- The Australian dollar exhibited a rally in response to lower-than-expected PPI numbers in the United States, reflecting the prevailing confusion surrounding inflation.

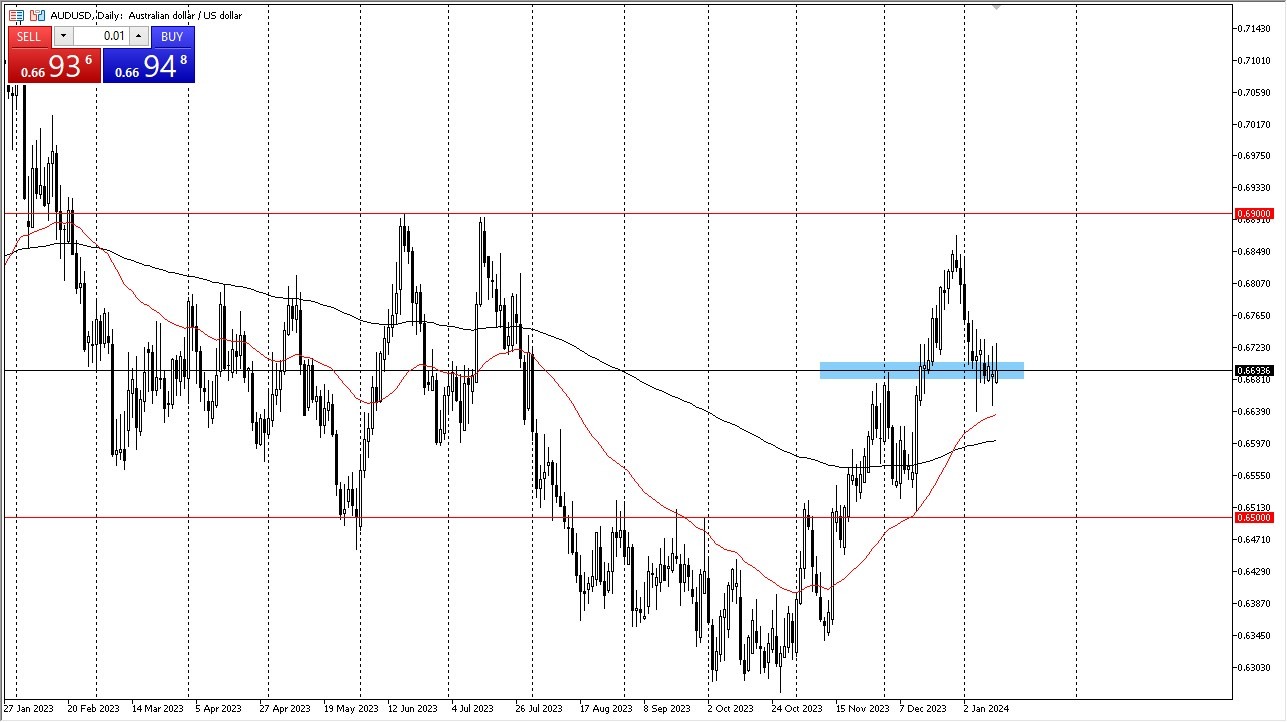

- Looking at the AUD/USD pair, the Australian dollar made a notable ascent during Friday's session, reaching a longstanding resistance level. This upward movement was a direct consequence of the cooler-than-anticipated PPI figures in the United States, causing the US dollar to struggle.

However, the key factor to watch for is whether we can achieve a daily close above the 0.6750 level, which would signify a shift towards a bullish outlook. As of the current moment, the market remains somewhat uncertain, requiring further observation for potential follow-through. If the 0.6750 level is surpassed on a daily closing basis, it's likely that the Australian dollar will aim for the 0.68 level and potentially even the 0.69 level, which marks the upper boundary of the overall consolidation range. Monitoring US bond yields is crucial, as a continued decline in yields may weaken the US dollar.

In a Downturn…

Conversely, if a downturn occurs from the current level, the 0.6650 level below holds significant support. Additionally, the 50-day EMA in that vicinity could provide substantial support as well. Expect considerable turbulence in this area, given its position as fair value, lying midway between the prominent levels of 0.69 and 0.65, which are of interest to longer-term traders. In essence, anticipate a period of erratic and turbulent behavior.

It's essential to note that the Australian dollar is highly sensitive to global economic growth and commodity prices. Meanwhile, the US dollar is often viewed as a safe-haven currency. While these dynamics can fluctuate, the prevailing technical analysis suggests robust buyer interest during price declines. However, bear in mind that volatility remains a significant concern. On a broader scale, it's worth considering that geopolitical issues could potentially drive increased momentum in the US dollar if they escalate out of control.

In the end, the Australian dollar experienced a rally in response to lower PPI figures in the United States, highlighting the ongoing uncertainty surrounding inflation. The AUD/USD pair faces a critical juncture at the 0.6750 level, with potential bullish implications upon a daily close above it. Nevertheless, the market's outlook remains uncertain, and volatility should be expected. Keep an eye on US bond yields and geopolitical developments, as they could influence the US dollar's trajectory in the coming days.

Ready to trade our Forex daily analysis and predictions? Here are the best currency trading platforms Australia to choose from.