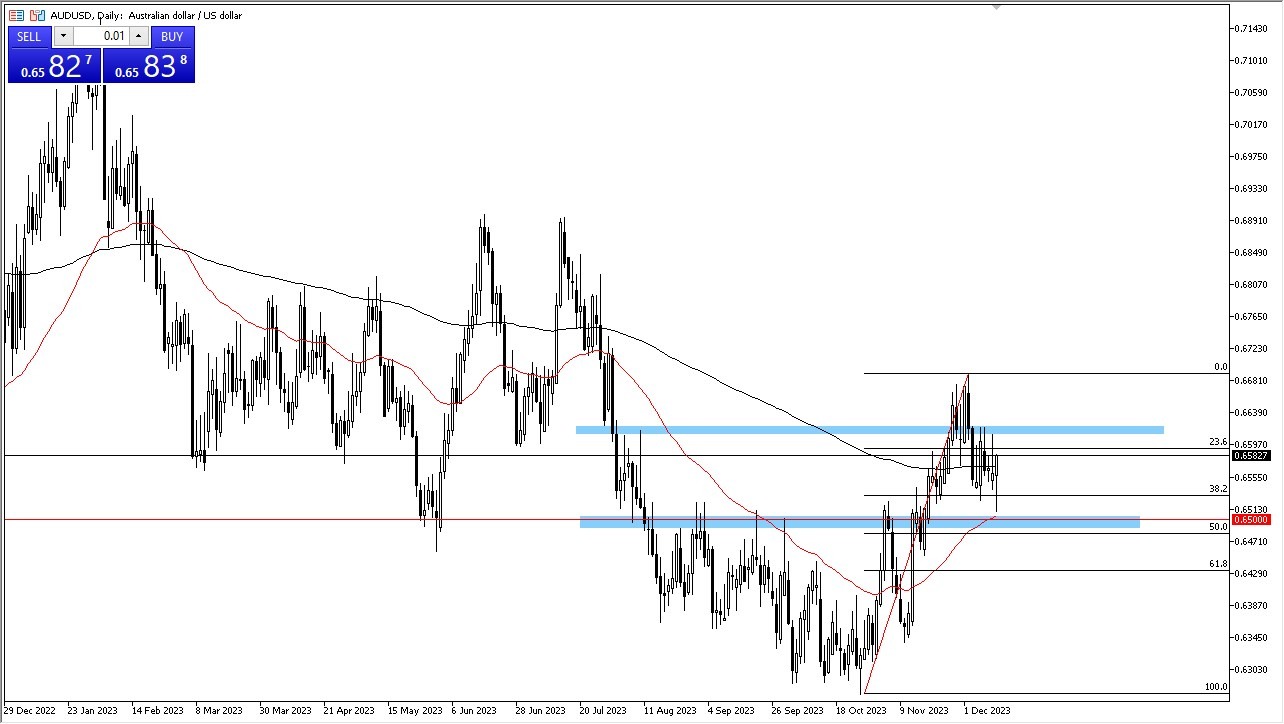

- The AUD/USD experienced a notable decline during Wednesday's trading session, gravitating towards the 50-Day Exponential Moving Average, coinciding with the key 0.65 level.

- This level is not only a round figure but also carries psychological significance, having previously acted as a point of resistance.

- This indicates that while there may be substantial buying interest below this level, resistance is expected above, particularly around the 0.6650 mark.

Adding complexity to the market is the anticipation of the Federal Reserve's announcement later in the day, which is poised to influence market movements significantly. Market participants are currently trying to gauge the Federal Reserve's approach to monetary policy. The key question is whether the Fed will maintain its current tight policy stance or shift in response to recent economic indicators, particularly inflation data. These factors contribute to the uncertainty and volatility in the market.

The Australian dollar market appears to be range-bound at the moment, and it wouldn't be surprising to see it fluctuate without a clear direction until the year's end. As the holiday season approaches, liquidity issues might arise, further contributing to the market's indecisiveness. However, a breakout from this range could provide valuable insights into the market's next likely direction. A daily close below the 0.65 level could signal a selling opportunity, just as a close above 0.6650 might indicate a potential buying scenario.

Bond Markets Remain Crucial

Investors and traders should also keep a close watch on the bond markets in the United States. A rally in bond yields could suggest strengthening of the US dollar, which in turn would impact the AUD/USD pair. Given the current market conditions, the scenario of heightened noise and market reactions is highly plausible as nobody seems overly convinced of anything.

In the end, the Australian dollar is navigating a phase of significant uncertainty, with key levels at 0.65 and 0.6650 acting as crucial markers for future movements. The market's direction is heavily influenced by the Federal Reserve's policy decisions and the associated market perceptions. As we head into the holiday season, reduced liquidity and heightened sensitivity to external factors like US bond yields will likely add to the market's volatility. Traders should be prepared for potential range-bound activity, while remaining vigilant for signs of a breakout, which could offer clear trading signals in this otherwise uncertain environment.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.