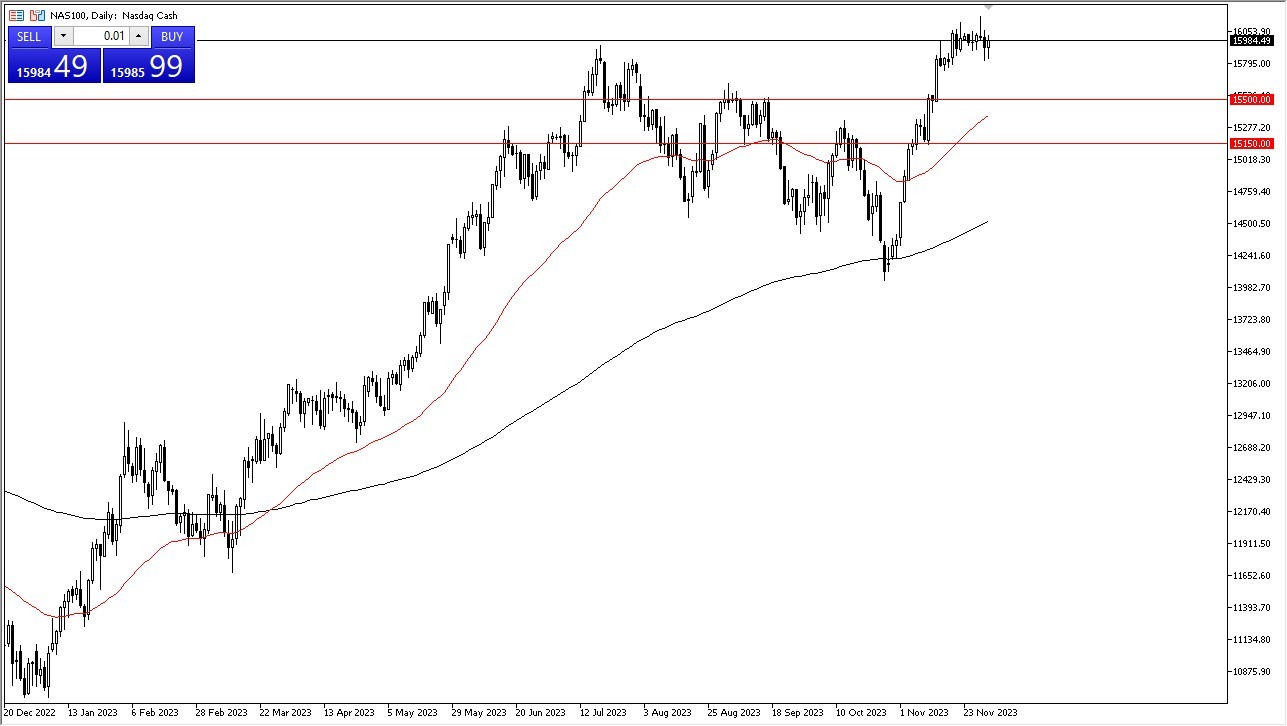

- The NASDAQ 100 initially pulled back during trading on Friday, but just as we have seen several times in the past, the buyers came back with gusto to pick up the index.

- Remember that the NASDAQ 100 is driven by just a handful of stocks, as it is not an equal weighted index. In other words, it’s all at the same usual suspects that people are buying every time we get some type of pullback.

- With this, the market is likely to continue to see a lot of noisy behavior, but as we head into the last month of the year, it suggests that we will continue to see a lot of chop.

Ultimately, there will eventually be a “Santa Claus rally” based on the historical backdrop of the stock market, and I think that’s what a lot of people are paying close attention to. The 15,500 level editing should be a significant barrier that keeps the market somewhat afloat, especially as the 50-Day EMA approaches that level.

Avoid Shorting the Market

With this, I think it’s almost impossible to short this market, and therefore I think you’ve got a situation where the market will eventually force its way higher, but after the tumultuous run-up that we had seen over the last several weeks, it does make quite a bit of sense that we may have to work off some excess froth.

On a break above the high of this past week, I suspected that point the NASDAQ 100 will go looking to the 16,300 level. The market underneath continues to attract a lot of people looking to fix their portfolios, as they have to show clients at the end of the year that they own the proper assets. The NASDAQ 100 has been one of the huge winners over the last several weeks, not to mention the last several months. With this, I think it’s probably only a matter of time before traders come back into all of the same major stocks that they have been all year, and therefore I think this is a situation where we are continuing to see a bit of a “one-way trade”, but you don’t want to jump into it right away with a huge position. All things being equal, this is a situation where a little bit of patience probably goes a long way.

Ready to trade the NASDAQ 100? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.