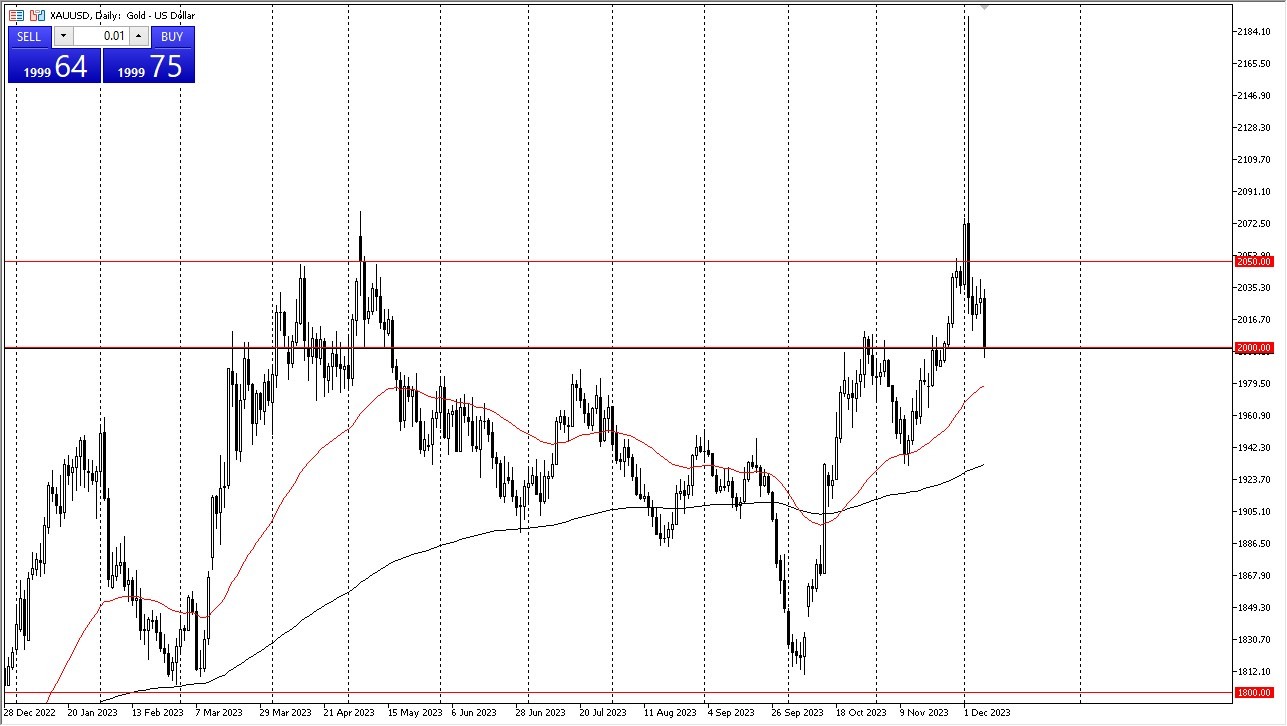

- The current state of the gold markets is drawing attention to a crucial support area, and there is growing anticipation that value-seeking investors will soon converge around the $2000 mark as a potential entry point.

- The prospect of traders re-entering the market at this juncture could trigger a rally towards the $2025 level.

- However, it's important to acknowledge that this market has been marked by considerable volatility in recent days, and the past week has proven to be quite challenging for market participants.

The $2000 level holds particular significance, having served as a formidable resistance level in the past. Beyond its historical relevance, it represents a psychological milestone due to its round number value. Therefore, any movements around this level warrant close scrutiny.

Are We Still Consolidating?

As things stand, the market appears to be stuck within a consolidation range of approximately $50. Should we witness a breach of the $2000 level, it would raise concerns about the 50-Day Exponential Moving Average, an indicator closely monitored by many traders. While the outlook for gold currently appears precarious, it doesn't necessarily entail a complete breakdown of support levels. It is worth noting that gold has experienced a prolonged upward trajectory, and the unusual events that unfolded in the market at the beginning of the week have disrupted the status quo.

The possibility of gold transitioning into a downtrend would come into focus if it were to dip below the 50-Day EMA. However, the trajectory of gold is inextricably linked to the performance of the bond market. Rising interest rates in the bond market would exert downward pressure on gold, while the opposite holds true as well. Recent trends in bond yields indicate a substantial decline, which has piqued interest in gold among investors seeking safe-haven assets.

In essence, this market is teetering on the brink of offering a promising buying opportunity, but the necessary momentum has yet to materialize. The upcoming week promises to be an intriguing one, as market participants closely monitor developments and seek clarity on how the intricate interplay between gold, bond markets, and prevailing economic conditions will shape the future trajectory of this commodity. The path forward for gold remains uncertain, but it is precisely this uncertainty that makes it a captivating market to watch in the days ahead.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.