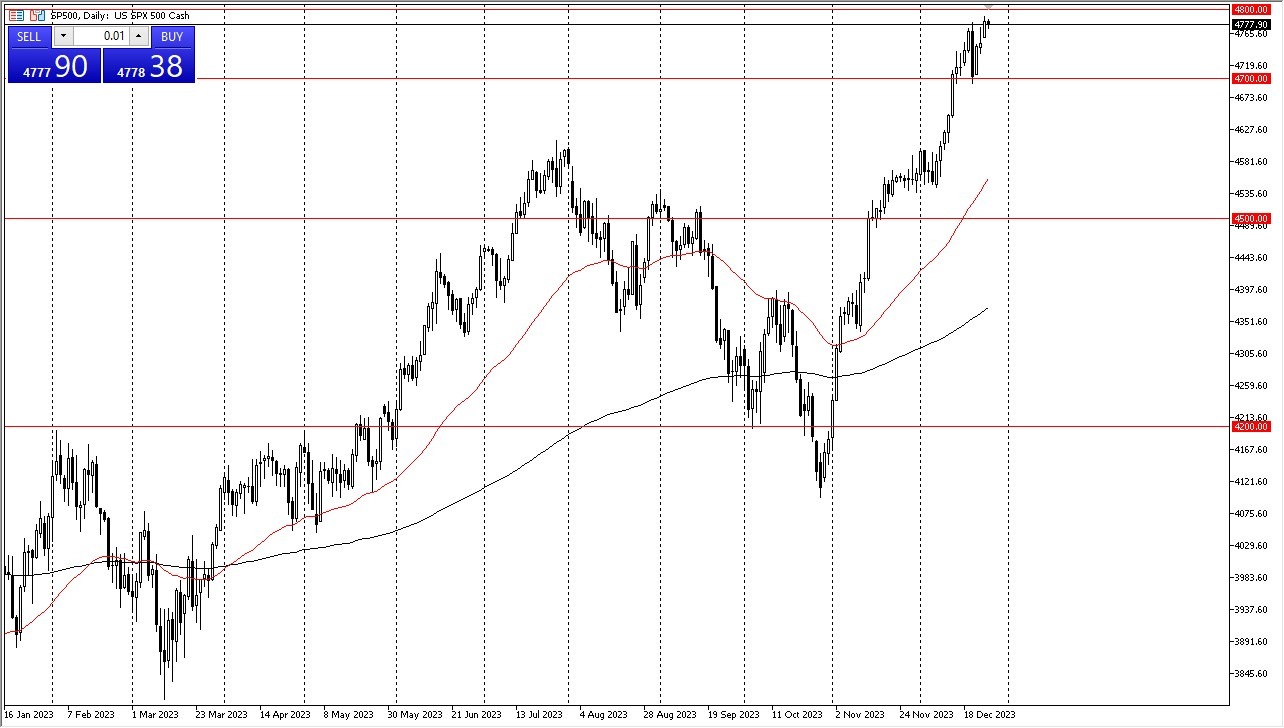

- The S&P 500 market exhibited a degree of stagnation in Wednesday's trading session, primarily due to the persistent resistance encountered at the 4800 level.

- Breaking above this level, which represents an all-time high, could pave the way for further upward movement in the S&P 500.

- However, there are considerations of market overextension, suggesting the need for a potential pullback to identify value opportunities.

- It wouldn't be surprising to witness such a pullback, possibly pushing the market down to the 4700 level.

The 4700 level could potentially serve as a support area, although an even more favorable scenario would be a pullback to the 4600 level. Technical traders often keep a close eye on the 50-day Exponential Moving Average, and its significance in this context cannot be overlooked.

Please Come Back…

In the grand scheme of things, a pullback would be welcomed as it could provide a chance to enter the market at a more attractive price. However, the possibility of such a pullback remains uncertain. The prevailing sentiment on Wall Street appears to be driven by a singular focus on the Federal Reserve's potential interest rate moves in the coming year. As long as the belief persists that the Federal Reserve might reduce rates, Wall Street seems intent on propelling the stock market higher.

It's important to note that Federal Reserve rate cuts often act as a catalyst for select stocks, driving the index higher. Nevertheless, there may come a point where market participants start questioning the reason behind the central bank's rate-cutting decisions. If it signals an attempt to preempt a significant economic slowdown, it could potentially trigger a market selloff.

While a drastic selloff isn't on the immediate horizon, it's a scenario worth keeping in mind. In the present context, the prevailing sentiment leans toward a "buy on the dip" approach, and momentum appears to be in control of market dynamics.

In conclusion, the S&P 500 market faced resistance at the 4800 level, potentially necessitating a pullback to identify value opportunities. While the 4700 level may offer support, a retreat to the 4600 level could be even more enticing. Technical traders are closely monitoring the 50-Day EMA. The market's primary focus remains the Federal Reserve's interest rate policy, which is perceived as a driver of stock market momentum. However, the reasons behind rate cuts may come under scrutiny in the future, potentially impacting market dynamics. For now, the prevailing sentiment is to capitalize on buying opportunities during market dips, with momentum likely to persist. Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.

Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.