- During Wednesday's trading session, the gold markets exhibited a noticeable rally, indicating a potential shift back towards an upward trajectory.

- This movement comes after a period of bullish behavior in the gold markets, although the unusual candlestick pattern observed on Monday likely caused some investor apprehension.

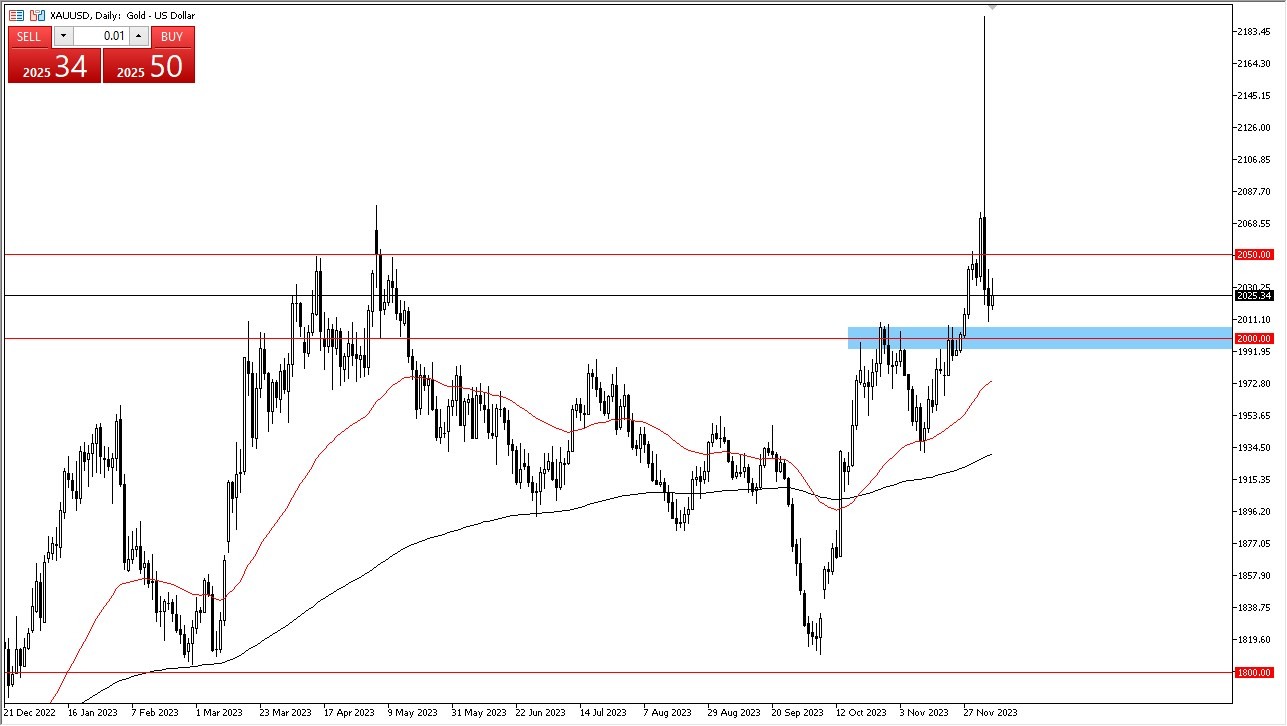

- Currently, the market is heavily influenced by the dynamics of the interest rate markets, making the $2000 level a crucial support point. This level is not only significant in terms of its round figure but also holds psychological importance in the trading community.

Given the rapid sell-off that has occurred recently, the gold market seems to be in an oversold position, which could set the stage for a rebound. If the market can sustain this upward momentum, the next target could be the $2050 level, another significant point that may introduce further volatility. Conversely, a decline below the $2000 threshold could lead the market to test the 50-Day Exponential Moving Average, drawing the attention of technical traders.

Jobs Number Incoming

An upcoming factor that could heavily influence the gold markets is the release of the jobs number this Friday. The bond market's reaction to this data is expected to be a critical determinant for the direction of gold prices, as gold often moves inversely to interest rates. In this context, the gold market could see continued noisy behavior, attracting value hunters who are looking for an opportunity in this volatility. However, any significant movement in the market is likely to hinge on the bond market's performance or the general risk appetite among investors.

Moreover, the response of the US dollar to the jobs report on Friday is another aspect to watch closely. Until then, the market might primarily reflect a narrative of stability, regaining its footing after the significant sell-off experienced on Monday.

At the end of the day, the gold market is currently navigating a complex landscape, influenced by interest rate movements, technical indicators, and upcoming economic data. Traders and investors are advised to monitor these factors closely, as they are likely to play a pivotal role in determining the short-term trajectory of gold prices. The current situation presents a mix of challenges and opportunities, necessitating a cautious and informed approach to gold market investments.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.