Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a buy deal with a pending order from the 28.60 level.

- Place a stop loss closing point below the 28.40 support levels.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 28.75.

Best-selling entry points

- Entering a sell deal with a pending order from the 28.80 level.

- The best points to place a stop loss are closing the highest level of 28.95.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 28.49.

The price of the Turkish Lira stabilized against the dollar near its lowest levels ever during early trading on Thursday morning. The Monetary Policy Committee of the Turkish Central Bank is scheduled to announce the interest decision today, as a state of anticipation prevails among investors regarding the Turkish Central Bank’s next move regarding interest rates. Expectations are divided between raising interest rates between two and five points in light of the continuation of the monetary tightening policy followed by the new economic team that took charge following the presidential elections in Turkey last June.

The Turkish Central Bank raised interest rates over the course of five consecutive meetings at varying rates. Interest rates jumped from 8.5%, which the bank approved last May, to 35% at its last meeting last October.

The Turkish Central Bank aims, through a series of raising interest rates and tightening monetary policy, to reduce inflation and raise the real interest rate, which is still negative so far. The real interest rate is measured by subtracting the interest rate announced by the Turkish Central Bank from the inflation rate in the country. Current estimates indicate that inflation will continue to rise until the middle of next year despite raising interest rates, as the country suffered from a prolonged stimulus policy that caused economic imbalances and increased demand with a decline in the value of the lira.

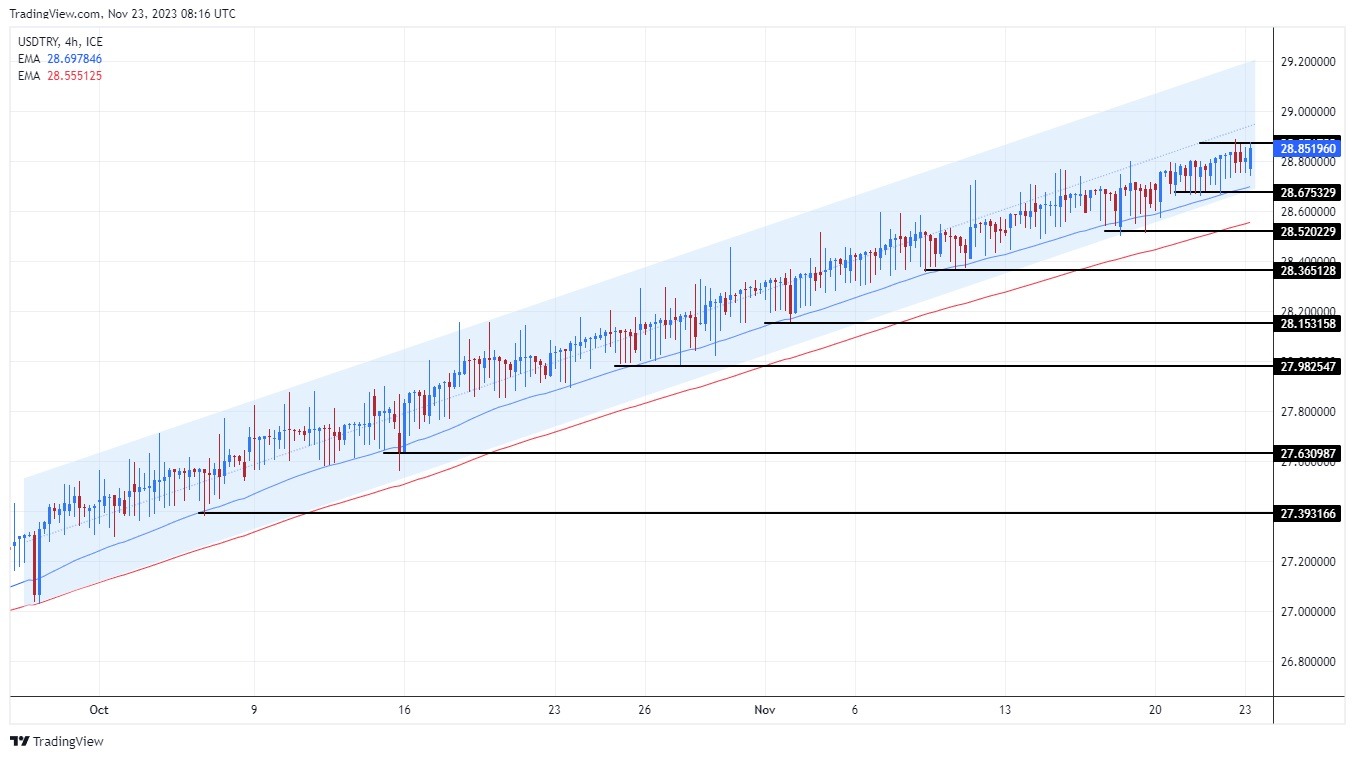

USD/TRY Technical Analysis

On the technical level, the dollar pair against the Turkish lira did not witness major changes, as the pair stabilized near its highest levels ever at 28.80 levels. The pair settled within the ascending price channel on the 240-minute time frame shown in the chart. If the pair declines, it will target the support levels concentrated at 28.65 and 28.45, respectively. On the other hand, if the price rises, it will target the resistance levels, which are concentrated at 28.85 and 28.99, respectively.

At the same time, the price is trading above the 50 and 200 moving averages on the daily time frame, as well as on the four-hour time frame, indicating the control of buyers within the general upward trend that the pair is recording in the long term. The change in monetary policy may prepare the pair to record an upward wave, but at a slower pace. Please adhere to the numbers in the recommendation, with the need to maintain capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.