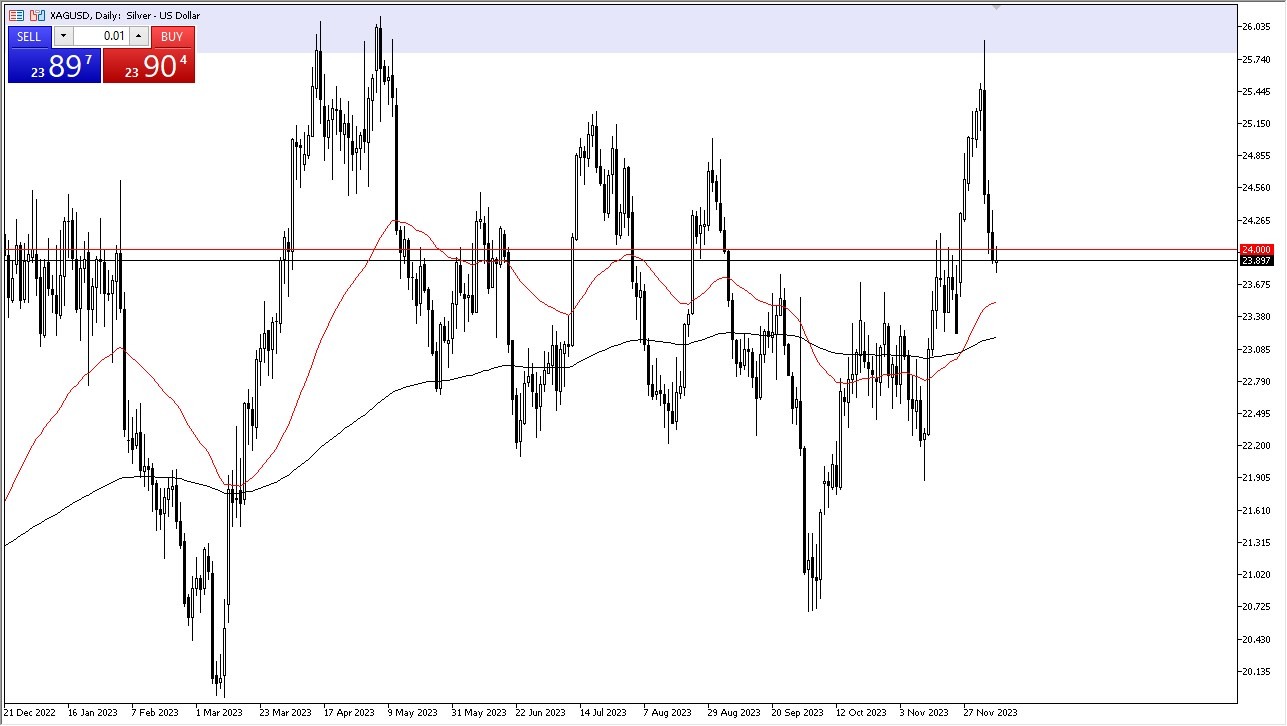

- Silver experienced a turbulent day on Thursday as uncertainty loomed over its upward trajectory and the possibility of the recent rally coming to an end. The recent steep decline in silver prices has been undeniably harsh and appears to have been excessively severe.

- Should we manage to achieve a daily closing price surpassing the $24 mark, I believe there is a chance for a gradual recovery towards the $25.50 range over a significant time frame.

- Conversely, if we witness a breakdown below the lower boundary of Thursday's trading session candlestick, it opens up the potential for a descent towards the 50-Day EMA.

In essence, this situation is characterized by a plethora of erratic fluctuations, which is not uncommon in the silver market, particularly given the current less-than-ideal circumstances. The oversold condition of silver is indeed noteworthy, considering the considerable volatility prevalent in the precious metals sector. However, as interest rates continue to decline in the United States, it is likely to provide overall support for silver. Consequently, there appears to be a genuine prospect of a substantial rally in this market. Moreover, there will be individuals seeking to acquire "discounted silver" after possibly missing out on the substantial rally that initially propelled prices to this level. In light of this, it is prudent to view this as a potential buying opportunity, but one should exercise caution and await a resurgence in upward momentum before acting upon it.

Reversal Possible

If a reversal occurs, leading to a breach below the 50-Day EMA, it would undoubtedly signify a highly adverse development, potentially paving the way for a descent towards the 200-Day EMA. The 200-Day EMA is poised to garner significant attention due to its status as a longer-term technical support level and its capacity to determine the overarching trend. It is likely to trigger a flurry of algorithmic trading activities, potentially causing tumult within the markets. Nonetheless, it is worth noting that we are currently a considerable distance from such a scenario playing out at this point. Consequently, I maintain a positive outlook on buying on dips that show signs of follow-through.

Potential signal: I am buying silver on a DAILY CLOSE in the spot market above $24.08, with a stop loss at the $23.88 level. I am looking to take profit at the $24.45 level above, perhaps even higher if momentum warrants this.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.