Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a buy deal with a pending order from the 28.90 level.

- Place a stop loss closing point below the support level at 28.70.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 29.15.

Best-selling entry points

- Entering a sell deal with a pending order from the 29.10 levels.

- The best points to place a stop loss are closing the highest levels of 29.25.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 28.85

The TRY/USD stabilized during the early trading of the weekly trading near its highest levels ever. Investors followed Morgan Stanley's expectations that the Turkish Central Bank would raise interest rates by 250 basis points at its expected meeting this month, targeting a final rate of 45% after an additional hike in January. These forecasts are based on the bank's guidance and inflation expectations. While investors are awaiting hints about future interest rates during the bank’s statement following the issuance of the interest decision. The bank's analysts also expect the end of the current tightening cycle, which has been ongoing since approximately mid-year, next January, while it is not unlikely that further increases in interest rates may occur depending on inflation trends. As for inflation expectations, Morgan Stanley indicated that annual inflation will reach its peak at 71.6% next May, before falling to 42.3% by the end of the year, despite their expectation that the risks of inflation declining will rise more slowly than expected.

Meanwhile, investors followed the statements of the Governor of the Turkish Central Bank, Hafiza Ghaya Arkan, who announced the bank’s goal for inflation during 2025, as the bank aims to reduce inflation to 14 percent. While she commented on the decline in the value of the Turkish lira, saying that the bank does not interfere in the lira’s exchange rate.

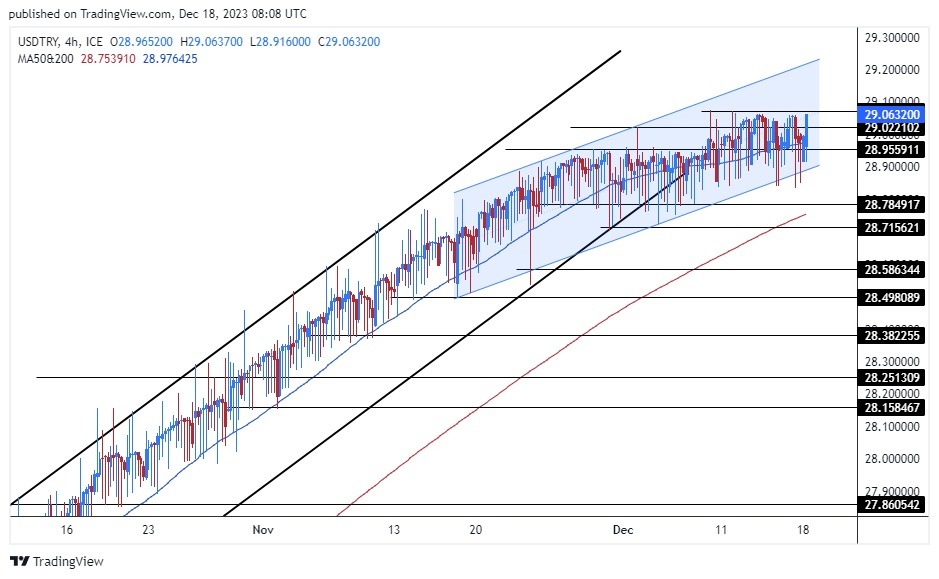

TRY/USD Technical Analysis

On the technical level, the lira pair against the dollar traded in a narrow range at the same price range in which it moved over the past week, as the price moves near its highest levels ever at 29.05 levels. On the larger time frame, the price moves within an ascending price channel on today's time frame, reflecting the strong general upward trend that the pair has been following over the course of several months. While the pair has recently recorded a slowdown, with the price entering another ascending price channel, but it is less severe, as the price was unable to significantly penetrate the 29.10 levels over the course of the current month.

If the pair rises, it targets the resistance levels, which are concentrated at the levels of 29.15 and 29.25, respectively, while on the other hand, if the pair declines, it targets the levels of 28.90 and 28.75, respectively. The pair is trading above the 50 and 200 moving averages respectively on the day time frame, as well as on the 4-hour time frame in a reflection of buyers' control over the price. The pair is expected to continue its general upward trend as long as it stabilizes within the borders of the mentioned price channels. Please adhere to the mentioned recommendation points and maintain capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.