Today's recommendation on the USD/TRY

Risk 0.50%.

Best buying entry points

- Entering a buy deal with a pending order from the 28.50 level.

- Place a stop loss closing point below the support level at 28.30.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 28.75.

Best-selling entry points

- Entering a sell deal with a pending order from the 28.80 level.

- The best points to place a stop loss are closing the highest level of 28.95.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 28.49.

The Turkish currency stabilized during early trading today, as the USD/TRY pair traded near its highest levels ever. The positive echo of the current account recording a surplus in Turkey continues, as the Turkish Minister of Trade, Omar Polat, stated that his country’s government is working to improve the current account through some measures, which include supporting exports, the value of which in the 12 months until last September reached about 98.3 billion dollars. The tourism sector's income also increased on an annual basis in October, reaching $46.9 billion, confirming the continuation of efforts in this regard. Data issued yesterday revealed that Turkey's current account surplus rose for the second time in two years, recording a surplus estimated at approximately $1.9 billion, compared to expectations of recording a surplus estimated at only $1.4 billion.

In other news, the credit rating agency Fitch commented on the Turkish economy through a recently issued report that stated that the shift in monetary and economic policy following the recent presidential elections has contributed to raising financing pressures from Turkish banks. The external debts of these banks also recorded slight increases during the first half of this year, reaching $126 billion, while the short-term external debt maintained its increases. The agency’s report included that the mechanism for lira deposits protected from foreign exchange rate fluctuations would be gradually dismantled.

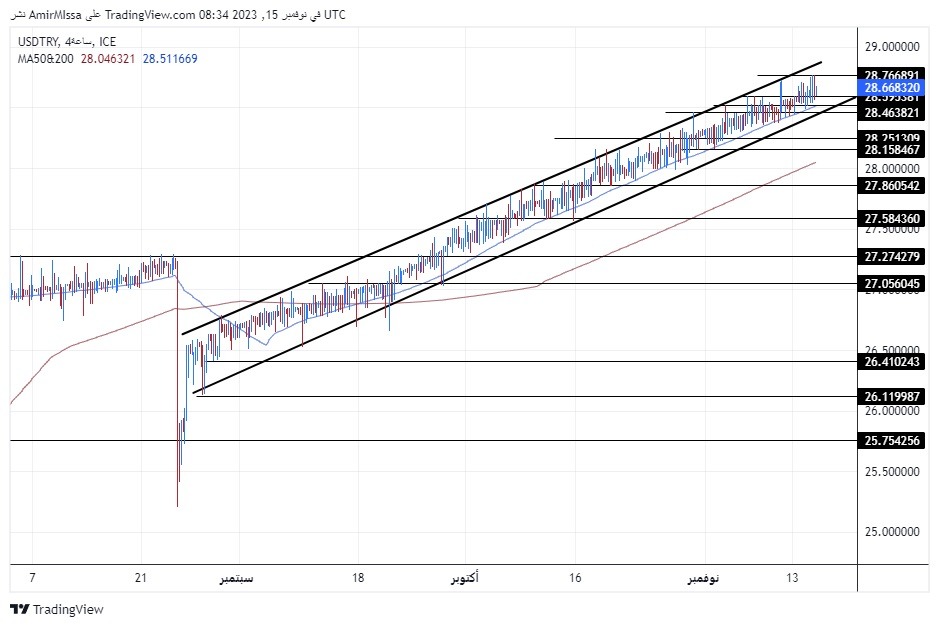

USD/TRY Technical Analysis

On the technical level, the dollar pair rose against the Turkish lira during Wednesday morning trading, as it settled near its highest levels ever at levels of 28.77. The pair continued trading within the ascending price channel on the 240-minute time frame shown in the chart. If the pair declines, it will target the support levels concentrated at 28.55 and 28.25, respectively. On the other hand, if the price rises, it will target the resistance levels, which are concentrated at 28.85 and 28.99, respectively.

At the same time, the price is trading above the 50 and 200 moving averages on the daily time frame, as well as on the four-hour time frame, indicating the control of buyers within the general upward trend that the pair is recording in the long term. The change in monetary policy may prepare the pair to record an upward wave, but at a slower pace. Please adhere to the numbers in the recommendation, with the need to maintain capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.