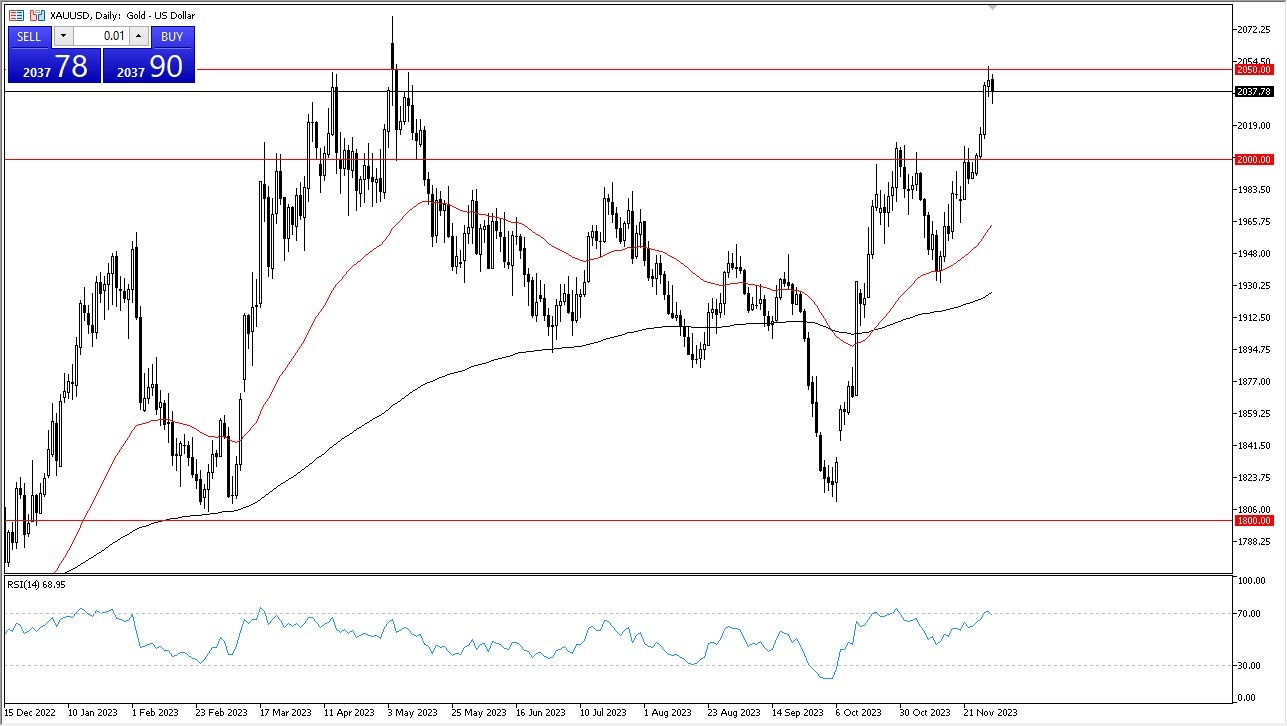

- The gold market displayed minimal movement in the early hours of Tuesday, as it continued to test the critical $2000 level for potential support.

- In this current climate, it appears that the market is in a phase of consolidation, attempting to set up its next move and digest the substantial recent gains.

- While it's not implying an imminent sharp decline in gold prices, a period of profit-taking seems likely in the short term. (Unless of course we get more turmoil in the Middle East.)

Technical analysis of the market suggests the possibility of a rising wedge formation, a bearish pattern that could potentially lead to a decline of approximately $50 from the current price point. Though this might appear significant, within the context of the previous upward trend, it would be considered a customary retracement. Conversely, a breakout above recent highs could pave the way for an ascent towards the $2050 level, and potentially even the $2100 mark.

It's worth noting that gold's recent price movements have been heavily influenced by breaking news headlines, making predictions challenging. The ongoing conflict between Israel and Hamas in the Middle East, for instance, continues to fuel concerns about an escalating regional war, bolstering gold's appeal as a safe-haven asset. Conversely, a political resolution in the region could trigger a temporary decline in gold prices. Additionally, the inverse relationship between gold and U.S. interest rates remains a significant factor to consider. As U.S. interest rates rise, the attractiveness of non-interest-bearing assets like gold diminishes.

There is Little Interest in Shorting Gold

Presently, the overall sentiment in the gold market leans towards bullishness, and a significant shift in this trend would require several pivotal developments. Therefore, many traders view short-term pullbacks, including the potential breakdown of the aforementioned rising wedge, as opportunities to enter long positions. It's important to note that there is little interest in shorting gold, but there is also a reluctance to chase the trade in the current climate.

In the end, the gold market appears to be at a crossroads, with $2000 acting as a pivotal level. The technical outlook suggests potential downside, while the broader context hints at further upside potential. However, the market's sensitivity to breaking news and the influence of U.S. interest rates add an element of unpredictability. Traders are cautiously navigating these waters, with a preference for buying on short-term dips while maintaining a watchful eye on the evolving market dynamics.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.