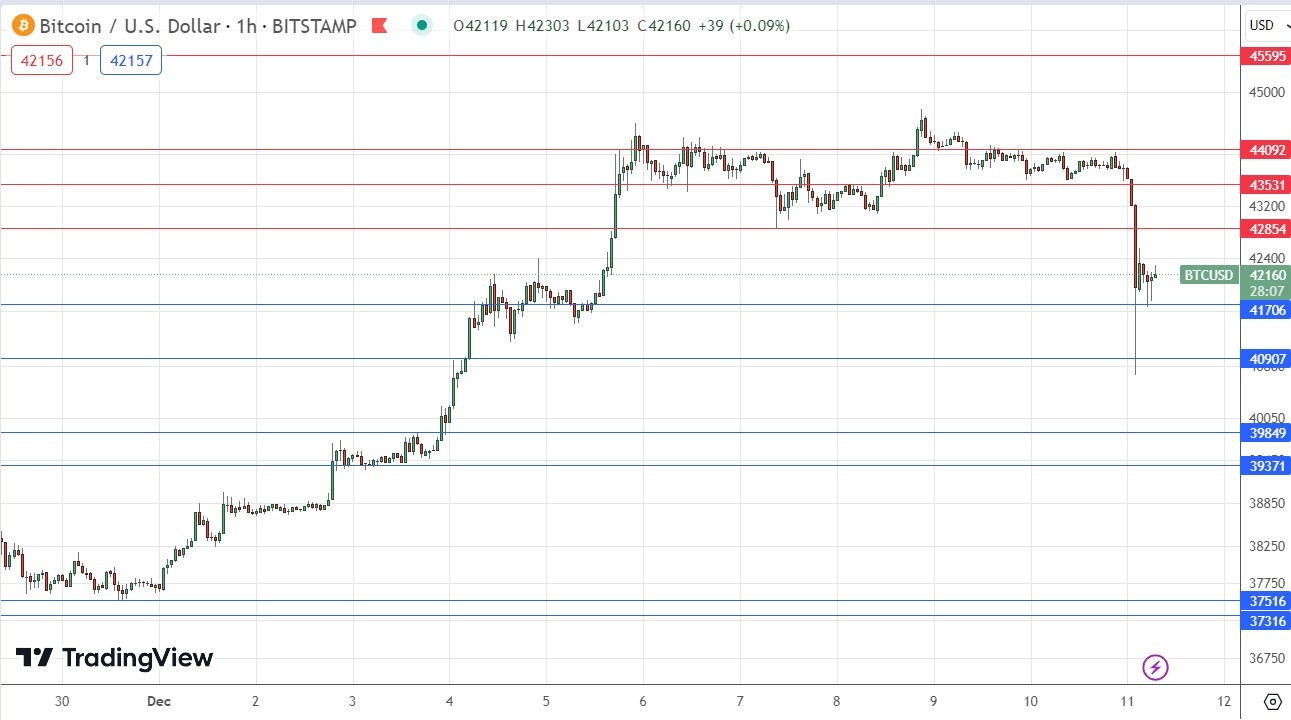

My previous BTC/USD signal on 4th December produced a small win from the bullish bounce at the support level of $37,666.

Today’s BTC/USD Signals

Risk 0.75% per trade.

Trades may only be taken prior to 5pm Tokyo time Tuesday.

Long Trade Ideas

- Go long after a bullish price action reversal on the H1 timeframe following the next touch of $41,706, $40,907, or $39,849.

- Put the stop loss $100 below the local swing low.

- Move the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Ideas

- Go short after a bearish price action reversal on the H1 timeframe following the next touch of $42,854, $43,531, or $44,092.

- Put the stop loss $100 above the local swing high.

- Move the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote in my previous BTC/USD analysis last Monday that with the price of Bitcoin breaking strongly on healthy volatility with firmly bullish daily candles to new long-term highs, it was worth taking notice and trying to come along for the ride with a long trade. Significant bullish breakouts were one of the signals I was looking for.

This was a great call as the price continued to rise and made a significant bullish breakout the very next day to rise by another $2,000 or so to make a new long-term high above $44,000.

This strong advance to new long-term highs has faltered now, and in recent hours we have seen a sharp drop followed by a bounce off the support level below the current price at $41,706.

It might be that Bitcoin is a good long-term buy at this level, but the drop from the highs printed several new resistance levels which may be hard to break. The best approach might be to enter any bounces off support as long trades but be prepared to treat them like short-term trades if they do not perform well quickly.

It will be interesting to see whether Bitcoin now holds its low, or breakdown down again and continues to fall. A break below $40,907 could see the price quickly test the $40k area. Such a breakdown would suggest that the bullish trend will fail to advance any further for a while.

There is nothing of high importance scheduled today regarding the US Dollar.

Ready to trade our daily Bitcoin signals? Here’s our list of the best Bitcoin brokers worth cjecking out.