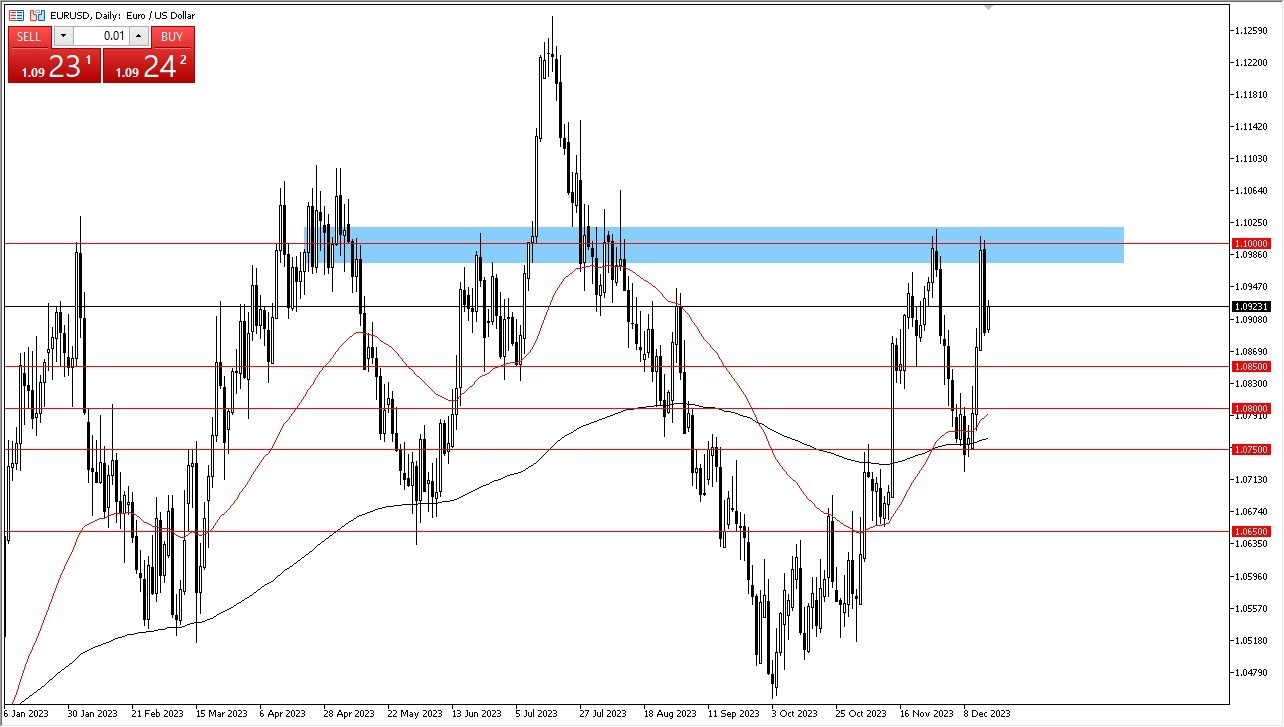

During Monday's trading session, the euro experienced a modest increase, largely influenced by the recent changes in the Federal Reserve's "dot plot," which suggests a potential decrease in interest rates. This scenario tends to diminish the value of the US dollar, indirectly boosting the euro's momentum. Additionally, the European Central Bank (ECB) hinted that it's not yet considering changes to its monetary policy. This stance keeps the euro in a somewhat bullish position, leading to speculation that it might approach the 1.10 level, a threshold that has previously acted like a formidable barrier.

Looking at support levels, the 1.0850 mark seems likely to continue offering stability. Right below this, the 1.08 level, accompanied by the 50-Day EMA, also stands as a significant support point. Given these factors, the market might continue to attract value hunters, making each dip a potential opportunity for buyers. This trend of purchasing on dips is expected to persist, offering chances to capitalize on any emerging value. However, if the euro were to fall below the 1.0750 level, this could alter its current upward trajectory. This could be a possibility, but at this point, it doesn’t look very likely anytime soon.

Possible Trading Range

- Moving forward, the market might be attempting to establish a trading range, although it's a bit early to focus on that possibility. It's also important to consider that market liquidity can decrease during this time of year, which could affect the likelihood of significant movements in the near term.

- Nevertheless, if the euro manages to close above the 1.10 level, it could signal the start of a more robust rally, potentially aiming for the 1.1250 mark.

- This level has historically been a point of resistance and a selling area.

Overall, the euro's current situation is a blend of market reactions to central bank policies and broader economic indicators. Traders are advised to monitor these developments closely, as they can significantly impact currency values. The potential for fluctuations in market liquidity towards the year's end also adds an element of uncertainty. This environment may offer opportunities for strategic investments, particularly for those who are adept at identifying and leveraging potential dips in the market. As always, staying informed and adaptive to market changes is key to navigating the currency trading landscape effectively.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.