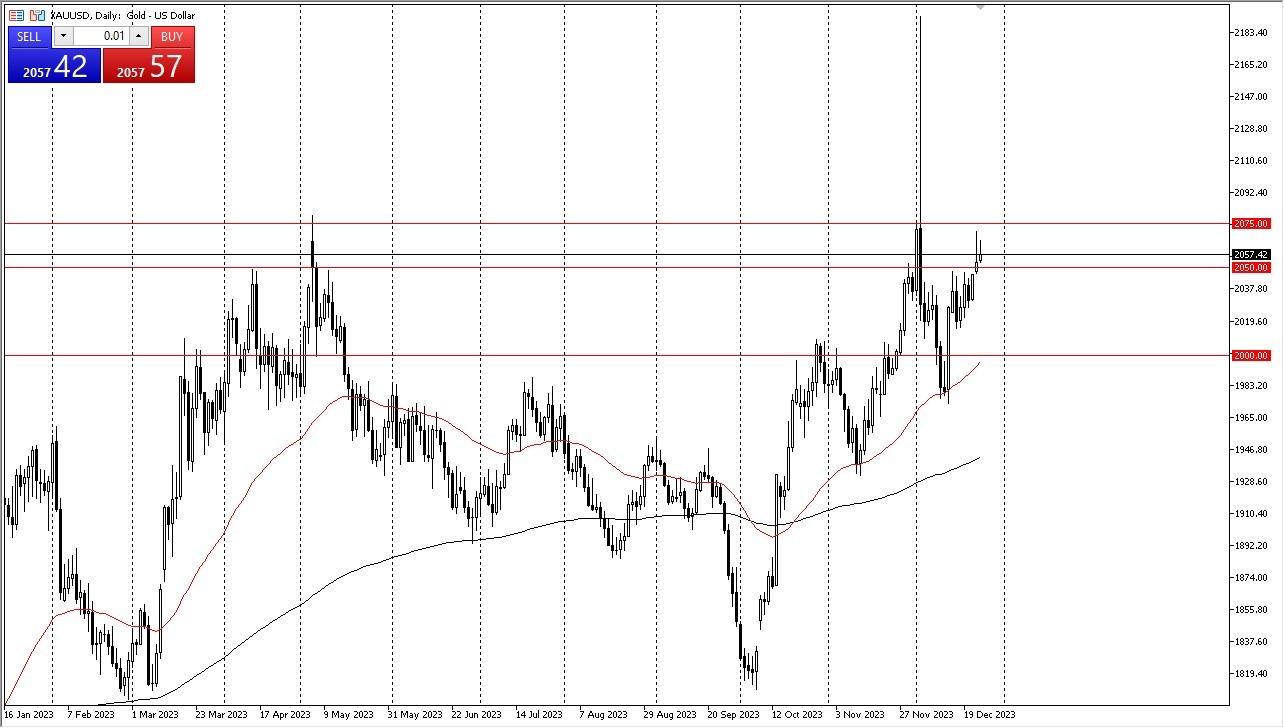

- The gold market experienced a modest rally during Tuesday's trading session, underscoring the persistent bullish sentiment. Of particular significance is the $2050 level, which has emerged as a key focal point.

- This level not only serves as a formidable support but also carries the weight of "market memory," given its prior role as resistance.

- In light of these factors, it becomes apparent that this zone has garnered substantial attention from market participants, making it an attractive entry point.

Conversely, on the upper end of the spectrum, the $2075 level stands as a robust barrier, offering formidable resistance. A decisive breach of this level could pave the way for a sustained upward trajectory. It is noteworthy that the gold market recently surpassed this level, as evidenced by the events of December 4. That particular day exhibited an unusual trading pattern, marked by a significant wick, suggesting a pocket of illiquidity. This anomaly could resurface as traders seek confirmation of sustained momentum to propel gold higher.

Bond Markets and Gold

It is imperative to recognize the substantial influence exerted by the bond markets on gold's trajectory. Additionally, market participants must factor in the holiday season's impact on liquidity. With the festive period straddling between two major holidays, it is plausible that traders' focus may shift toward family and social engagements rather than chart analysis. Nonetheless, holiday periods often introduce elements of unpredictability, characterized by sporadic surges in trading activity. In such instances, unexpectedly large positions can be initiated, resulting in substantial market moves. Consequently, the current landscape presents an element of uncertainty, albeit within an overarching upward trend. Any potential sell-off is likely to be met with skepticism, given the prevailing bullish sentiment. As such, opportunities to acquire gold at a perceived value are expected to attract a plethora of buyers.

To summarize, the gold market's recent performance signifies a robust bullish bias. The evolving landscape should be monitored closely, with a keen eye on key support and resistance levels, as well as the interplay between the bond markets and gold. While the holiday season may introduce some market unpredictability, the overall trajectory leans toward the upside, making any pullbacks an appealing proposition for prospective buyers. Selling gold remains a less favorable option, with market sentiment favoring opportunities for entry during retracements.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.