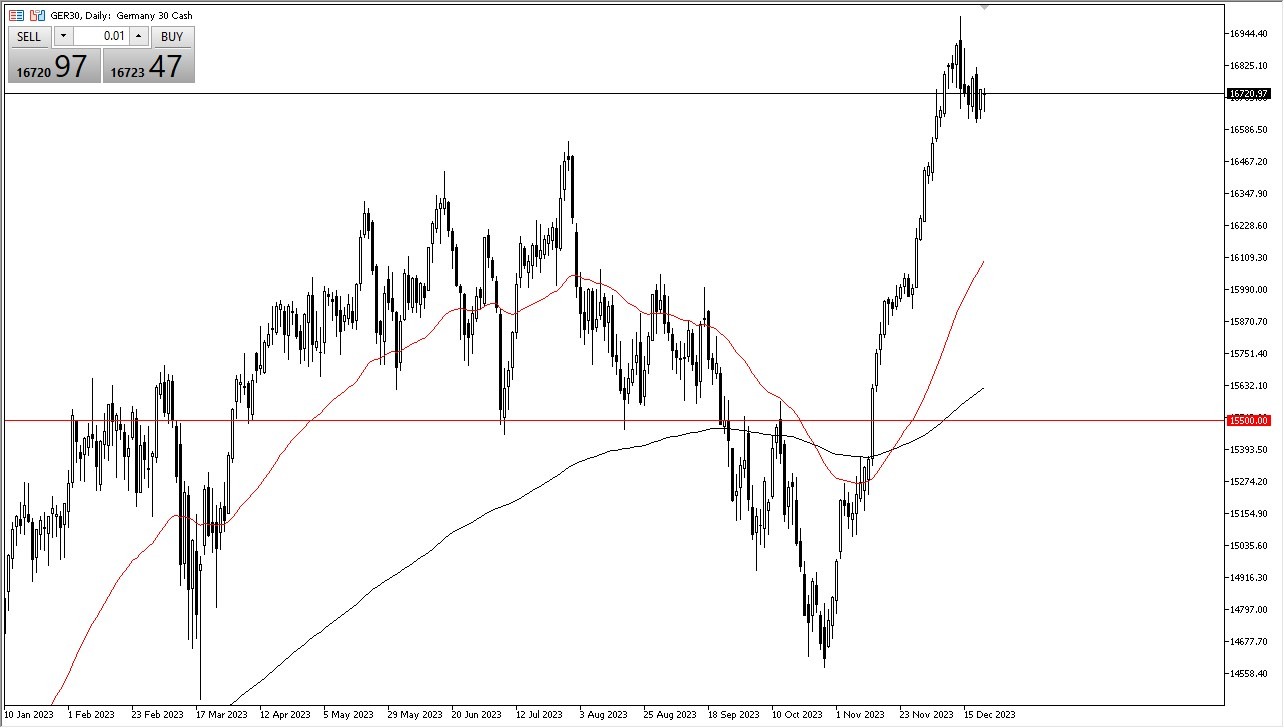

- The German DAX initially pulled back a bit during the trading session on Friday, but it does look as if there are buyers underneath, especially near the €16,600 level.

- This is an area that has offered support recently, and the fact that we have bounced from that bottom does suggest that we probably have further to go to the upside.

In the short term, I suspect that the lack of liquidity between Christmas and New Year’s Day will continue to be a major influence on the market, and therefore we could see a little bit of noisy trading in the short term. It’ll be interesting to see how Wednesday opens up as Tuesday was a bank holiday in Germany.

Overextended?

You can make an argument that the DAX is very overextended, as we have rallied quite drastically. The 16,000 level is an area that a lot of people have paid close attention to, and of course, it is a large, round, psychologically significant figure. Furthermore, the 50-day EMA is crossing the general vicinity, so I would be especially interested in buying the DAX on a pullback to that area. However, I also recognize that we may not pull back, rather we could just go sideways. Either way, we need to work off some of the excess froth, which is because we have gone straight up in the air since the end of October. Stocks are overbought worldwide, and the DAX of course is not going to be any different.

If we were to simply rally from here, the €17,000 level is an area that a lot of people will pay attention to as potential resistance, as we have sold off from that area. It’ll be interesting to see how this plays out, because we are either going to see a pullback that buyers will take advantage of due to value, or we will go sideways. I will be watching the €16,500 level very closely because it is a short-term support level. If we break down below there, then we find even more value. During this time of year, I tend to put on small positions, and then build those positions up as the trade proves itself to be correct. This allows me to essentially “dollar cost average” on the pullback. With this, as exactly how I’m going to trade the DAX going forward over the next several weeks.

Ready to trade our DAX forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.

Ready to trade our DAX forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.