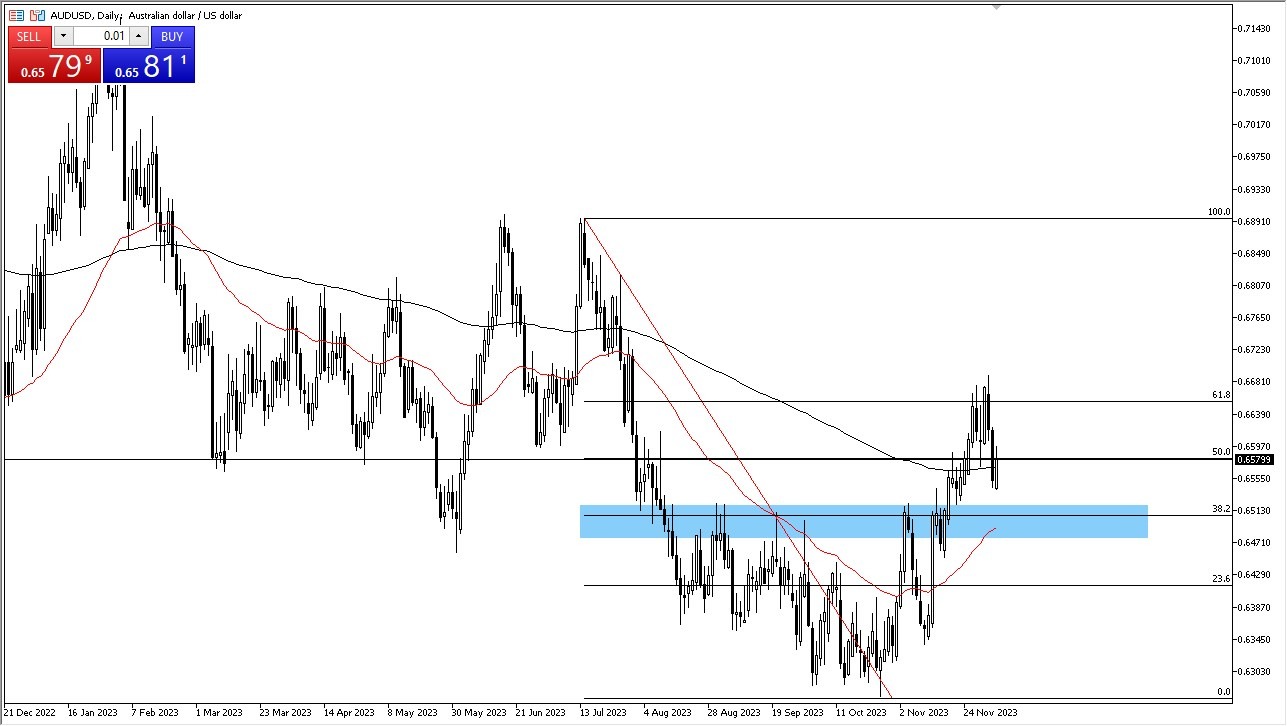

During Wednesday's trading session, the Australian dollar showed signs of resilience, breaking above the 200-Day Exponential Moving Average and challenging the 0.66 level. This movement indicates a significant shift, especially considering the recent market dynamics. The 0.66 level is not only noisy due to its nature but also because it represents the 50% Fibonacci retracement level from the previous decline, adding to the complexity of market predictions.

One of the notable aspects of this rally is the size of the candlestick in the trading charts. It suggests that the Australian dollar is recouping a substantial portion of its losses from the previous session. However, traders are currently in a phase of assessing the market's direction, weighing whether the currency will continue its upward trajectory or reverse its gains.

The decision-making in the currency market is heavily influenced by the bond market, particularly in the United States. The interest rate differential, a crucial factor in forex trading, has been narrowing as U.S. interest rates decrease. This change in the interest rate landscape impacts the Australian dollar, often seen as a barometer for risk sentiment in the financial markets.

Assessing Short-Term Australian Dollar Volatility Amidst Global Economic Factors

- In the short term, the Australian dollar is expected to experience significant fluctuations. This volatility is partly attributed to the upcoming Non-Farm Payroll announcement from the United States.

- The bond market's reaction to this data will be a critical determinant of the Australian dollar's movement. If bond yields in the U.S. spike, it could lead to a weakening of the Australian dollar as the U.S. dollar gains attractiveness.

- Conversely, a drop in U.S. yields could bolster the appeal of the Australian dollar, potentially indicating a global shift towards riskier assets.

Additionally, the Australian dollar's fate is closely tied to the economic activities in Asia, the primary destination for Australian exports. The current economic climate presents multiple challenges and opportunities, making it a market that requires cautious navigation, especially in terms of position sizing.

In the end, the Australian dollar's current trajectory reflects a mix of technical resilience and vulnerability to global economic factors. Traders are advised to approach the market with caution, keeping an eye on the evolving interest rate scenario in the U.S. and the economic health of key Asian markets. The upcoming period, marked by crucial economic announcements and shifting global sentiments, will likely play a pivotal role in shaping the Australian dollar's path.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.