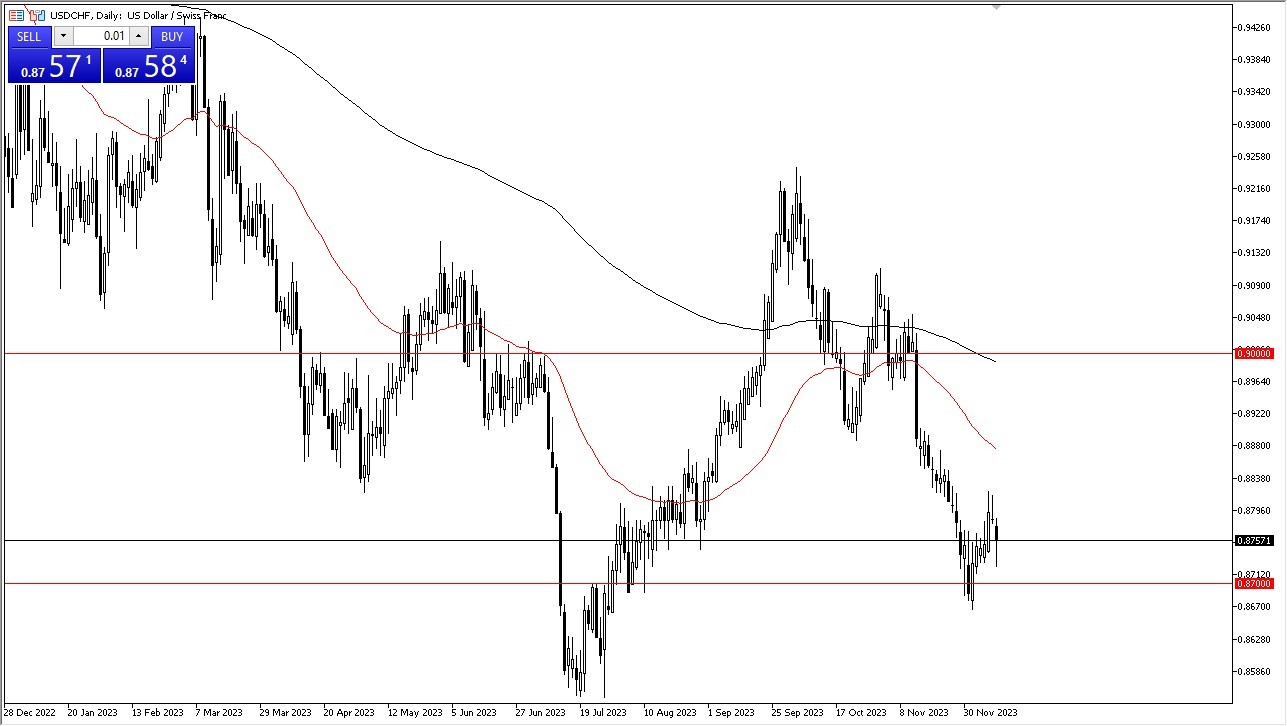

- The USD/CHF initially fell during the trading session on Tuesday, but looks as if it is trying to find some type of bottom against the Swiss franc.

- This is going to particularly interesting pair to watch over the next couple of days as the Federal Reserve has an interest rate decision on Wednesday, and then the Swiss National Bank has an interest rate decision on Thursday.

- With that being said, I expect to see a lot of volatility.

A lot of this will probably fall in the hands of the Americans, because the Swiss Natural Bank is typically very loose with its monetary policy anyway, so that being said, the market is likely to continue to see a little bit of buying pressure, but keep an eye on the 0.87 level underneath, due to the fact that it is a large, round, psychologically significant figure and of course an area that has been important on longer-term charts. As long as we can stay above there, we have a real shot at turning around.

Exploring the Challenges and Opportunities

That being said, if we were to break above the 0.88 level, it opens up the possibility of a move to the 50-Day EMA, possibly even as high as 0.90 level after that. The 0.90 level is an area that features a 200-Day EMA and of course is a large, round, psychologically significant figure as well. Because of this, I think it is going to be very difficult on the way out, but if you are going to continue to be vigilant and impatient with the trade, I do think that it could eventually work out.

That being said, the market were to turn around and break down below the 0.8670 level, then we could enter a bit of a freefall toward a 0.85 level after that. Ultimately, I don’t think that’s as likely but it is something that you need to keep in mind. After all, the interest rate differential still favors United States, but not as greatly as it once did. Pay attention to the bond markets in the United States, because the interest rates rising in the United States will push this market higher. Ultimately, be cautious with your position sizing, but recognize that the market is likely to be very choppy and therefore you have to be somewhat cautious.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.