- Natural gas markets displayed a notable rally on Wednesday, primarily driven by the anticipation of colder temperatures arriving in the northeastern United States.

- This weather-related development is poised to exert a significant influence on the natural gas markets, at least in the immediate term.

- It's worth noting that the market tends to react most strongly to short-term weather patterns, underscoring the importance of staying updated on meteorological reports for informed trading decisions.

Previously, there was anticipation that the winter season might pose considerable challenges for Europe, but as we look ahead, the futures market is already shifting its focus towards spring. While sporadic upward spikes may occur, these are expected to be short-lived phenomena.

50 Day EMA

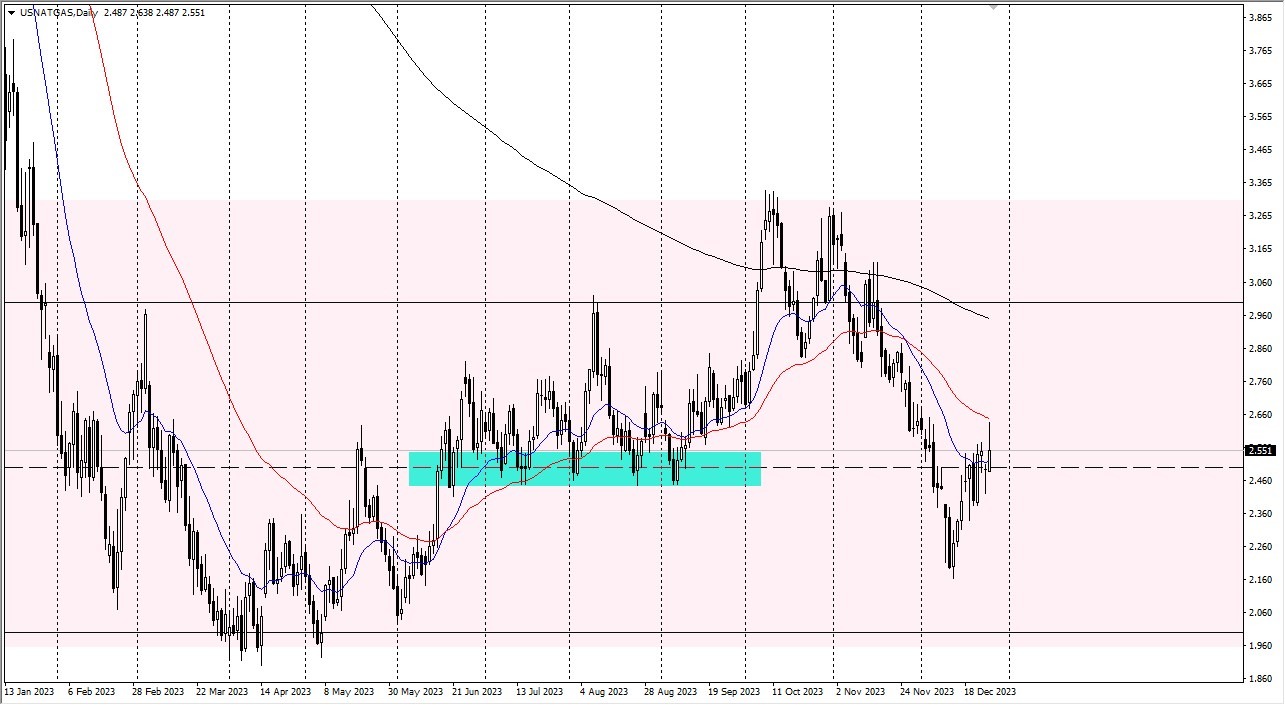

The presence of the 50-Day Exponential Moving Average hovering just above current levels adds a potential resistance point to watch. If this resistance is breached, it could potentially pave the way for a stronger upward momentum. It's worth noting that the market appears to be establishing a broader trading range, with the $2.00 level serving as the floor and the $3.33 level as the perceived ceiling.

Considering these factors, there is merit in considering long positions in the market. However, it's essential to approach them with a short-term perspective, as the window of opportunity for natural gas to exhibit significant winter-related gains has passed. It's important to recognize that even in the realm of Contracts for Difference (CFD) trading, the focus remains largely on the movements in the futures markets. These futures markets have already progressed beyond the threshold of New Year's Day.

In the spot CFD market, potential support levels can be identified, with short-term dips possibly finding support around the $2.40 level. A breakdown below this level could introduce a bearish outlook once more. On the flip side, it's reasonable to consider that the recent rally could be attributed to short-covering moves by traders looking to secure gains as they approach the new year.

At the end of the day, the recent rally in natural gas markets reflects the market's sensitivity to short-term weather patterns, with colder temperatures in the northeastern U.S. serving as a catalyst. While the possibility of further gains exists, a prudent approach involves viewing these opportunities as short-term trades, given the shifting focus in the futures market and the potential for short covering as the year ends. The extent of follow-through in the market remains uncertain, and traders should remain vigilant.

Ready to trade Natural Gas Forex? We’ve made a list of the best commodity broker platforms worth trading with.

Ready to trade Natural Gas Forex? We’ve made a list of the best commodity broker platforms worth trading with.