly, making the USD stronger and sending the AUD lower.

In the end, the Australian dollar faced a notable decline against the US dollar on Friday, reflecting the prevailing market dynamics and the inclination of traders to secure year-end profits. The 0.69 level remains a key obstacle to overcome for any potential upside momentum. While the Australian dollar has the potential to recover, it is essential to remain vigilant and consider the broader economic factors that influence its performance. Moreover, keeping a close eye on US yields will provide valuable insights into the currency pair's future movements.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.