Today's Recommendation on the TRY/USD

Risk 0.50%.

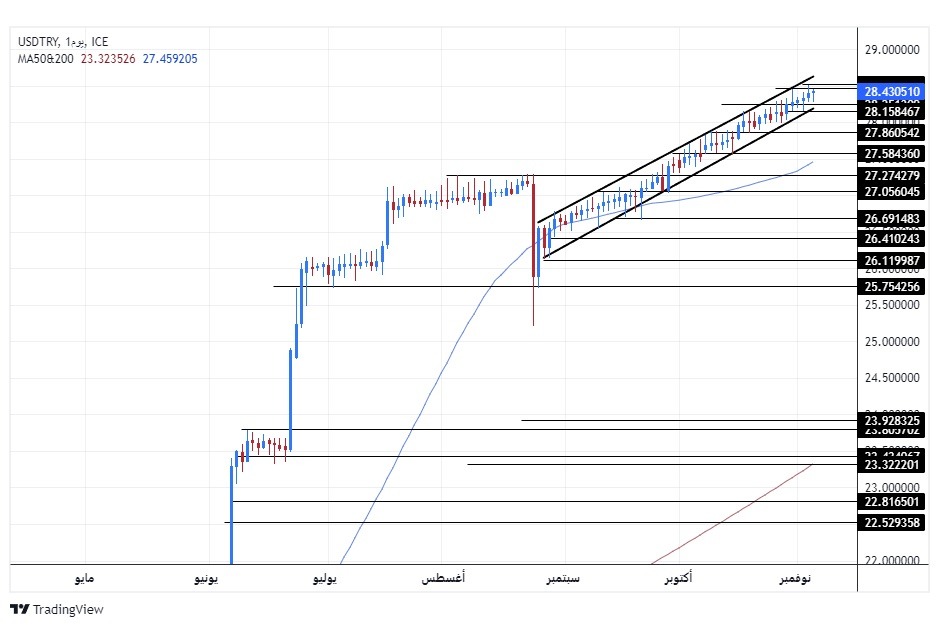

Best buying entry points

- Entering a buy deal with a pending order from the 28.25 level.

- Place a stop loss closing point below the 28.10 level.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 28.50.

Best-selling entry points

- Entering a sell deal with a pending order from the 50.28 level.

- The best points to place a stop loss are closing the highest level of 28.65.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 28.30.

The price of the Turkish Lira stabilized against the US dollar during early trading on Monday morning, after data issued at the end of last week, through which the Turkish Central Bank revealed a slowdown in inflation in the country during last October, compared to expectations as well as compared to the previous month’s figures. The consumer price index recorded a monthly increase of 3.43% in October compared to 4.75% recorded in September, while expectations indicated that inflation would rise to 3.93%. On an annual basis, inflation reached 61.36%, which is lower than expectations, which were 62.12% compared to the 61.53% recorded in October of the previous year.

In other news, the Turkish Central Bank announced that the total foreign currency reserve rose in the week ending October 27 to the highest level in more than two and a half years, reaching 126 billion and 560 million dollars, recording an increase estimated at about 435 million. While the central bank's net international reserves increased by about $2.6 billion to $25.15 billion in the same week.

Meanwhile, investors followed the Fitch report, which raised its forecast for the economy in Turkey to 4.1 percent compared to 3.9 percent. The credit rating agency's report also mentioned expectations that the size of the Islamic finance sector in the country would rise to exceed $100 billion within several years. The government supports raising the percentage of assets of banks operating in the Islamic system to double its current percentage by 2025.

TRY/USD Technical Analysis

On the technical level, the dollar pair against the Turkish lira maintained its stability during European trading this morning, as it traded near its highest level ever, approaching the levels of 28.50 lira per dollar, as the pair maintained its movements within an ascending price channel on today’s time frame shown by Through the chart.

Currently, if the pair goes up, it targets the resistance levels concentrated at 28.75 and 29.00, respectively, while if the pair declines, it targets the support levels concentrated at 28.10 and 27.90, respectively.

The price is moving above the 50 and 200 moving averages on the daily time frame, as well as on the four-hour time frame, indicating the control of buyers and the general upward trend recorded by the pair. The pair is expected to record gains as long as it settles within the ascending price channel range. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.