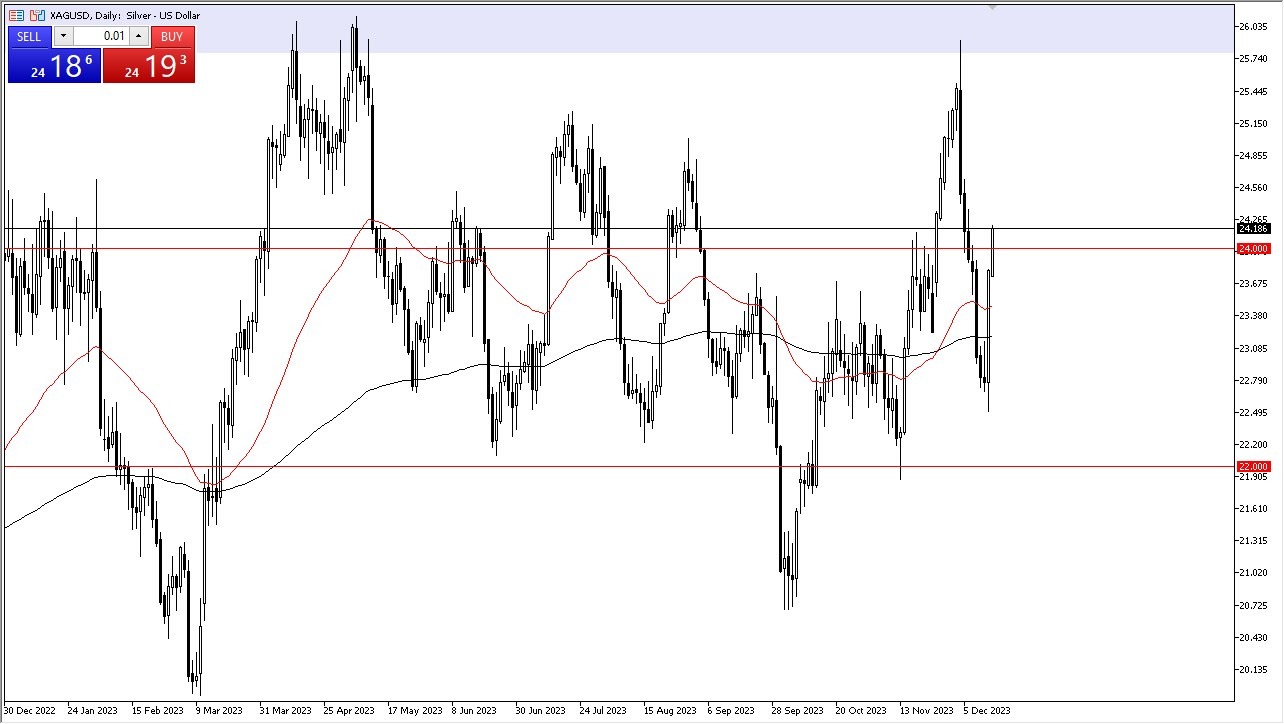

- Silver had a good day in trading on Thursday, climbing above the $24 level. It looks like buyers are interested in silver, and that's partly because the Federal Reserve made some changes in its plans during the last session.

- The market is trying to figure out its next move, but I believe silver is on its way up. It wouldn't surprise me if silver reaches the highs we saw some time ago.

- That being said, the market has seen a massive turnaround from those highs, and I think it will be difficult to get above there. However, I am thinking that we will at least try to get there.

If we look below, there's the 50-Day EMA sitting around the $23.50 level, which could act as short-term support. I don't think we'll go all the way down to that level, but it's something to keep in mind just in case. The value of the US dollar has a big impact on silver, and so do the bond markets. When bond yields drop, silver tends to do well. It seems like the Federal Reserve might lower interest rates next year, which would be good news for precious metals like silver.

If Silver Dips

If silver's price dips a bit, many traders will see it as a chance to buy at a lower price. So, it might be a good idea to consider buying if silver gets close to $24 or even down to the 50-Day EMA. However, be cautious because silver can be very volatile. It's essential to manage your investments carefully.

In the bigger picture, I think silver will eventually reach the $25 level. When it gets there, we might encounter some psychological resistance. However, silver has risen quite quickly recently, so there could be a point where it gets tired, and that could be an opportunity to buy. Until then, it's important to be patient and careful with your trading decisions.

In the end, silver is showing strength, and there's a good chance it will continue to rise. If there's a dip in its price, many traders will see it as a chance to buy. Keep an eye on developments in the US dollar and the bond markets, as they can influence silver's performance. But remember, silver can be quite unpredictable, so be cautious and patient in your approach.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.