- Silver exhibited a modest uptick during Tuesday's trading session, hinting at the prevailing external bullish pressures.

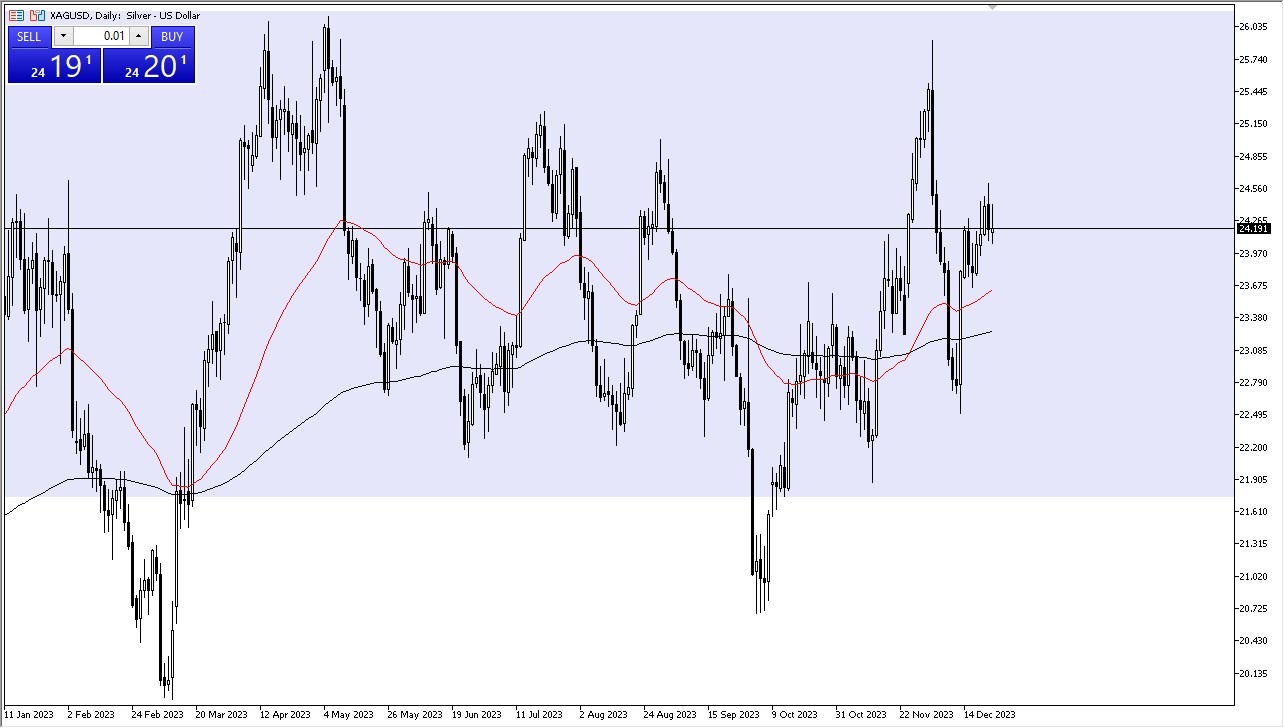

- The prospect of further gains becomes apparent if we can sustain this upward momentum, potentially breaching the $24.75 threshold.

- Such a breakthrough could pave the way for an ascent toward the $26 level. It is worth noting that this juncture has historically witnessed significant market activity, characterized by noise and price fluctuations.

- Therefore, the outlook hinges on the market's ability to generate sufficient momentum.

Holiday Season Illiquidity

The holiday season introduces an element of uncertainty, primarily due to the anticipated decrease in liquidity. Paradoxically, this lack of liquidity can either pose challenges or catalyze momentum, as traders navigate these air pockets that may move the market unpredictably. Nevertheless, the overarching sentiment remains bullish, which should attract buyers whenever a retracement occurs. These buyers are likely to acknowledge the significance of the $26 level as a formidable resistance zone, further fueling market interest.

Beneath the current price action, the $24 level emerges as a potential area for a more pronounced pullback. In such a scenario, market participants are likely to scrutinize the 50-Day Exponential Moving Average as a pivotal indicator. Until a clear breach of this EMA materializes, any pullback should be viewed with caution. I look at it as a market that cannot be shorted, as there is far too much in the way of momentum in this market.

Remember, the silver market retains its upward bias, with the potential for further gains. The interplay between silver and the US dollar is noteworthy, given the substantial negative correlation between the two. Consequently, any deterioration in the US dollar's strength could serve as an additional catalyst for silver's ascent. In this context, traders are expected to keep a watchful eye for opportune entry points in what is a robust market.

Overall, the silver market continues to exude strength, and traders are likely to seek opportunities to participate in this upward trajectory, despite the occasional retracements that may surface along the way. This should continue to be thought of as a buying opportunity, as the bond markets are showing that rates should continue to drop in the ten-year bond markets, and this should continue to help silver.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.