Bullish view

- Buy the BTC/USD pair and set a take-profit at 26,000.

- Add a stop-loss at 42,000.

- Timeline: 1-2 days.

Bearish view

- Set a sell-stop at 43,000 and a take-profit at 42,000.

- Add a stop-loss at 45,000.

Bitcoin price is hovering near its highest level since April 2022 as the Fear of Missing Out (FOMO) in the crypto industry continued. The BTC/USD pair rose to the important resistance point of 45,000 on Wednesday. It has surged by over 184% from the lowest level in December 2022 following the collapse of FTX.

FOMO continues

The BTC/USD pair has been in a strong uptrend, helped by the FOMO among investors. In most periods, a surge of Bitcoin price usually leads to more upside as investors attempt to join the rally. This explains why most altcoins have been in a strong rally.

Bitcoin has been doing well helped by three main factors. First, there are signs that institutions are buying Bitcoin in the past few months. MicroStrategy, the biggest BTC holder, has continued adding to its position.

Second, Bitcoin has rallied after several companies filed for a spot Bitcoin Exchange Traded Fund (ETF). Some of these companies are Blackrock, Franklin Templeton, and Invesco, which are specialists in ETFs.

Combined, these companies hold over $12 trillion in total assets under management (AUM). Some of these firms, including Blackrock, have started seeding their funds in preparation of the eventual approval.

Finally, Bitcoin is soaring as traders reflect on the falling bond yields in anticipation of Federal Reserve rate cuts. The 10-year yield dropped to 4.10% while the 30-year yield moved from the year-to-date high of 5% to 4.21%.

Further, the price of crude oil continued plunging. Brent dropped to $74.5 while the West Texas Intermediate (WTI) moved to $69.57, the lowest level in five months. This is a positive thing since it will have a positive impact on inflation. Therefore, the Fed will likely start cutting rates in the coming months.

BTC/USD technical analysis

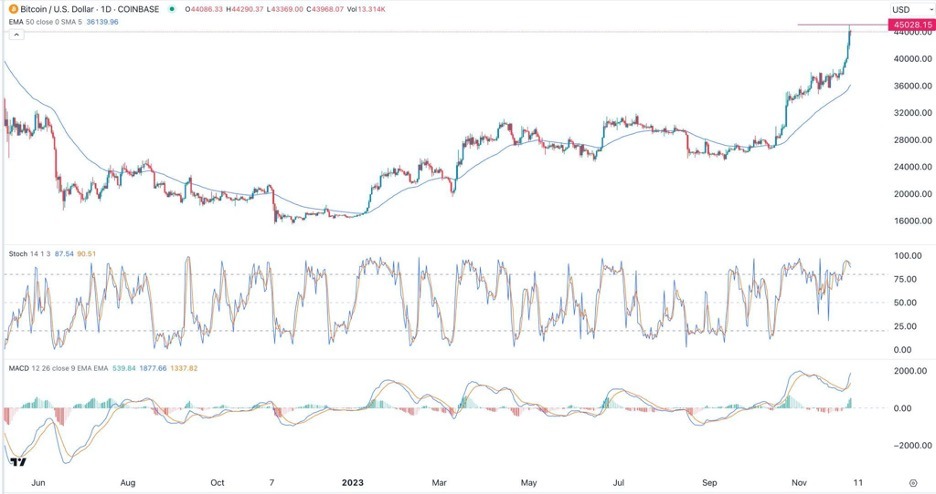

The BTC/USD pair has been in a strong uptrend in the past few months. On the daily chart, it has moved above the 50-day moving average. This is a sign that bulls are in control. At the same time, the Stochastic Oscillator has moved to the overbought level. The MACD indicator and the histogram have moved to the neutral point.

Further, the Average Directional Index (ADX) has continued rising. Therefore, the outlook for the pair is bullish, with the next price to watch being at 46,000. The stop-loss of this trade is at 42,000.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best MT4 crypto brokers in the industry for you.