Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a buy deal with a pending order from the 28.75 level.

- Place a stop loss closing point below the support level at 28.60.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 29.10.

Best-selling entry points

- Entering a sell deal with a pending order from the 29.00 level.

- The best points to place a stop loss are closing the highest level of 29.15.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 28.75

The Turkish Lira declined against the dollar during early trading this morning, as it traded near its lowest level ever against the US dollar around the level of 29.02 liras per dollar. Investors followed the data issued by the Statistics Institute in Turkey yesterday, which revealed that the unemployment rate in Turkey declined last October to 8.5 percent, bringing unemployment to its lowest level since November 2012. In general, the Turkish economy is witnessing positive numbers and data in conjunction with the shift in economic policy that the country is witnessing.

Turkish President Recep Tayyip Erdogan commented on the unemployment data. He said that his country is on the right track, especially since what he called inflation fever has begun to decline in conjunction with the emergence of positive effects in the markets. He also added that his country will see better data during the next month. At the same time, Turkish Vice President Cevdet Yilmaz stated that his country's economic policy is to raise the domestic savings rate while reducing the current account deficit, while paying attention to the productive sectors by directing savings to them. Yilmaz also stressed that inflation will fall to single digits during 2026.

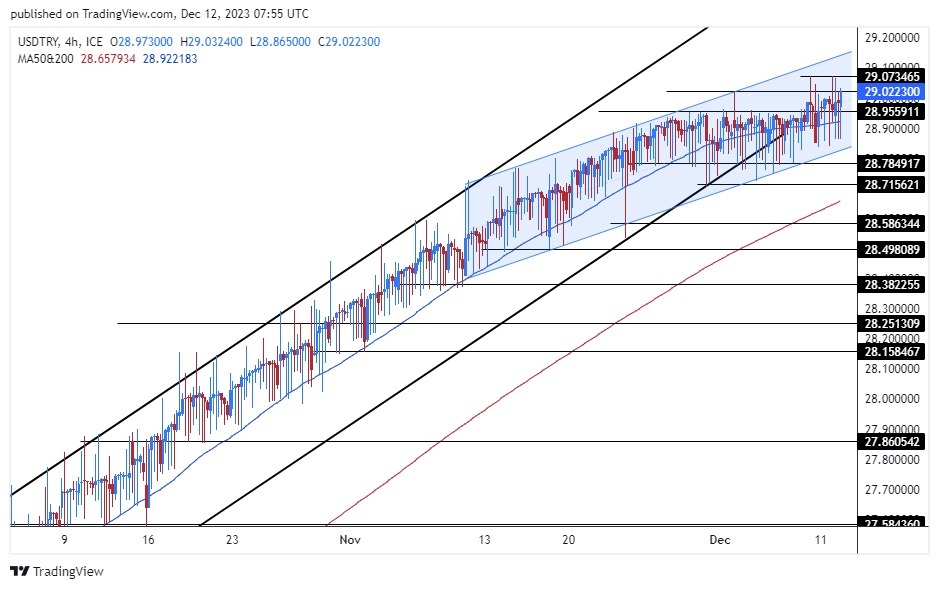

TRY/USD Technical Analysis

On the technical level, the dollar's trading has increased against the Turkish lira, as the pair is trading near its highest levels ever, which it previously recorded earlier this month after breaching the 29.02 levels. In general, the pair maintained its upward path, as it trades within the ascending price channel on today's time frame shown in the chart. While the pair records semi-lateral trading, with the pair moving within a smaller, less severe price channel shown in the chart, the upper border of which the pair was unable to break.

If the pair declines, it will target the support levels concentrated at 28.80 and 28.65, respectively. On the other hand, if the price rises, it will target the resistance levels, which are concentrated at 29.10 and 29.15, respectively. At the same time, the price is trading above the 50 and 200 moving averages on the daily time frame, as well as on the four-hour time frame, indicating the control of buyers within the general upward trend that the pair is recording in the long term. The change in monetary policy may prepare the pair to record an upward wave, but at a slower pace. Please adhere to the numbers in the recommendation, with the need to maintain capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.