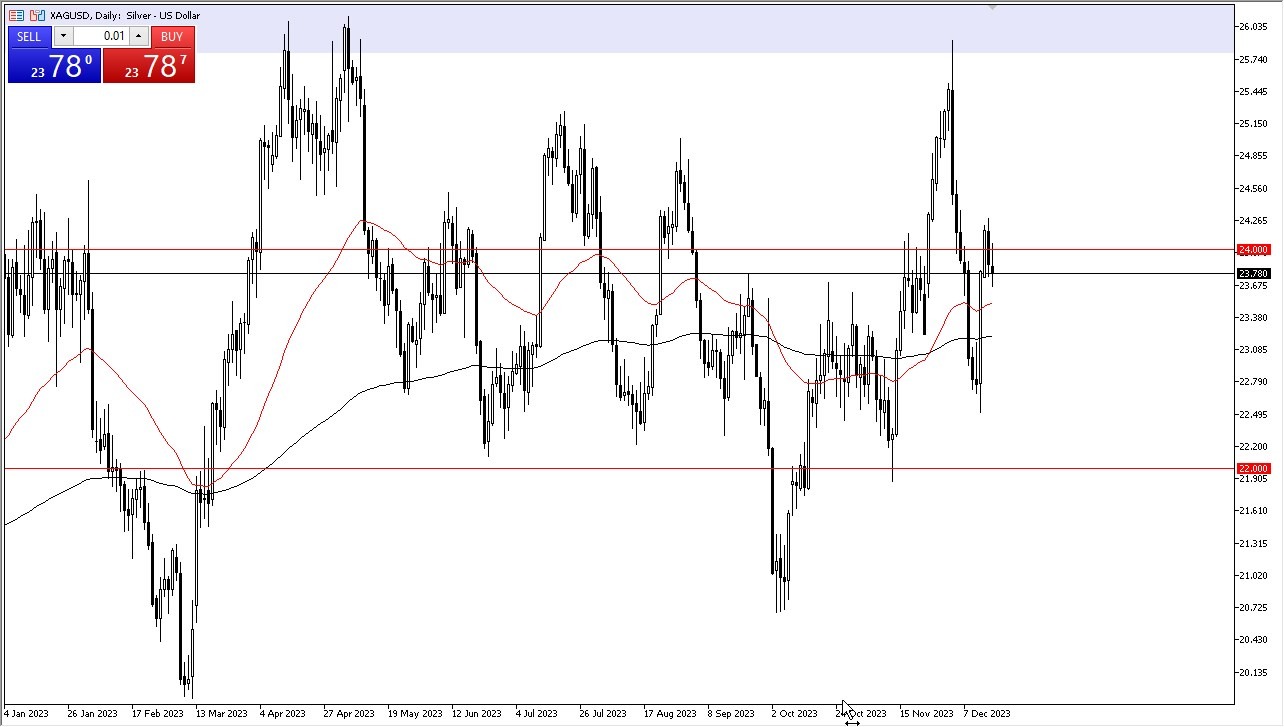

During Monday's trading session, silver prices fluctuated around the $24 level, a price point that has been significant for a considerable time. Silver has been marked by notable volatility recently, but there are indications of a potential recovery, largely based on expectations regarding the Federal Reserve's monetary policy. The latest update from the Fed, including the "dot plot," suggests multiple interest rate cuts in 2024, which could lead to a slight devaluation of the US dollar. This potential weakening of the dollar generally supports the value of precious metals like silver.

Looking at technical indicators, the 50-Day EMA is providing some support and is on an upward trend. This level is likely to be seen as a short-term base for silver prices. However, if prices were to fall below this support, a further drop towards the 200-Day EMA might be on the cards. Conversely, if silver can surpass the highs seen in the Friday session, this could pave the way for a move towards the $26 level. This price has previously acted as a significant resistance barrier and overcoming it could prove challenging. A break above the $26 mark would be a particularly bullish signal, but considering the recent sharp decline from higher levels, reaching and exceeding this point could be difficult.

Yields and the Effect on Metals

Another important factor to monitor is the yield on the 10-year US Treasury note, as it often shows a negative correlation with silver prices. Changes in these yields can serve as a leading indicator for the future direction of silver prices. Therefore, keeping an eye on both the 10-year yield and the silver market is a sensible strategy for those interested in this commodity.

In summary, silver's current market position is influenced by a combination of the anticipated shift in the Federal Reserve's monetary policy, the behavior of the US dollar, and technical support and resistance levels. Additionally, external economic indicators such as US Treasury yields also play a significant role in forecasting silver's price movements. Investors and traders in the silver market should consider these various factors to make informed decisions, understanding that the precious metal's value can be sensitive to a range of macroeconomic and market-specific influences.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.