Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a buy deal with a pending order from the 28.50 level.

- Place a stop loss closing point below the support level at 28.30.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 28.75.

Best-selling entry points

- Entering a sell deal with a pending order from the 28.80 level.

- The best points to place a stop loss are closing the highest level of 28.95.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 28.49.

The Turkish currency stabilized during early trading today, as the dollar/lira pair traded near its highest levels ever. Investors followed a report issued by Deutsche Bank, which included optimistic expectations about the Turkish lira as well as lira bonds. The bank's analysts expected that Turkish bonds would move from the worst rating during the current year among the debt market in developing countries to turn into the best investment during the coming year. The bank's report stated that according to the shift in monetary policy that the country witnessed during the current year, it is expected that local bonds will be repriced by 200 to 400 basis points. The bank's analysts also expected bonds to decline further until the end of this year, due to high inflation and the high volume of debt instrument issuances, with the Turkish Central Bank expected to approve raising interest rates by about 5 percent before the end of 2023.

At the same time, the report included recommendations to buy the Turkish lira against the dollar, as the report described it as the best deal, amid expectations that the return on two-year bonds would reach 40% compared to 41% currently, while the bank expected that the return on ten-year bonds would reach 35%, compared to 31% currently.

Positive estimates and optimistic expectations about the future of the Turkish economy continued after a series of interest rate hikes carried out by the Turkish Central Bank over the past months.

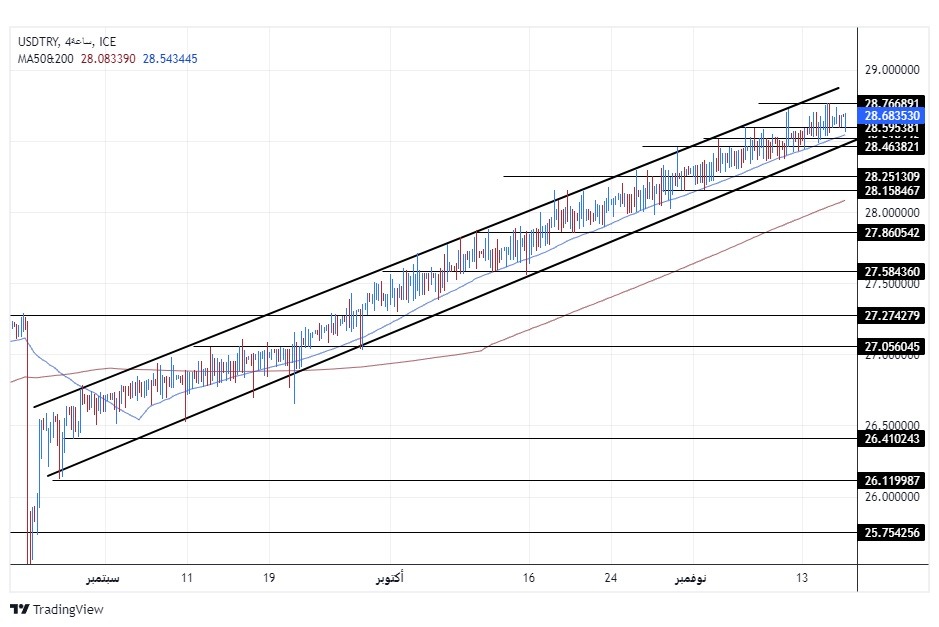

TRY/USD Technical Analysis

On the technical level, the dollar pair stabilized against the Turkish lira during Thursday’s trading, as it settled near its highest levels ever at levels of 28.77. The pair continued trading within the ascending price channel on the 240-minute time frame shown in the chart. If the pair declines, it will target the support levels concentrated at 28.55 and 28.25, respectively. On the other hand, if the price rises, it will target the resistance levels, which are concentrated at 28.85 and 28.99, respectively.

At the same time, the price is trading above the 50 and 200 moving averages on the daily time frame, as well as on the four-hour time frame, indicating the control of buyers within the general upward trend that the pair is recording in the long term. The change in monetary policy may prepare the pair to record an upward wave, but at a slower pace. Please adhere to the numbers in the recommendation, with the need to maintain capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.